On Oct. 23, shoe company Deckers Brands (DECK +1.17%) reported financial results for its fiscal second quarter of 2026 and the stock promptly plunged by more than 10%. As of this writing, Deckers stock is now down 56% so far in 2025. It's the stock's largest pullback in over a decade. And this gives it the unfortunate title of the worst-performing stock in the S&P 500 year to date.

I'm sure advertising technology company The Trade Desk and athletic apparel business Lululemon are thankful to not be in last place anymore -- these two stocks were previously the only two S&P 500 stocks that were down 50% or more and they've taken turns at last place. But after Q2 results, Deckers dropped below them both.

Image source: Getty Images.

The Trade Desk is staring down its slowest growth as a publicly traded company, so investors understandably have concerns. Meanwhile, there seems to be weak demand for Lululemon's products in key markets and tariffs put uncertainty on its cost structure. But why are investors souring on Deckers?

Deckers just revised its outlook for fiscal 2026. And it wasn't the kind of revision that investors wanted to see.

What's going on with Deckers?

Deckers has two main shoe brands: Hoka and Ugg. These two brands collectively comprise 97% of the company's net sales, with Ugg accounting for 53% of Q2 net sales compared to 44% for Hoka.

NYSE: DECK

Key Data Points

At the start of the fiscal year, Deckers' management said that it expected a full-year net-sales growth rate in the mid teens for Hoka and in the mid-single digits for Ugg. But with its Q2 report, management revised both of those growth ranges down to the low teens for Hoka and to the low-single digits for Ugg.

The revision to the growth rate was minor. But investors may also be eyeing trends with Deckers' profitability. In its fiscal 2025, the company had a gross margin of 58% -- an all-time high. But for fiscal 2026, management is projecting a gross margin of 56%.

A slowdown in sales and a pullback in the gross profit margin suggests an undesirable scenario for Deckers. It's possible that demand for its shoes is fading, which would lead management to lower prices to move inventory. For what it's worth, fashion trends can quickly change in the world of shoe stocks.

Deckers could be in the early stages of this weaker-demand-lower-prices trend, which is why investors are eager to move on sooner rather than later.

Are investors overreacting?

I believe that investors should tap the brakes when it comes to fears regarding Deckers stock.

Over the last five years, Deckers' revenue has more than doubled. Given that rate of growth, its ongoing growth projections for fiscal 2026 don't indicate weakened demand to me. It's simply hard to keep growing at the same rate.

Moreover, Deckers is facing some expense headwinds due to tariffs. This will bring down its gross margin for the remainder of the year. To clarify, a lower gross margin isn't the result of lower prices. Indeed, Deckers' selling prices are holding up well.

It's reasonable to expect any apparel or shoe company to have periods of slowing sales and times where margins have a haircut. But these are relatively minor things and overshadow some positives with the business.

For starters, Deckers generates positive cash flow. Moreover, its balance sheet is cash-rich with $1.4 billion and zero debt. If there is some uncertainty in the shoe space right now, this is a strong business that can outlast some of the others.

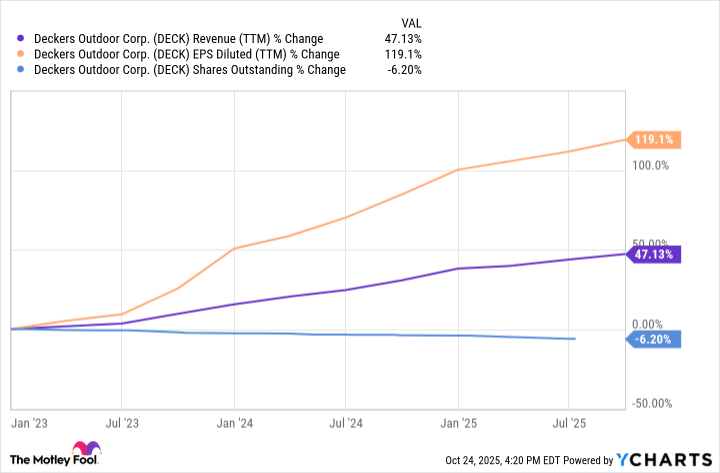

Additionally, Deckers is repurchasing shares to boost value for its shareholders. As a result, earnings per share (EPS) continue to grow at a better rate than revenue, which is what investors want to see.

DECK Revenue (TTM) data by YCharts

Because of its poor performance in 2025 coupled with ongoing EPS growth, Deckers stock now trades at its cheapest valuation since it briefly crashed during the early days of the COVID-19 pandemic. The price-to-earnings (P/E) ratio is a mere 13, which represents roughly a 50% discount to the average stock in the S&P 500.

Given its ongoing growth and its strong balance sheet, I believe that Deckers could be a good stock to buy here considering its steep discount to the market. Simply put, short-term investors seem to be overreacting to Deckers' Q2 report, providing long-term investors with a great investment opportunity.