Artificial intelligence (AI) technology is having a positive impact on several industries across the globe. From education to healthcare to manufacturing to supply chain, AI adoption is gaining steam thanks to the many benefits that this technology brings.

Not surprisingly, the global AI industry is expected to record an annual growth rate of 37% through 2031. That's the reason why companies offering AI solutions that help their customers improve productivity are likely to witness healthy growth in the coming years. Twilio (TWLO 0.56%) is one such company whose cloud-based application programming interfaces (APIs) enable its clients to remain connected with their customers through various channels.

Importantly, Twilio has embraced AI, and this move is now translating into solid financial gains. Let's look at the reasons why this cloud stock may turn out to be one of the best AI-centric investments of the decade.

Image source: Getty Images.

AI is boosting Twilio's growth

Twilio operates in the cloud-based contact center market. Its APIs displaced traditional contact centers that required heavy initial investments and running costs, such as buying several computers and communication equipment, along with monthly expenses such as building rent and infrastructure management costs.

NYSE: TWLO

Key Data Points

Twilio's clients can simply install its APIs on an internet-enabled computer/laptop, and this allows their customer service agents to assist customers from anywhere at any time. Not surprisingly, the cloud contact center market is growing at a healthy pace. Mordor Intelligence expects it to hit $32.6 billion in revenue in 2025.

Twilio generated $3.7 billion in revenue in the first nine months of 2025. The company's guidance for the final quarter of the year suggests that it will end the year with at least $5 billion in revenue. That would put its share of the cloud contact center market at just over 15% (based on Mordor Intelligence's market size estimate).

However, don't be surprised to see the company cornering a bigger share of this market in the future, all thanks to AI. The company has been integrating various AI-focused tools into its cloud communications platform in recent quarters, and the good part is that its efforts are paying off. CEO Khozema Shipchandler remarked on the latest earnings call that "our innovation bets on new trusted capabilities like conversational AI and branded communications are also paying off."

The company points out that several AI companies have been using Twilio's platform to build conversational AI applications. Specifically, Twilio's revenue from its 10 largest voice AI start-up customers jumped by more than 10 times from the year-ago period. That trend is likely to stay here, considering that the adoption of AI in cloud contact centers is expected to jump by over 5 times over the next decade.

Twilio reported a 15% year-over-year increase in revenue last quarter to $1.3 billion, which was an improvement over the 10% spike in revenue it reported in the same period last year. Its non-GAAP (adjusted) earnings increased by 22.5% to $1.25 per share. This improvement can be attributed to a robust expansion in the company's customer base, as well as an increase in spending by existing customers.

Twilio's active customer accounts increased by 22% from the year-ago period. Again, that was a major improvement over the year-ago period when its customer base increased by less than 5%. Twilio's dollar-based net expansion rate, which compares the spending by its customers at the end of a quarter to the spending by that same customer cohort in the year-ago quarter, increased by four points from the prior year.

Twilio's dollar-based net expansion rate landed at 109% last quarter. A reading of more than 100% means that its existing customers are now spending more on its solutions. This combination of an increase in the customer count and a bump in spending by existing customers explains why its earnings growth was solid in Q3. And given that Twilio's customer growth accelerated significantly last quarter, there is a good chance that its expansion rate will keep heading higher in the future.

The stock seems poised for terrific gains through the end of the decade

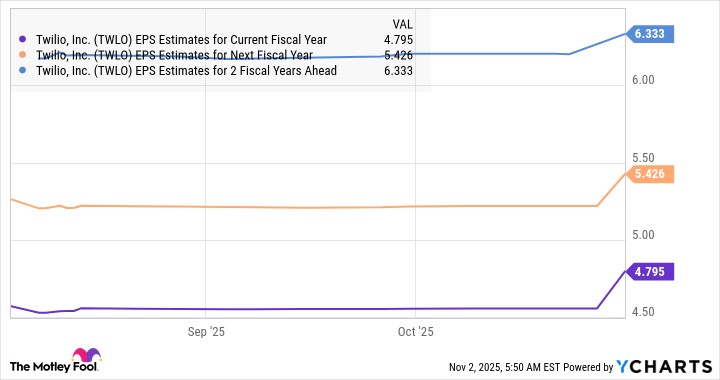

Analysts have raised their growth expectations for Twilio following its latest earnings report.

TWLO EPS Estimates for Current Fiscal Year data by YCharts

The important point worth noting in the chart above is that its bottom-line growth is expected to step on the gas going forward. It won't be surprising to see Twilio's growth accelerate beyond 2027 as well, considering the secular growth of the cloud contact center market and the adoption of AI in this space.

Assuming its bottom line jumps by 20% in the three years after 2027, Twilio could report $10.94 per share in earnings in 2030. Multiplying the estimated earnings by the tech-laden Nasdaq-100 index's forward earnings multiple of 28 suggests that Twilio stock could jump to $306 after five years. That points toward a potential jump of 126% from current levels.

Given that Twilio is trading at just 20 times forward earnings right now, investors are getting a great deal on this AI stock that could turn out to be a big winner this decade.