Spending on data centers shows no sign of slowing down -- they're becoming more important by the day as more of our lives rely on computers. They process information to make streaming video, artificial intelligence (AI), online shopping, banking, and smart cars possible.

And as more companies move their systems to cloud environments to use AI tools that require massive power, data centers will continue to expand around the globe. Nvidia (NVDA +0.13%) CEO Jensen Huang said the company projects global spending on AI infrastructure will be $600 billion this year, and could reach $3 trillion to $4 trillion by 2030. That would be a growth rate of 400% to 566% at the top range, and a compound annual growth rate between 38% and 46%.

There are several great chip stocks for investors to consider to take advantage of AI data center growth. But the best is also the biggest, and that's Huang's own company, Nvidia. Let's look at why.

Image source: Nvidia.

Nvidia at a glance

It's hard to overstate the impact that Nvidia has as an AI company. Its graphics processing units (GPUs), which at one time were primarily used to run graphics for personal computers, evolved into the gold standard for high-performing AI applications that run large language models and make generative AI, machine learning, and other programs possible.

A key driver for Nvidia's dominance is its CUDA programming platform. CUDA is a parallel computing platform and programming model that allows developers to write and code applications on Nvidia's GPUs. The CUDA platform can perform multiple parts of a program simultaneously instead of one at a time, giving it faster processing times. And because it is designed to run on Nvidia GPUs, Nvidia gets an inherent advantage when developers are using the CUDA platform. No other AI company can match the CUDA platform.

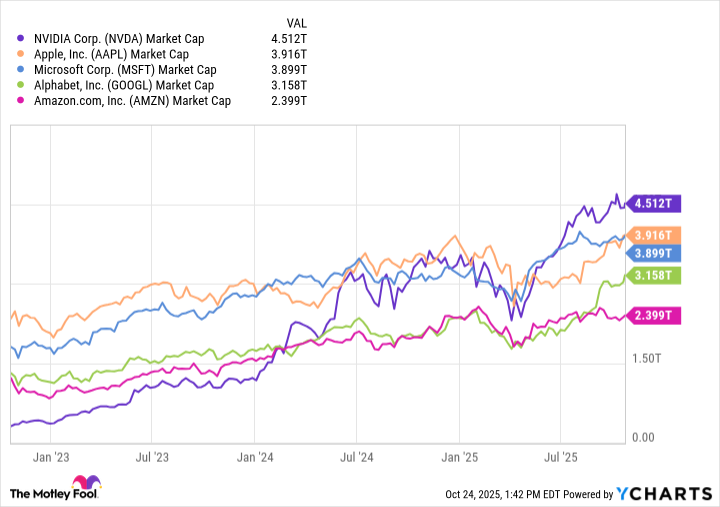

That's why Nvidia has been arguably the best stock in the market over the last three years. The company's jumped in market cap past the biggest companies in the world, seizing the top spot this year and becoming the first to top $4 trillion in market capitalization.

NVDA Market Cap data by YCharts

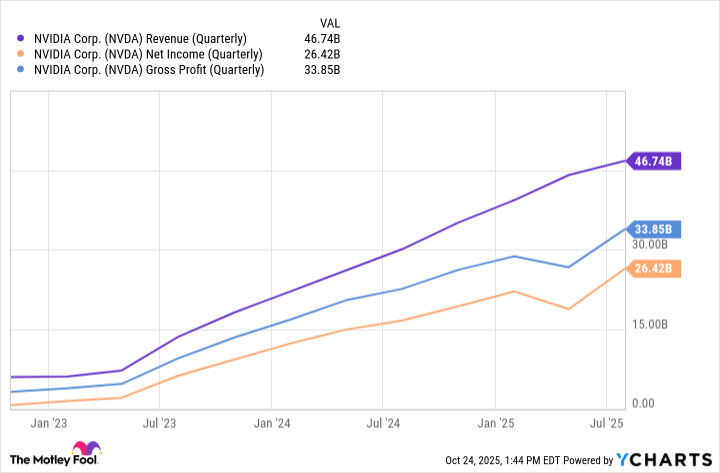

Nvidia's revenues continue to soar

Nvidia has an overwhelmingly dominant position in the data center GPU market, consistently over 90%. That's the biggest reason the company's revenue has climbed in tandem with its market cap. Revenues in the second quarter of fiscal 2026 (ended July 27, 2025) were $46.7 billion, up 56% from a year ago. Data center revenue was $41.1 billion, up 56% from the previous year, Nvidia said.

NVDA Revenue (Quarterly) data by YCharts

The company is mass-producing its Blackwell next-generation GPUs, which train AI models 2.5 times faster than Nvidia's Hopper models and run AI models up to six times faster. Nvidia said its Blackwell revenue rose 17% sequentially in the second quarter, and the company's expecting solid numbers when it reports third-quarter revenue.

On the downside, Nvidia is completely shut out of the China market now -- which is significant considering that the company previously had a 95% market share in China and generated 17% percent of its annual revenue in FY 2025 from China.

NASDAQ: NVDA

Key Data Points

However, Nvidia isn't sitting still. It's signing a lot of deals, among them an agreement with Uber Technologies to develop AI-powered autonomous driving technology and a partnership with OpenAI to build 10 gigawatts of AI data centers with Nvidia infrastructure. It has also taken a $5 billion stake in Intel to manufacture central processing units with Nvidia's NVLink, the company's high-speed interconnect technology.

Nvidia is the best AI stock to buy today... and tomorrow

Nvidia will need to continue to score deals if it wants to maintain it dominant market share. But nobody knows that more than Huang, who's become one of the world's most prominent CEOs.

Data centers sit squarely at the foundation of the tech ecosystem, and Nvidia is in the catbird's seat to profit from that buildout. As long as companies keep expanding their computing capacity -- and that's something that is not going to change in the near future -- then Nvidia will continue to be the market leader, and the best AI data center stock to buy.