Coca-Cola (KO 0.38%) stock surged higher following its earnings announcement for the third quarter of 2025.

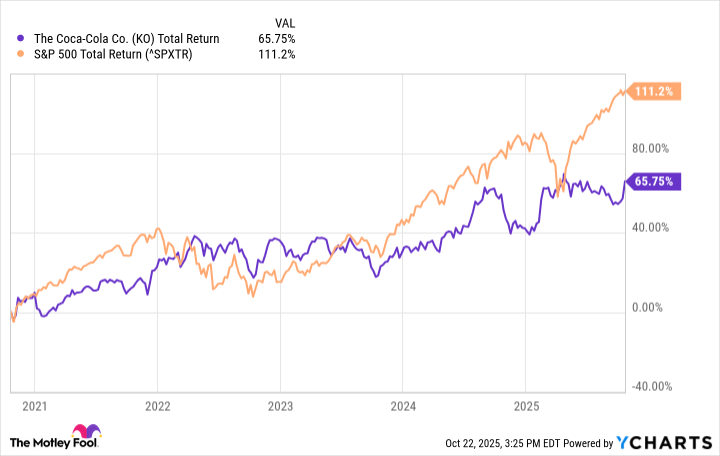

The beverage giant rose 4% following the announcement as it posted positive revenue and earnings growth. However, the company has struggled to outperform the S&P 500 in recent years. Knowing that, is the stock headed for a long-awaited rebound, or is the good news likely to be forgotten?

Image source: Getty Images.

How Coca-Cola fared in Q3

For the third quarter of 2025, revenue of $12.5 billion increased by 5% compared to year-ago levels. Still, upon closer inspection, a 6% rise in the price/mix led to most of the gains. In terms of sales volumes, global unit case volume rose by only 1%, and a closer look at its numerous beverage brands paints a mixed picture.

The water, sports, coffee, and tea segment grew by 3%, offsetting the 3% decline in juice, value-added dairy, and plant-based beverages. Despite strong sales from variants such as Coca-Cola Zero Sugar, the sparkling soft drinks segment reported flat growth.

The news was more positive on the net income front, at least from a certain point of view. Thanks to a 94% fall in other operating charges (driven primarily by transaction losses in Q3 2024), net income surged by 29% to almost $3.7 billion. Still, when measured on a non-GAAP basis, which excludes most one-time charges, net income increased by 6%, barely outpacing the increase in revenue.

Moreover, one metric should continue to work in the favor of Coca-Cola bulls. The company predicted that it would maintain 5% to 6% revenue growth for 2025, indicating that the improved results should continue in the near term.

NYSE: KO

Key Data Points

Coca-Cola moving forward

Nonetheless, as mentioned before, Coca-Cola has tended to underperform the S&P 500, even when including the 2.8% dividend yield on its rising dividend. Unfortunately, the report offered little hope that conditions will improve significantly.

KO Total Return Level data by YCharts.

Even with the strong GAAP profit growth, the 6% non-GAAP increase in earnings is probably a more accurate reflection of its longer-term net income growth. Additionally, its heavy dependence on price increases to drive that growth is concerning, since Coca-Cola's beverage brands face heavy competition.

Plus, while its price-to-earnings (P/E) ratio of 25 is below the 31 average for the S&P 500, it's not a level that makes the stock inexpensive. That means that investors will likely think twice about paying 25 times earnings when non-GAAP profit growth is mired in the single digits.

Will the run in Coca-Cola stock continue?

Considering the Q3 results, Coca-Cola stock should rise over time, but not enough to outperform the S&P 500.

Coca-Cola's brands continue to earn increasing amounts of revenue, and at least so far, price increases have not materially deterred sales.

Nonetheless, Coca-Cola faces the challenge of driving growth with mature brands in a highly competitive environment. Moreover, its valuation is likely not cheap enough to drive significant long-term increases in investor interest.

Ultimately, Coca-Cola should continue to drive modest growth over time. However, at current levels, investors should treat this stock as a hold.