Tesla (TSLA 0.65%) reported earnings last week. And while there were some disappointments, I am left very excited about one thing: a revelation from Elon Musk regarding the company's robotaxi ambitions.

Tesla is no longer considered an automaker

It seems that Tesla is no longer considered an automaker. At least that's what the market is saying.

Image source: Tesla.

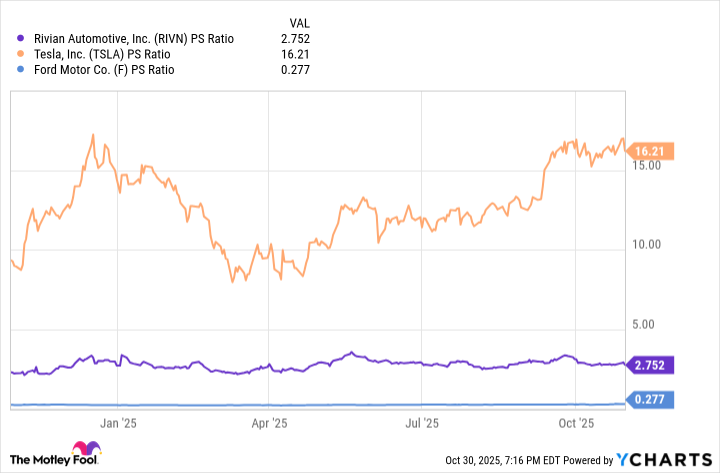

Take a look at Tesla's price-to-sales ratio versus other automakers. The valuation gap is obvious. Tesla trades above 16 times earnings -- a sizable premium to other EV stocks like Rivian, as well as conventional automakers like Ford. This type of valuation is typically only reserved for tech businesses with huge growth potential, not capital-intensive manufacturing companies.

RIVN PS Ratio data by YCharts

This valuation gap isn't due to rapid trailing sales or profit growth. In fact, Tesla is expected to experience a decline in sales this fiscal year. In some parts of the world, Tesla's sales are plunging by up to 40%, even as EV sales in those regions continue to rise as a whole. Plus, the EV industry just lost valuable federal subsidies, including tax credits for buyers and regulatory credits for automakers -- credits that have brought Tesla billions in pure profit in recent years.

NASDAQ: TSLA

Key Data Points

And yet Tesla continues to trade at a huge premium to other automakers. The market now views it as an AI stock pursuing a multi-trillion dollar growth opportunity involving robotaxis.

Artificial intelligence and robotaxis are the future

Tesla CEO Elon Musk has a long history of overpromising. Just take a look at his track record regarding autonomous vehicles. In 2013, he boldly claimed that 90% of Tesla's driven miles would be autonomous within three years. That never happened.

In 2015, he tried again. "From a technology standpoint," he predicted, "Tesla will have a car that can do full autonomy in about three years, maybe a bit sooner." While regulatory barriers may have prevented the real world rollout of Tesla's technologies, it was never proven that the company would actually achieve full autonomy even in private tests.

In 2020, Musk shifted his focus from autonomous driving for personal consumers to a commercial fleet of robotaxis. "I feel very confident predicting that there will be autonomous robotaxis from Tesla next year," he told investors. "From our standpoint, if you fast forward a year, maybe a year and three months, but next year for sure, we'll have over a million robotaxis on the road." It wouldn't be until 2025 that the company would actually get its first robotaxis on the roads, albeit it in limited numbers, in a single city, complete with human drivers that could take over at any moment.

And yet Musk continues to promise big things. He predicts "millions" of Tesla robotaxis will roam the streets of the U.S. by the end of 2026 -- just one year away.

Here's the thing: This time could be different. Having robotaxis on the ground -- even in limited number and capacity -- is a big deal. Musk revealed on the last conference call that the service could expand to eight to 10 cities by the end of the year.

Even if he's off by an entire year, Tesla should be leading the charge when it comes to expanding its robotaxi service. That's due to two main factors. First, Tesla controls its own means of production, something few other existing robotaxi services can claim.

Second, it has invested heavily in AI in recent years, a game changer for autonomous technologies that have previously relied on a complex and costly system of cameras and sensors. Tesla's robotaxis will still have plenty of those, but rapid advances in AI allow for the processing of that information in higher volumes and greater speed than ever before -- a eureka moment for the entire industry.

"I'm callin' it," stresses Morgan Stanley analyst Adam Jonas. "Autonomous cars are solved. When I say solved, do I mean six or seven 9's to the right of the decimal? No. Perfection? Never. But enough to pull the safety driver at scale in major metros."

Tesla will face heavy competition when it comes to self-driving cars and robotaxis. But its vertically integrated business model combined with unparalleled access to capital, brand name recognition, and early investment should put it in the driver's seat to pursue what some experts believe could be a $10 trillion global opportunity.