1976 is remembered by many as the bicentennial of the founding of the United States. But it was also the year that Dow Jones Industrial Average component McDonald's (MCD +2.26%) issued its first dividend. The world has changed a lot in the 49 years since 1976, but through it all, investors have been able to count on the fast-food giant regularly paying out -- and increasing -- a dividend to shareholders.

The history of consistent increases continued last week when McDonald's announced a 5% dividend raise, putting it just one year and one more annual hike away from qualifying for membership in the elite group known as the Dividend Kings -- companies that have raised their dividends annually for 50 or more consecutive years.

Let's take a closer look at some of the reasons why McDonald's has what it takes to maintain its dividend-raising streak for decades to come.

Image source: Getty Images.

McDonald's secret sauce

McDonald's has developed an incredible business model that easily supports consistent dividend increases. That business model is built on the fact that roughly 95% of its 44,000 locations in over 100 countries are franchised. Franchisees pay McDonald's a down payment, licensing fees, rent, royalties, and other expenses. In exchange, they keep the revenues from their restaurants. McDonald's might alternatively be described as a real estate developer/landlord that also runs some restaurants.

This is a drastically different approach than a corporate-owned model like the one used by Chipotle Mexican Grill. That business model offers the corporation more control and consistency across restaurants, but it leaves it facing all of the financial risks alone if sales slow or costs rise.

McDonald's capital-light business model provides it with predictable cash flows and high margins, regardless of how the global economy is performing.

NYSE: MCD

Key Data Points

The blueprint of a cash cow

In 2024, McDonald's generated $15.72 billion in revenue from franchised restaurants and $9.78 billion in sales from its company-owned and operated restaurants. But it incurred $8.33 billion in expenses from those corporate-owned-and-operated restaurants, showing that its revenue from those stores is a far lower-margin source of income. By contrast, its operating expenses from franchised restaurants were just $2.54 billion.

McDonald's generated operating income of $11.71 billion in 2024 on $25.92 billion in revenue for an operating margin of 45.2%. But if you factored the company-owned and operated restaurants out of the equation, McDonald's would have an operating margin of 63.6%.That is an absurdly profitable business.

For context, Nvidia's trailing 12-month operating margin is 58.1%. So McDonald's franchise business converts a greater share of its revenue into operating income than the leading provider of the graphics processing units and associated software that are powering artificial intelligence models.

But unlike Nvidia, McDonald's doesn't have a pressing need to spend billions every quarter on research and development. Instead, it passes along the bulk of its free cash flow to shareholders through dividends and buybacks.

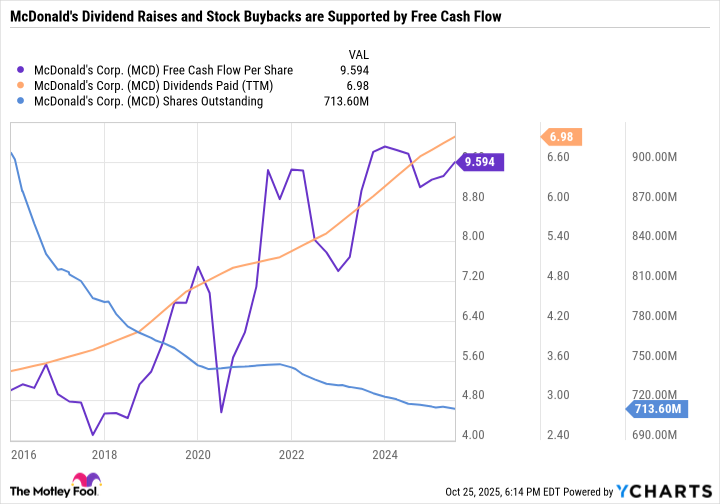

Data by YCharts.

McDonald's generates more FCF per share than it needs to pay the dividend, so it consistently buys back stock, thereby reducing its share count and accelerating earnings per share growth.

An elite dividend stock to buy now

McDonald's is an excellent choice for long-term investors looking for a blue chip dividend stock. With a 26.2 price-to-earnings ratio, it isn't dirt cheap. And there are plenty of stocks with yields that exceed McDonald's 2.4%.

Still, McDonald's is top-tier in dividend reliability, making it an ideal buy for risk-averse investors or folks looking to supplement their retirement income.