Warren Buffett built the Berkshire Hathaway holding company into a trillion-dollar conglomerate, catapulting his personal net worth to $145 billion. Ray Dalio, on the other hand, founded one of the world's most successful hedge funds, Bridgewater Associates, and he retired in 2022 with a net worth of over $15 billion.

In other words, they became two of the world's richest people thanks to their knack for picking winning investments. However, they have entirely opposite views on one of the best-performing assets this year: Gold.

The shiny yellow metal has soared by 48% in 2025, obliterating the S&P 500 (^GSPC +0.54%) stock market index, which is up 17%. Dalio thinks it's a must-have asset for investors, whereas Buffett has deliberately avoided it. Who's right?

Image source: The Motley Fool.

Warren Buffett calls gold an "unproductive" asset

Buffett oversees a number of wholly owned subsidiaries at Berkshire, in addition to a $312 billion portfolio of publicly traded stocks and securities. He likes to invest in companies with steady growth, strong earnings, and experienced management teams, but he especially favors those that regularly pay dividends and engage in stock buybacks, because they compound his returns much faster.

That's part of the reason he dislikes gold. In his 2011 letter to Berkshire's shareholders, he explicitly referred to it as an unproductive asset and highlighted two of its main shortcomings:

- Gold isn't very useful. It's a staple in the jewelry industry, and it has some applications in the semiconductor space because of its high electrical conductivity, but neither of those sources of demand is strong enough to soak up the new supply pulled out of the ground each year.

- Gold isn't procreative. An investor who buys one ounce of gold today will still have exactly one ounce of gold in a century from now, because it doesn't produce revenue or earnings. It doesn't rise in value in isolation; it only rises in value relative to depreciating fiat currencies like the U.S. dollar (more on this later).

In his 2011 letter, Buffett went on to compare the value of gold to various assets investors could buy instead. Following that line of thought, the total value of all above-ground physical gold is currently around $28 trillion, and for the same price, you could acquire the world's three largest companies (Nvidia, Microsoft, and Apple), more than twice over.

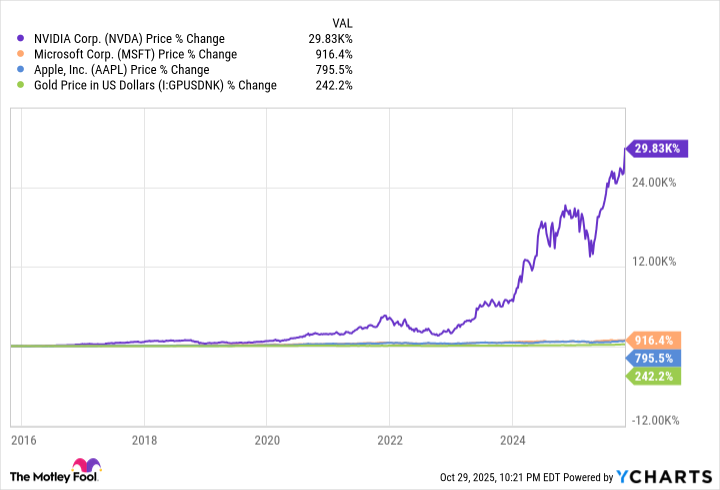

Those companies produce goods that add real value to the world, and their shareholders reap the benefits in the form of capital growth and cash flow from dividends. Over the last 10 years, the results speak for themselves:

Ray Dalio thinks investors should own gold

Dalio is a student of history, so he is very concerned about the potential consequences of reckless government spending in the U.S. and the soaring national debt.

Like many countries around the world, the U.S. used to peg the value of its domestic currency to gold. This was called the gold standard, and it prevented governments from printing money out of thin air, because every dollar had to be backed by physical gold reserves.

However, the U.S. abandoned the gold standard in 1971, and five decades later, the national debt just crossed $38 trillion for the first time ever. The government ran an eye-popping budget deficit of $1.8 trillion in fiscal 2025 (ended Sept. 30), so it's spending significantly more than it's receiving in tax receipts.

Dalio likens the current situation to the 1970s, when soaring inflation, spending, and debt eroded confidence in paper currency. He isn't surprised investors are flocking to gold right now because, unlike Buffett, he doesn't see it as just a metal -- he sees it as the most established form of money. It's hard to argue with that position because gold has been considered a store of value for thousands of years.

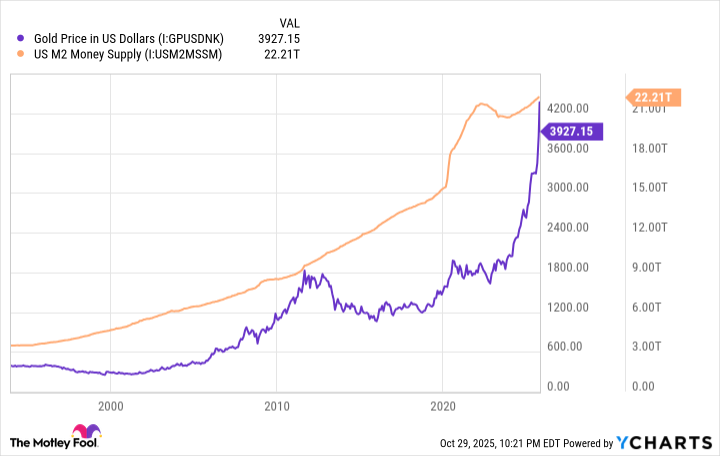

Investors are speculating that devaluing the dollar by significantly increasing the money supply is the only way the U.S. will be able to pay down its debt. The chart below shows a crystal-clear correlation between the growing money supply and the value of gold relative to the U.S. dollar.

Gold Price in US Dollars data by YCharts

As a result, while speaking at the Greenwich Economic Forum in October, Dalio said investors should consider parking up to 15% of their portfolios in gold. Of course, buying piles of physical gold isn't practical for most people, but exchange-traded funds (ETFs) like the iShares Gold Trust (GLD 4.00%) are a great alternative.

NYSEMKT: GLD

Key Data Points

What should investors do?

The answer is probably somewhere in the middle. Gold's 48% year-to-date rally in 2025 certainly isn't typical, because it has generated a compound annual return of 7.96% over the last 30 years. From that perspective, it's an inferior investment to the S&P 500, which returned 10.6% per year over the same period. One point for Buffett.

However, if America fails to get its fiscal house in order and it evolves into a full-blown economic crisis, the stock market probably won't be the best place to invest (at least temporarily). In that scenario, gold would probably experience significant inflows, so investors might be thankful they followed Dalio's advice and parked some of their assets in the yellow metal.

Perhaps a portfolio allocation of 15% is a little high since many financial advisors recommend somewhere between 5% and 10%, but it could certainly pay to own some gold. Think of it like holding an insurance policy.