The stock market has been in fine form in 2025 despite witnessing a tentative start to the year, when the tariff-induced trade war and recessionary fears sent investors into panic mode. As it turns out, the S&P 500 index is now up by almost 15% this year, with the index jumping by 25% in the last six months alone.

Technology stocks played a central role in driving this impressive rally in the broader stock market in the past six months. This is evident from the 42% gains clocked by the Nasdaq-100 Technology Sector index during this period, which is well above the S&P 500's gains. That's why it would be a good idea to put some money into technology stocks right now. This sector is winning big from a major catalyst in the form of artificial intelligence (AI).

If you have $1,000 in investible cash right now after paying your bills, clearing high-interest debt, and saving enough for difficult times, you can consider putting that money into the following names (either individually or combined).

Let's look at the reasons why they could turn out to be solid long-term investments.

Image source: TSMC.

AI chip demand has accelerated this company's growth

The demand for AI infrastructure such as chips, servers, and data centers is growing at a tremendous pace. That's not surprising, as companies and governments are spending huge amounts of money to train AI models and bring them into production to reap the benefits of generative AI.

Market research firm Gartner points out that sales of AI accelerator chips and general-purpose computing chips for tackling AI workloads may exceed $476 billion this year, up from $279 billion last year. This massive opportunity is powering healthy growth for Taiwan Semiconductor Manufacturing (TSM +0.62%).

NYSE: TSM

Key Data Points

The Taiwanese company, also known as TSMC, is the world's largest third-party chip manufacturer. The chips it fabricates for its long list of clients go into data centers, smartphones, and PCs, and all of these markets are witnessing healthy growth thanks to the adoption of AI. This is why TSMC's growth trajectory has started improving in recent quarters.

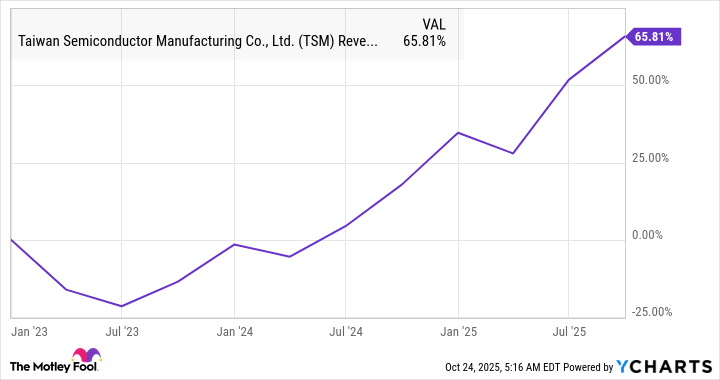

TSM Revenue (Quarterly) data by YCharts

The strong appetite for AI chips is the reason why TSMC is now expecting to register a mid-30% increase in revenue in 2025 as compared to its earlier estimate of around 30% growth. That would be an improvement over the 30% revenue jump the company clocked in 2024. It won't be surprising to see TSMC's growth rate accelerating further in the long run, as an estimated $5.2 trillion is expected to be spent on AI data centers through 2030.

McKinsey points out that $3 trillion of that investment will go toward semiconductors and other computing hardware, setting the stage for robust growth at TSMC given the company's dominant position in the foundry market. With shares of TSMC now trading at 25 times forward earnings, investors are getting a solid deal on this semiconductor stock right now that seems on track for years of impressive gains.

This high-flying stock isn't done soaring

Another company that's growing at a remarkable pace and seems worth buying right now is Applied Digital (APLD 1.38%). That's not surprising, as the company is in the business of designing, building, and operating AI data centers. The company witnessed an 84% year-over-year increase in revenue in its most recent quarter to $64.2 million.

NASDAQ: APLD

Key Data Points

While it is very small right now, it is worth noting that the company anticipates a massive $11 billion in contracted lease revenue over the next 15 years from its first data center campus in North Dakota. Additionally, Applied Digital has broken ground on its second data center complex, which it expects to reach full capacity by 2027.

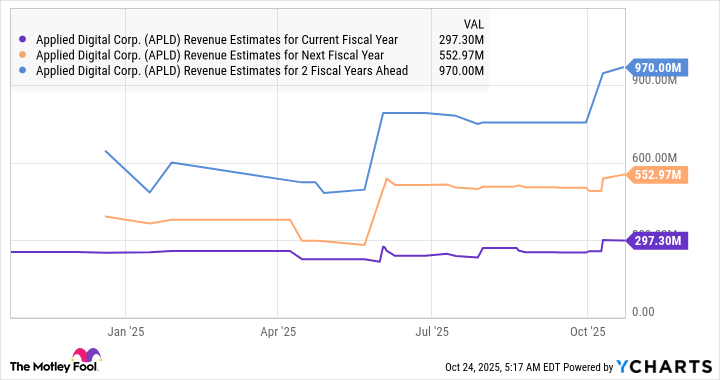

Goldman Sachs estimates that the demand for data centers could grow by 50% by 2027 to 92 gigawatts (GW), though that number could be higher thanks to AI. Not surprisingly, Applied Digital points out that it has already lined up a development pipeline of 4 GW to build AI-specific data centers. This could ensure outstanding long-term growth for the company, which explains why analysts are forecasting its revenue to increase impressively going forward.

APLD Revenue Estimates for Current Fiscal Year data by YCharts

Of course, buying Applied Digital right now looks like an expensive proposition, as it is trading at 37 times sales. This can be attributed to the 337% surge in its stock price this year. But the company's huge revenue pipeline and the pace at which its top line is expected to grow should allow it to justify that multiple.

For instance, if Applied Digital manages to achieve $970 million in revenue after a couple of years (as seen in the chart above) and trades at even half of its current sales multiple at that time, its market cap could jump to $18 billion. That would be almost double its current market cap, which means that this AI stock has the potential to deliver substantial returns and make investors richer in the long run.