The end of 2025 is fast approaching, and several stocks look poised to skyrocket to end the year. These are companies that have significant tailwinds blowing in their favor and will be well-positioned to thrive in 2026.

The three stocks I'm expecting to soar to end the year are Nvidia (NVDA +1.60%), Taiwan Semiconductor (TSM +2.21%), and Amazon (AMZN +2.06%). I think all three of these companies are excellent buys now, and investors should consider buying them before 2026 arrives.

Image source: Getty Images.

Nvidia

Nvidia's stock has been an absolute rocket ship since the artificial intelligence arms race kicked off in 2023. Its graphics processing units (GPUs) have built the AI infrastructure as we know it, and that doesn't look to be changing anytime soon. We're still a ways away from building out the computing footprint necessary to be an AI-first society, and Nvidia just announced that it has $500 billion in orders for its leading data center GPUs throughout the end of 2026.

NASDAQ: NVDA

Key Data Points

That's unbelievable growth, especially considering that Nvidia has generated $165 billion in revenue over the past 12 months. Should Nvidia deliver all of those products and grow that rapidly throughout the end of 2026, the stock is a no-brainer buy at these prices.

This will drive massive Nvidia buying before the year is over, making it an excellent stock to scoop up shares of now, even after its pop following the announcement.

Taiwan Semiconductor

A company that will benefit directly from the AI buildout is Taiwan Semiconductor (TSMC). Nvidia and its competitors don't have the capability to manufacture chips that go into these high-powered computing devices, so they farm that work out to Taiwan Semiconductor. TSMC is the leading chip foundry by revenue, and it's no secret that its capabilities are the best in the world.

With Nvidia's sky-high chip demand, it will drive increased TSMC sales. Furthermore, TSMC has a new 2nm (nanometer) chip technology entering production that could alleviate some of the energy concerns for data centers. Their 2nm chips utilize 25% to 30% less power when configured to run at the same speed as the preceding 3nm chip node. That's a huge efficiency improvement, and could drive Nvidia clients to buy higher-end chips due to the energy savings alone.

NYSE: TSM

Key Data Points

TSMC is positioned to benefit from whoever ends up being the ultimate winner in the AI arms race, and with the AI arms race spending spree far from over, it's positioned to soar by the end of 2025 and throughout 2026.

Amazon

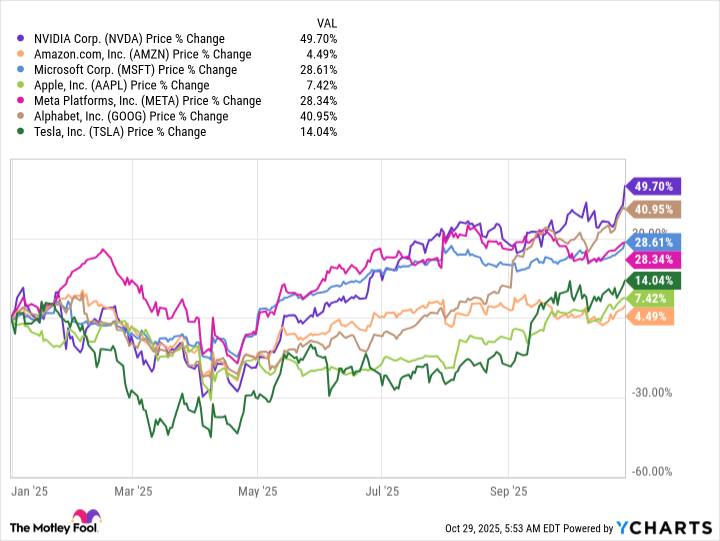

Last is Amazon. Amazon hasn't had a great year, and was the worst-performing Magnificent Seven stock so far in 2025 until it released its latest financial results late last week. Here's how it looked as of Oct. 28's close.

We saw that reverse slightly after its report, and I think that upward trend could continue over the next few months as investors start to realize that Amazon is a terrific bargain at these levels.

Amazon's growth story is centered around its margins improving thanks to the rise of high-margin businesses like advertising and its cloud computing wing, Amazon Web Services (AWS). Right now, Amazon's margins haven't improved over the recent quarter, but that's because it's dumping a ton of cash flow into AI computing capacity. Once this is complete, Amazon will have massive cash flow to be able to repurchase stock and boost shareholder returns.

Another item investors forget is that AWS still has the largest cloud computing market share. This is a massive advantage, as many clients will continue using AWS to deploy AI workloads as they come online. Although its competitors have posted stronger growth rates in recent quarters, AWS is still the leader in this industry.

Amazon is still a force to be reckoned with, and its recent underperformance despite solid results positions it well to have a phenomenal end to 2025 and catch up to its peers in 2026.