Another day, another big move in an artificial intelligence (AI)-related stock. Today it was the turn of the automated test systems company Teradyne (TER 2.35%), whose stock was up by almost 20% as of 2 p.m. ET today.

Why Teradyne stock popped higher today

The move comes after a stellar set of third-quarter earnings (revenue up 18% year over year) and management's guidance for the fourth quarter, which calls for a revenue increase of 25% and a whopping 56% increase (at the midpoint of guidance) in earnings per share (EPS) compared to the third quarter.

NASDAQ: TER

Key Data Points

The reason for the string performance comes down to its Semiconductor Test Group, with CEO Greg Smith noting during the earnings presentation: "Growth was driven primarily by System-on-a-Chip (SOC) solutions for artificial intelligence applications and strong performance in memory. As we look ahead to Q4, AI-related test demand remains robust."

Given that the Semiconductor Test Group generated almost 79% of Teradyne's sales in the third quarter, it's reasonable to expect the company's sales growth to remain strong as long as semiconductor companies continue to invest to capture demand from AI applications.

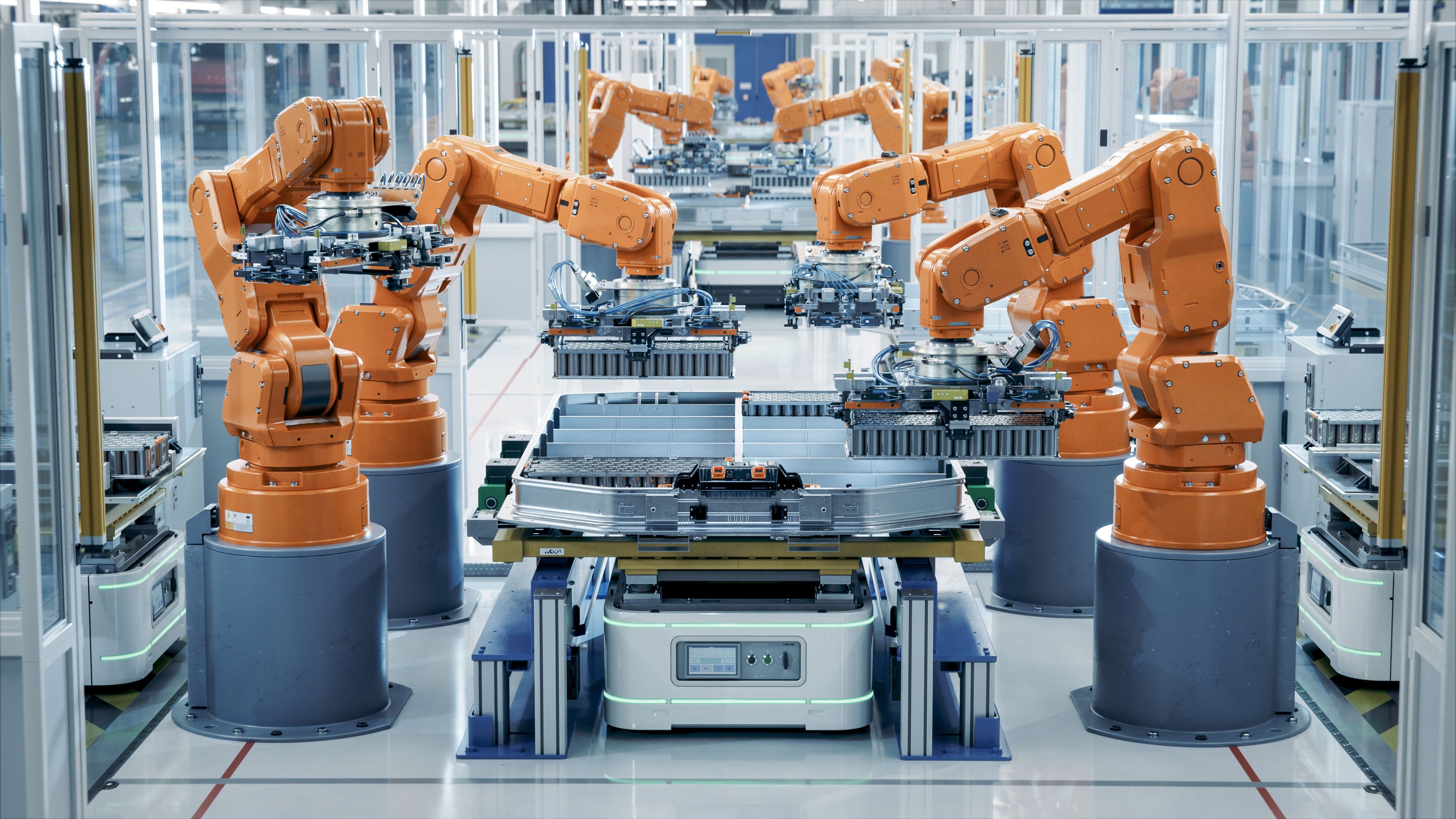

Image source: Getty Images.

What's next for Teradyne?

The company's results and guidance are yet more evidence that AI investment may still be in the early innings of an extended cycle. While it's unlikely to last forever, there's no sign of any let-up at the moment, and the underlying growth rate, which the AI market will inevitably settle on, could be much higher than the current assumptions implied in Teradyne's valuation.