Over the last three years, shares of semiconductor powerhouse Nvidia (NVDA 0.32%) have soared by 1,500%. At the dawn of the artificial intelligence (AI) revolution, Nvidia's market capitalization hovered around $345 billion. Today, that figure has surged to $5.1 trillion, handily placing Nvidia as the most valuable company in the world.

NVDA Market Cap data by YCharts.

Gains of this magnitude are hard to come by. Nvidia's momentum has been so jaw-dropping that many investors probably think the stock is frothy and they've missed their chance.

But what if I told you that Nvidia's joyride could be just getting started? Below, I'll break down both macro and micro factors currently in play that could continue fueling Nvidia's unstoppable rally.

AI infrastructure is a multi-year tailwind worth trillions of dollars

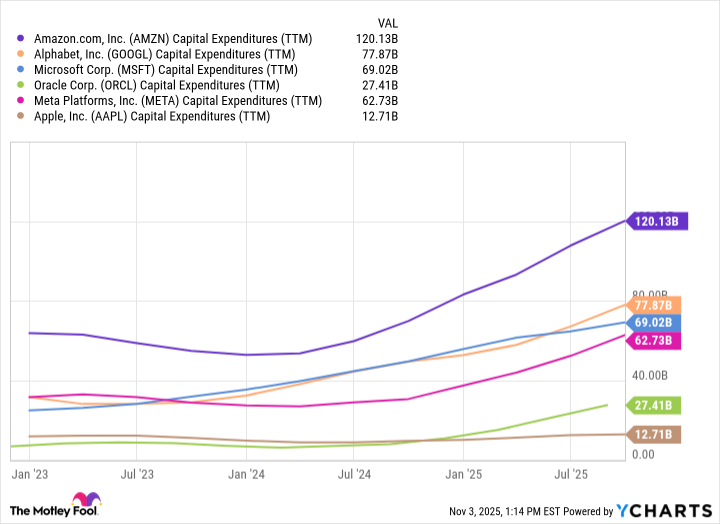

For the last few years, big tech has ramped up its capital expenditure (capex) efforts. For the most part, these hyperscalers have been focused on one thing: securing graphics processing units (GPUs) from Nvidia. These advanced chips are widely considered to be the gold standard for generative AI development, serving as both a strategic asset and a highly coveted catalyst for product innovation.

AMZN Capital Expenditures (TTM) data by YCharts.

From a macro perspective, management consulting firm McKinsey & Company is projecting AI infrastructure to be a $7 trillion opportunity over the next five years. More than 40% of this spending is expected to be allocated toward procuring IT equipment and next-generation GPUs.

What's interesting about the trends above is that among the three major cloud hyperscalers -- Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) -- investment in AI infrastructure is accelerating.

Image source: Nvidia.

Cloud hyperscalers are leading the charge in the AI infrastructure era

From a company-specific point of view, Goldman Sachs estimates that the hyperscalers alone will account for roughly $500 billion of AI infrastructure spend next year. Chief among the big spenders is Amazon. While the company has long been tied to Anthropic, the e-commerce and cloud giant recently struck a major partnership with ChatGPT developer OpenAI.

On Nov. 3, AWS announced a seven-year deal with OpenAI worth $38 billion. At its core, AWS will be deploying clusters of Nvidia's GB200 and GB300 GPUs for OpenAI to access as it works to scale its workloads.

NASDAQ: NVDA

Key Data Points

How does OpenAI's $38 billion deal with AWS affect Nvidia?

There is a strong case to be made that Nvidia should enjoy the secular tailwinds of AI infrastructure over the next several years. But I think that OpenAI's $38 billion deal with AWS is just as much a win for Nvidia as it is for Amazon.

Here's why. The combination of a multi-year deal structure featuring hundreds of thousands of Nvidia GPU clusters should make switching to an alternative platform virtually unthinkable. Against this backdrop, I think the partnership between OpenAI and Amazon could serve as a proxy for continued demand for Nvidia's next-generation chip architectures over the coming years.

As such, I think Nvidia remains in a solid position to command lucrative levels of pricing power -- further strengthening its competitive moat over the likes of Advanced Micro Devices and custom chip manufacturers. For this reason, Nvidia should continue enjoying enviable levels of revenue visibility that are complemented by robust earnings growth.

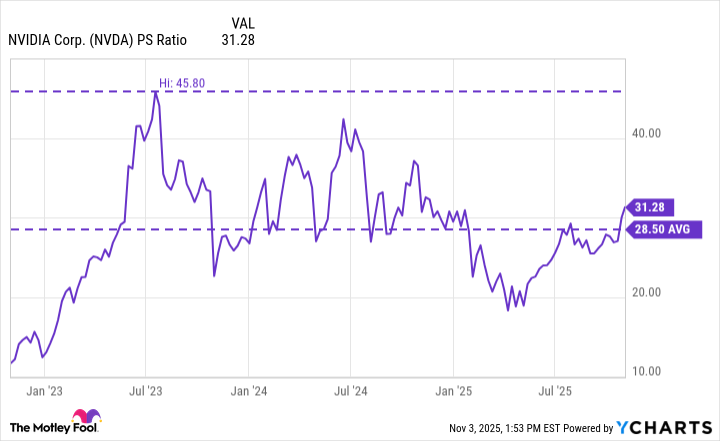

While Nvidia is currently the largest company in the world as measured by market capitalization, that statistic alone doesn't reveal much about the company's actual valuation. As the chart below illustrates, Nvidia's price-to-sales (P/S) multiple of 31 is roughly in line with the company's three-year average. What's more interesting, however, is that the company's P/S multiple is significantly lower than its prior highs at the onset of the AI revolution.

NVDA PS Ratio data by YCharts.

With these dynamics in play, Nvidia appears both reasonably valued and well-positioned for further valuation expansion in the AI infrastructure era -- leading to even more meaningful gains over the long term for patient investors.