One of the worst-performing stocks on the S&P 500 this year has been Lululemon Athletica (LULU 1.86%), down a staggering 53% thus far in 2025. It's been a brutal year for the company during a time when the overall market has been doing fairly well (The S&P 500 index is up around 13.6%).

There are multiple issues plaguing Lululemon's stock these days. However, with so much negativity already priced in and the apparel stock declining so quickly this year, could it have bottomed out? Is now a good time to take a contrarian position in Lululemon?

Image source: Getty Images.

Can Lululemon turn things around?

The stock market is doing well this year, but it doesn't mean consumers are in good shape. There have been multiple examples of how consumers recently have been tightening their budgets due to adverse economic conditions.

Walmart is seeing more high-income shoppers visit its stores as they look to cut down on spending. Meanwhile, Dollar General's CEO says the discount retailer's consumers are more cash-strapped than they were a year ago due to inflation, and many have just enough for the bare essentials.

While these developments aren't directly tied to Lululemon, you often can get hints of how one company's results might affect another. The overarching theme from these and other stories is that consumers aren't loading up on discretionary purchases. Instead, they're cutting back and focusing on necessities, so there's likely going to be far less demand for Lululemon's high-priced yoga pants and other clothing.

If that's the case, there's a possibility that things could get even worse for Lululemon before they get better. In its most recent quarter, which ended on Aug. 3, Lululemon's comparable-store sales rose by just 1%. What's even more problematic is that in the Americas, the growth rate was a negative 4%.

In China, a key market for Lululemon, the growth rate was in double digits, at 17%. Between poor economic conditions in the local market and a dependency on sales growth in China, which a trade war may negatively impact, it may not be easy for Lululemon to turn things around anytime soon.

For investors, it could prove to be a bit of a waiting game for economic conditions to improve. The good news is that expectations may be extremely low at this point.

The stock has been steady of late

Investors are clearly worried about Lululemon's future results. This once top growth stock has lost more than half of its value this year, and the last time it fell to these levels was during the 2020 COVID-19 stock market crash. However, things might be starting to stabilize: In the past month, the stock has risen by around 2%.

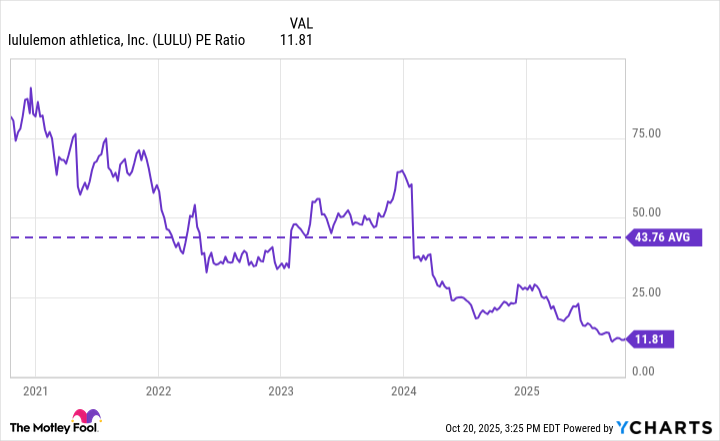

This may be a sign that investors may be willing to pay the current price for Lululemon's stock, even amid all the uncertainty ahead. The stock trades at a price-to-earnings multiple of just 12, which is far below what it has averaged in previous years, so it could appear to be a bargain buy.

Data by YCharts.

However, in order for the stock to command a high premium again, investors will need to believe that there will be stronger earnings growth ahead for Lululemon. That may not happen for a while -- perhaps for multiple years, depending on how quickly and how strongly the economy ends up recovering from where it is today.

NASDAQ: LULU

Key Data Points

Lululemon's stock can still go lower

Lululemon stock may look cheap based on its valuation, but the company faces some considerable risk and uncertainty. I don't see a path for a quick turnaround for the stock as its growth rate may continue to come under greater pressure in the future, particularly if growth dries up in international markets, which may happen if countries struggle due to trade wars and tariffs.

The danger with buying a stock in a tailspin like this is that it can always go lower. Until there's a solid reason to believe the business is turning things around and its financials will get better, the safest option for investors is to watch and wait. Lululemon may be trading around multiyear lows, but I don't think it has bottomed out just yet. There could still be a very long path to recovery.