Stock splits used to be a lot more common when fractional shares weren't widely available. That makes them all the more exciting when they're announced. While stock splits are mostly cosmetic, they do have some consequences for investors who don't have access to fractional shares and for options strategies.

Additionally, most companies tend to see their stocks rise slightly when stock splits are announced. So, if you can identify a company that could be announcing a stock split soon, then it may be smart to buy the stock before it's announced.

On Oct. 29, one of the largest stock splits in history could be announced, as the company is worth nearly $2 trillion and trading at over $700 per share. The company? Meta Platforms (META 0.64%). Will Meta announce a stock split then? Or is there another reason to buy the stock now?

Image source: Getty Images.

Meta has never announced a stock split before

Meta Platforms, formerly known as Facebook, has never split its stock before. It reports earnings on Oct. 29, which is when stock splits are commonly announced. This would make it quite a historic split for the company. Additionally, with Meta Platforms being the sixth-largest company in the world, it could be one of the largest companies to split its stock. Only Nvidia's stock split in 2024 would have been larger when it was about a $3 trillion company.

While an impending stock split may be exciting, I think there are plenty of other good reasons for investors to consider Meta Platforms.

NASDAQ: META

Key Data Points

Meta Platforms is known as an artificial intelligence hyperscaler. This means that it's spending a lot of money to bring its vision of what AI can be to the masses. This includes integrating AI-powered content into its social media platforms like Instagram and Facebook, but also using AI to boost ad conversions. This is the biggest AI use case for Meta, as it's just an advertising business at its core.

Advertising has also been incredibly strong, with ad revenue rising 22% in Q2. For Q3, Meta expects revenue to rise about 20%. That's a sign of a dominant business and that AI is having an impact on its advertising already.

This also brings up another point: Meta isn't as exposed to an AI bubble (if there even is one forming) as one may think.

If an AI bubble bursts, Meta Platforms will be fine

While it's debatable if there's an AI bubble or not, Meta Platforms wouldn't be affected over the long term if one bursts. That's because nearly all of its revenue comes from advertising on its social media platforms. The stock would likely sell off with the rest of the market in the short term, but would be OK from a long-term standpoint because it would just stop spending money on AI infrastructure, which would boost its margins.

This is a key point, and makes Meta Platforms a fairly safe investment. Additionally, it's not terribly expensive.

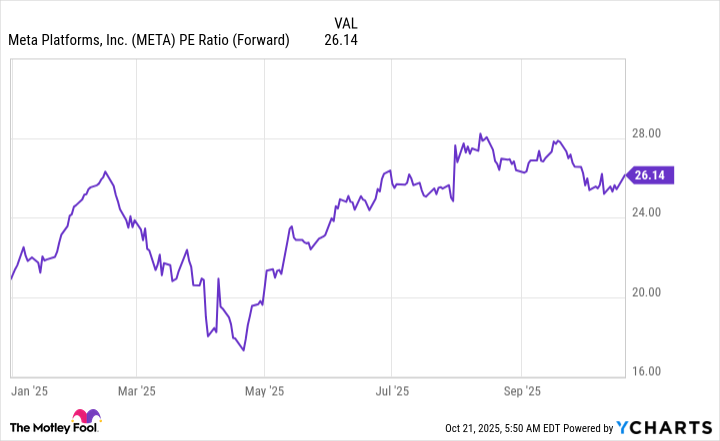

META PE Ratio (Forward) data by YCharts

At 26 times forward earnings, Meta Platforms holds a slight premium to the broader market, as measured by the S&P 500. The S&P 500 trades at 22 times forward earnings, but Meta has earned that premium due to its rapid growth rate, which is double the market's long-term average (Meta is growing at 20% while the market normally grows at a 10% pace).

I think that premium is well worth paying, as Meta is set to benefit from the massive AI buildout through increased advertising conversions and improved internal efficiency via AI agents. Even if a potential AI bubble bursts, Meta will still be fine over the long term, making it a great stock to buy and hold now.