A high and growing valuation has not stopped investors from piling into the artificial intelligence (AI) decision-making company Palantir (PLTR 6.87%), which has seemed invincible up until recently.

The company leverages large language models (LLM) to help companies and government divisions leverage data like never before. Palantir's technology can gather information from wide-ranging sources and use its data manipulation capabilities to glean incredible insights, which helps organizations make more informed decisions.

Image source: Getty Images.

Palantir's technology can also help organizations dissect the consequences of future actions it may make based on the data. Many government agencies and commercial businesses are now using Palantir, and people don't need to be LLM experts to use the technology.

While very few doubt the immense potential of the company, many investors are questioning the stock's monstrous valuation of roughly 240 times forward earnings, wondering if the market is getting ahead of itself.

If you'd invested $1,500 in the company one year ago

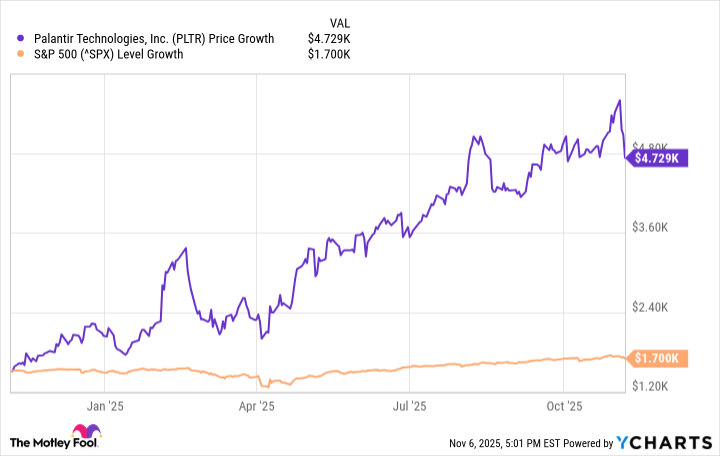

As I mentioned above, Palantir's stock has been on an incredible run. The stock is up roughly 1,165% over the last five years and about 215% over the past year. So if you invested in the company at any time in recent years, you've likely done well.

As you can see, $1,500 invested in Palantir one year ago would be worth over $4,700 today. The same amount invested in the broader benchmark S&P 500 index would only be worth $1,700, as the S&P 500 has registered a roughly 13.4% one-year gain.