GameStop (GME +0.70%) stock remains under pressure. It has been nearly five years since a meme stock-fueled rally took the stock to a split-adjusted intraday high of $120.75 per share. Today, trading at around $22 per share, it is far removed from that time, and has fallen by approximately 30% in this year alone.

Still, despite the performance, GameStop's financials point to a turnaround for the business. Revenue is on the rise, and profits are exploding higher. But are those positive signs enough to make the stock a reasonable buy, or should smart investors continue to stay away?

Image source: Getty Images.

Making sense of today's GameStop?

Fundamental changes to what had been a dying business began when serial entrepreneur Ryan Cohen joined GameStop's board in January 2021. Cohen worked to build GameStop's online presence, including creating a one-stop shop for game downloads.

Additionally, recognizing that more would be needed to save the company, he had the company launch an NFT marketplace (which has since shut down) and led it into collectibles and Bitcoin investments. Cohen's vision led the board to appoint him president and CEO in September 2023.

In the first half of 2025, GameStop generated $1.7 billion in revenue, a 1% increase year over year. Moreover, revenue grew 22% yearly in Q2, powered by strong demand for consoles and collectibles.

Consequently, during the year's first two quarters, it booked net income of $213 million -- a far better result than the $18 million loss it suffered in the year-ago period. Considering that improvement and the stock's P/E ratio of 30, GameStop seems to offer the potential for significant growth at a relatively low valuation.

NYSE: GME

Key Data Points

Investing challenges

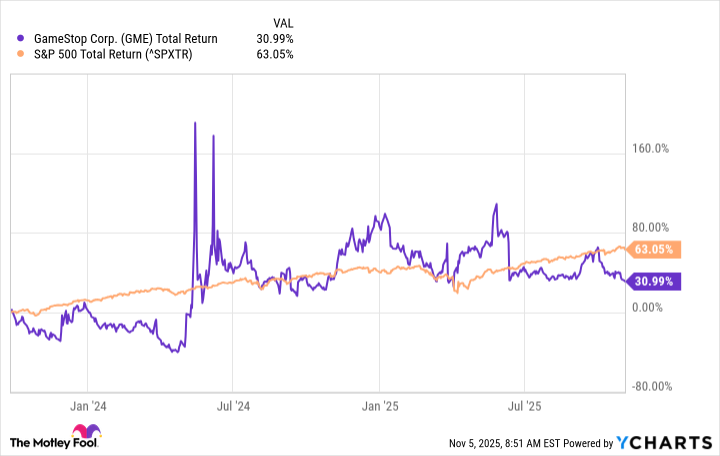

However, investors also have to remember that the meme stock craze left GameStop with what was once a nosebleed valuation. As a result, Cohen's efforts to revive the company have not delivered much in the way of shareholder returns. Although the stock price has risen since Cohen became CEO (including a few significant but unsustainable spikes along the way), it has underperformed the S&P 500 during that time.

GME Total Return Level data by YCharts.

Now, with GameStop operating a hodgepodge of different businesses, one has to question if it's a company that can be easily handed off to new leaders once Cohen departs.

One might recall the case of Jack Welch, who built GE into a diversified conglomerate. After he left, it struggled for decades under the management teams that followed him. Ultimately, they decided not to keep that conglomerate intact. With such examples in mind, investors should probably be cautious about buying into GameStop's current narrative.

Is GameStop a turnaround story?

Indeed, given GameStop's remaining challenges, investors should be hesitant to even call this stock a "turnaround story."

It's encouraging that management has transformed what was a struggling business into a thriving enterprise. With that task achieved, its positive net income and a much lower P/E ratio might encourage some investors to take an interest.

Unfortunately, the turnaround has happened through a hodgepodge of enterprises that may help the business more than its shareholders. Moreover, now that GameStop has become a conglomerate of sorts, it is also worth asking whether anyone besides Cohen can effectively run the business as it currently exists. With so many uncertainties, investors should probably continue to steer clear of this retail stock.