Investing isn't easy. If it were, everyone would do it. But there are shortcuts that can make it a lot less difficult. If you're a dividend-loving investor, the Schwab US Dividend Equity ETF (SCHD +1.67%) is one of those shortcuts, and it could set you up for a lifetime of reliable payouts.

What does Schwab US Dividend Equity ETF do?

If you want to get technical about it, the Schwab US Dividend Equity ETF doesn't actually do anything but track an index. So the real story here isn't what the exchange-traded fund does, but what the index does. The index in question is the Dow Jones U.S. Dividend 100. However, it's a bespoke index -- it was created specifically so an ETF could track it.

Image source: Getty Images.

Multiple steps go into the process by which that index determines which 100 stocks should be among its components. First, only stocks that have dividend-hiking track records of 10 straight years or more are considered for inclusion. (Real estate investment trusts are not eligible for inclusion because of their unique corporate structures.) A 10-year dividend-boosting streak is actually something that a lot of ETFs look at: The Vanguard Dividend Appreciation ETF, for example, uses that as its primary investment criterion. (In addition, that fund lops off the highest yielding 25% of stocks, which means it is more growth focused than income focused.)

What really separates the Schwab US Dividend Equity ETF and the Dow Jones U.S. Dividend 100 index from the pack is what happens next. The index creates a composite score for all of the companies it looks at. There are four main components to the score.

First is the cash-flow-to-total-debt ratio, which is a way to assess a company's financial strength. Second is return on equity, which is a way to assess how well a company is run. Third is dividend yield, which is a way to assess how much an investor will get in income today, but also acts as an alternative way to assess valuation. Higher-yielding stocks are often trading at attractive valuations. Fourth, the company's five-year dividend growth rate is taken into consideration. That assesses both the company's growth and management's commitment to returning value to shareholders over time.

The 100 companies with the best composite scores are put into the index and, thus, the Schwab US Dividend Equity ETF. The holdings are weighted by market cap, so the largest companies have the greatest impact on the index's performance. And the portfolio is updated annually, so the list of holdings is always close to the theoretical target.

NYSEMKT: SCHD

Key Data Points

A surprisingly attractive cost picture

A lot is going on under the hood with the Schwab US Dividend Equity ETF. If you had to do all of that complicated work, it would be time consuming, to say the least. Which is why it is a little shocking that the expense ratio for this ETF is a very low 0.06%. That is as close to free on Wall Street as you are likely to get for the amount of work being done to manage the fund's portfolio.

But what work is actually being done? If you step back and look at the investment approach, the Schwab US Dividend Equity ETF is really trying to find well-run companies that are financially strong and growing, and that also have attractive and growing dividends. If you are a dividend investor, that's likely to be exactly what you are trying to do, too. If you buy the Schwab US Dividend Equity ETF, you can hand all of the work off to the ETF and spend your time doing other things. And since the portfolio is updated annually, you could be set up for life here. The fund will always own the same types of stocks and doesn't really need to be watched like a hawk in the way that a portfolio of individual stocks you picked yourself might require. You just need to buy into the index construction methodology.

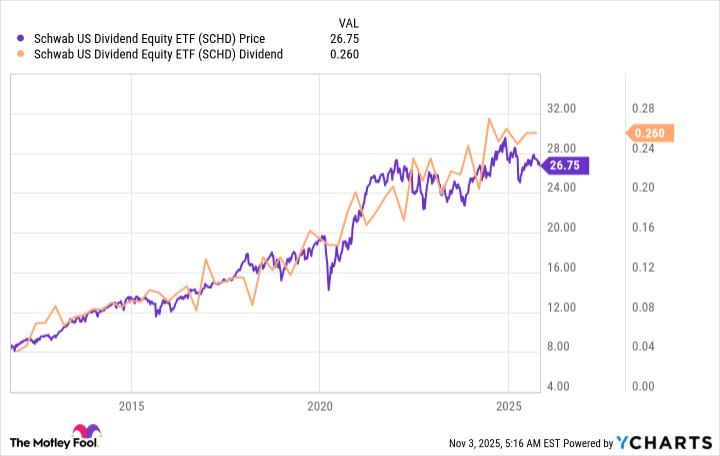

What are you really getting? As the chart above shows, the ETF's price and dividend have both trended roughly higher over time. So more capital and more income. Sure, there have been ups and downs along the way, but overall, this is a solid option for dividend investors who don't want to put a ton of work into building and managing their income-focused portfolios.

There's one trade-off to consider

The big caveat with the Schwab US Dividend Equity ETF is going to be its roughly 3.8% dividend yield. Some income investors might feel like that's a bit low. And it might be, but it's also important to consider the long-term growth outlook for that dividend.

The buying power of a large initial dividend that doesn't grow will get eaten away by inflation over time. In other words, for most dividend investors, a slightly lower starting yield backed by the reasonable expectation that the dividend will grow steadily is probably a better choice. All in all, the Schwab US Dividend Equity is designed to set investors up with a lifetime of income with a minimal amount of work (for the investor, anyway).