Decentralized applications hold a lot of promise, because there is a growing demand for services that can't be controlled or manipulated by a single entity (like a company or government). They have become especially popular in areas like financial services, gaming, and even real estate, where people value transparent systems of record and the ability to control their own data.

Ethereum (ETH 5.26%) is the world's largest platform for developing decentralized applications. Every time someone uses an Ethereum-based app, they incur a fee payable in the network's native cryptocurrency, Ether. In theory, this arrangement creates constant demand for Ether as long as the network continues to expand, which could benefit investors.

Ether actually hit a new record high of $4,954 per coin earlier this year. It's down 32% from that peak, so should investors buy the dip before it potentially recovers and breaks above the $5,000 milestone?

Image source: Getty Images.

The go-to network for decentralized apps

Decentralized apps are governed by smart contracts, which are slivers of computer code that live on the Ethereum blockchain. These contracts set the rules for each application's functionality, and they typically can't be changed, which ensures no person, company, or government can disrupt the app's decentralized structure.

The Ethereum network itself is also completely decentralized. Rather than hosting its blockchain system of record inside a data center, which is what a traditional business would do, Ethereum is hosted on thousands of nodes all over the world. These nodes can be computers that are run by practically anybody, and they each store a full copy of the Ethereum blockchain, making it practically impossible for a hacker to take down the entire network.

Thousands of decentralized apps have been created using Ethereum. Several online casino and betting platforms, for instance, host the outcomes, transactions, and the rules behind each game on the blockchain, so any user can verify them. Plus, as crypto-based platforms, they are much easier for users to access without disclosing as much of their personal information.

These platforms differ significantly from traditional centralized betting platforms, which are burdened by strict regulations and offer limited transparency regarding the functionality of their games.

Decentralized crypto exchanges offer similar benefits. Ethereum-based Uniswap, for example, lets users swap their cryptocurrencies for other cryptocurrencies, and it uses smart contracts to calculate prices and execute transactions. Users can simply connect their crypto wallet to Uniswap without setting up an account, making it very convenient.

Whenever someone uses a decentralized app, whether it's to gamble or exchange cryptocurrencies, they activate smart contracts that trigger fees payable in Ether, thus creating demand for the coin that drives its price higher.

CRYPTO: ETH

Key Data Points

Should you buy Ether while it's under $5,000?

Ethereum is attracting a growing amount of support from traditional financial analysts. Geoff Kendrick from Standard Chartered thinks Ether could hit $25,000 per coin by 2028, as legislation like the Genius Act in the U.S. makes it easier for developers to launch stablecoins, many of which are built on Ethereum.

Then there is Tom Lee from Fundstrat Global Advisors, who believes the Ethereum network could transform entire industries, especially financial services, which could drive Ether to a whopping $62,000 per coin by 2035. That would give Ether a market capitalization of $7.5 trillion based on its current supply of 120.7 million coins, making it far more valuable than the world's largest company today ($4.9 trillion tech giant Nvidia).

It's difficult to predict where the business of decentralized applications will be a decade from now, but we do know Ethereum will face growing competition. The Solana network, for example, was designed to be a faster, cheaper, and more efficient alternative to Ethereum, and it's slowly gaining momentum with the developer community.

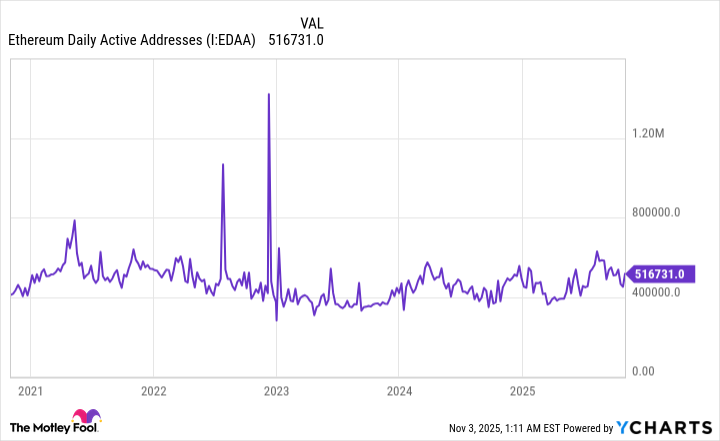

Another thing we know right now is that the number of Ethereum daily active addresses, which is a proxy for how many users are participating in the network, has flatlined. This might explain why Ether struggled to maintain its momentum after hitting a new record high in August.

Ethereum Daily Active Addresses data by YCharts

In summary, investors who believe in the future of decentralized apps will probably want to own at least some Ether, given Ethereum's status as the world's largest platform for developers. However, whether it will surpass the $5,000-per-coin milestone soon -- or ever -- is impossible to know, and investors need to be comfortable with that uncertainty before parking their money in this cryptocurrency.