Multiple media outlets on Thursday were reporting that the U.S. government is in talks to take equity stakes in quantum computing companies as part of a national security push. The outlets named IonQ (IONQ +6.81%), Rigetti Computing (RGTI +3.72%), and D-Wave Quantum (QBTS +0.38%). All three stocks surged on the news. No deals are final, but federal backing would fundamentally de-risk the space.

Among these names, IonQ stands out. Its trapped-ion technology demonstrates superior performance metrics, and the company already leads in cloud distribution and commercial traction -- exactly what government support would amplify.

Here's why this quantum computing stock stands out as one of the best ways to play this emerging tech.

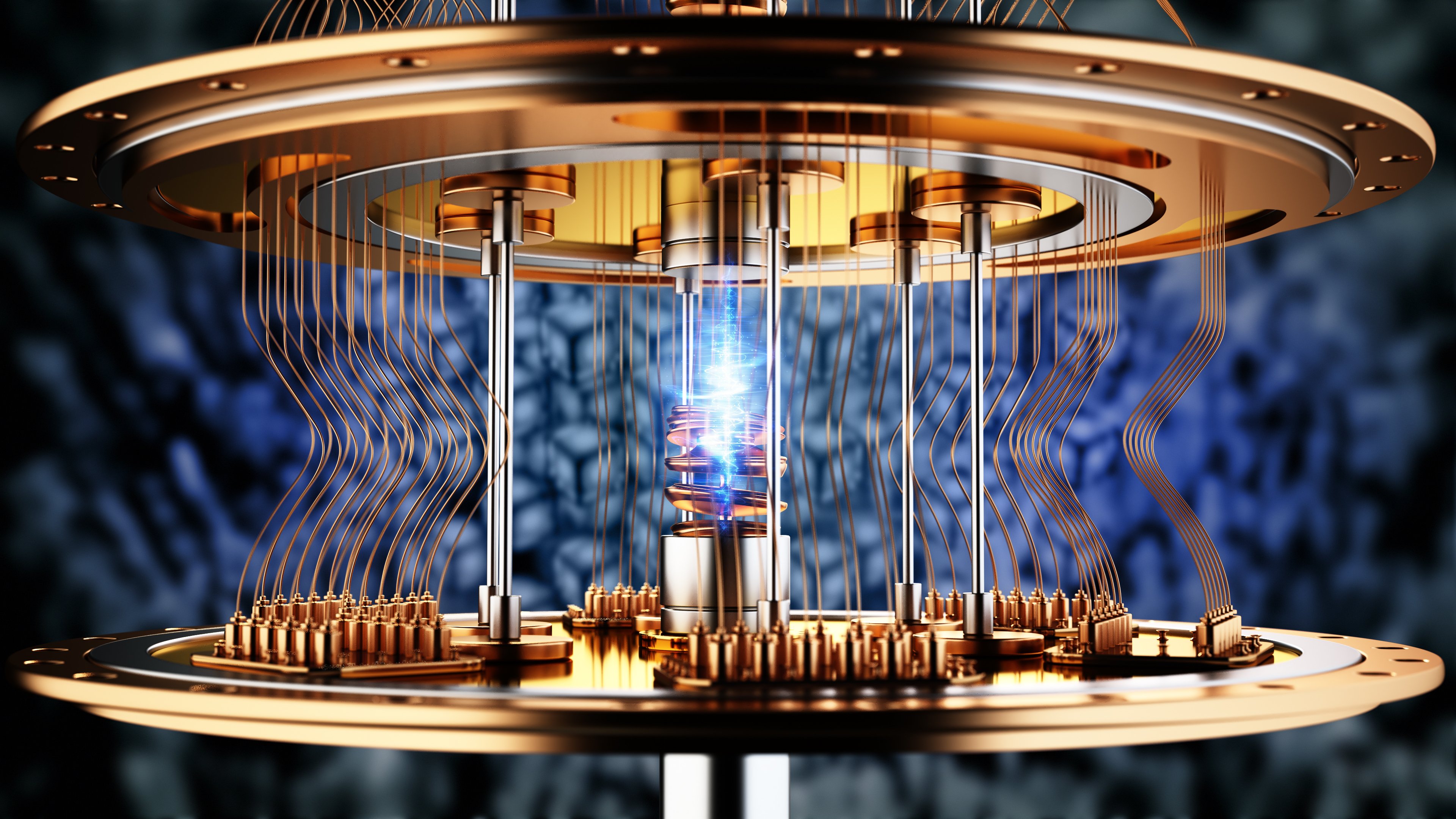

Image source: Getty Images.

Why does this news favor the technology leader?

Government support tends to flow toward deployment-ready platforms. IonQ already enjoys the best cloud availability and enterprise pathways among pure-play quantum companies. Federal investment would deepen those advantages.

NYSE: IONQ

Key Data Points

This isn't about momentum trading the news. If the government takes a stake or procurements follow, customers and talent would gravitate toward the perceived winner. That dynamic historically compounds in frontier technology. The company with the strongest technical foundation captures the most value from government validation.

The technology case

IonQ reached "a record algorithmic qubit score of #AQ 64" ahead of schedule this year -- a metric reflecting the complexity of problems quantum computers can solve reliably.

The company reports approximately 99.99% 2-qubit gate fidelity, meaning operations execute correctly 9,999 times out of 10,000. Higher accuracy lets you chain more operations together before errors accumulate and ruin the calculation.

Best of all, IonQ's trapped-ion qubits offer long coherence times without the burden of needing extreme refrigeration. These advantages translate directly into superior fidelity and performance metrics over competing methodologies.

Signs of real commercial traction

IonQ's hardware is available on Amazon Web Services' Braket, Microsoft Azure's Quantum, and Alphabet's Google Cloud Marketplace, as well as through direct IonQ cloud access. Teams can prototype quantum alongside classical workloads without building custom infrastructure.

Furthermore, the Electric Power Board of Chattanooga (EPB) -- a city-owned utility running an advanced smart grid and citywide fiber network -- is IonQ's partner on a $22 million Chattanooga quantum hub. EPB will host an IonQ system and work with IonQ on grid optimization projects, and IonQ is opening a local office to support training and customer work.

IonQ's revenue is small but growing. In the most recent quarter, the quantum pioneer reported $20.7 million in revenue, up about 82% year over year and above guidance. There is also early institutional validation, including Amazon's recent disclosure of a $36.7 million stake in IonQ. Government backing would lower the cost of capital and likely attract additional enterprise customers.

Why not Rigetti or D-Wave?

Rigetti Computing has shown real technical progress and a big stock move this year, but it still runs on a smaller revenue base and has fewer visible commercial channels than IonQ. Today's headline lifts the whole group, but it does not close that gap.

D-Wave Quantum is strong in optimization and has added European wins, yet quantum annealing serves a narrower set of problems than universal gate-based systems. If policy support and customer budgets tilt toward broadly applicable platforms, the company best positioned to capture that spend is IonQ.

Risks and my take

These are rumored talks, not signed deals. Terms could change or never arrive, and volatility cuts both ways. Quantum computing remains pre-profit, with years to go before fault-tolerant systems are scaled. Expect sharp drawdowns and uneven revenue. Investors should keep positions small and treat this as speculative capital.

If policy support concentrates on deployment-ready platforms, it will amplify the advantages that already exist. IonQ leads its peer group on fidelity, application benchmarks, cloud distribution, and visible commercial traction. Federal investment would strengthen those edges rather than create them. If you are taking one speculative position in quantum, make it IonQ.