This year marks the 100th anniversary of quantum mechanics, the scientific principle upon which quantum computing is based. So it's fitting that stocks in the sector have soared in 2025.

Among them is IonQ (IONQ 7.46%), the first pure-play quantum computer company to go public back in 2021. Its shares are up over 100% in the past 12 months through Nov. 6, hitting a 52-week high of $84.64 in October.

Since then, shares have retreated from the high but are still well above the 52-week low of $16.29 reached last November. Given how hot quantum computing stocks have been, is IonQ worth buying at this level? Answering the question requires a deeper analysis of the company.

Image source: Getty Images.

IonQ's jaw-dropping accomplishments

IonQ is enjoying tremendous success in the quantum computing field. In the third quarter, it reported revenue of $39.9 million, an impressive 222% year-over-year increase. As a result, the company increased its 2025 full-year revenue outlook to a range between $106 million to $110 million. That would represent spectacular growth above the $43.1 million made in 2024.

The revenue increase is a testament to its ion-based quantum technology. Given the quantum computing industry is still in its infancy, the companies with the most promising technologies are likely to gain the greatest sales growth from the sector's expansion.

In this area, IonQ possesses several advantages. It achieved a world record of 99.99% fidelity on its system. Fidelity measures the level of accuracy on quantum computers, which today suffer from high rates of calculation errors. IonQ's fidelity milestone puts it a step closer to a device capable of widespread adoption.

Another advantage is that IonQ's equipment can operate at room temperature. The quantum computers produced by many competitors, such as IBM, require special cryogenic equipment to operate, making them costly to implement.

IonQ's technological accomplishments allowed it to capture a partnership with Swiss institutions to deploy the nation's first citywide quantum network in Geneva. The company also signed a deal with the U.S. Department of Energy to deploy quantum technology in outer space.

NYSE: IONQ

Key Data Points

IonQ's areas of concern

Given its successes, IonQ looks like a compelling investment in the field of quantum computing. However, it possesses downsides.

Along with the 222% revenue growth to $39.9 million in Q3, the company's costs have also skyrocketed. This resulted in a Q3 operating loss of $168.8 million, up from a loss of $53.1 million in 2024.

Moreover, the company issued stock warrants to generate much-needed funds, and that contributed to a staggering Q3 net loss of $1.1 billion compared to a loss of $52.5 million in the previous year. To keep the business well funded, IonQ issued an equity offering of $2 billion in October, but that move dilutes the stock.

The company is racing to build quantum tech that will be widely adopted, yet it's at the cost of financial health. If IonQ can't get revenue ramped up to higher levels in the coming quarters, begin to pare back costs, or ideally both, its business eventually could be headed for financial disaster.

Deciding whether IonQ stock is worth its share price

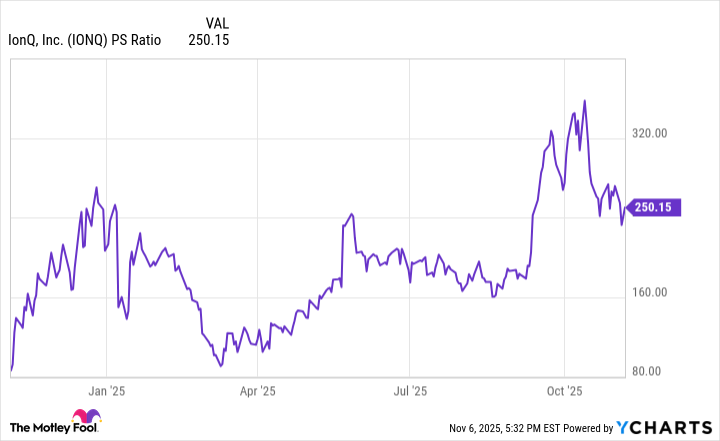

This backdrop brings us to whether the company is a good long-term investment in the quantum computing space given its current share price. To assess this, here's a look at IonQ stock's price-to-sales (P/S) ratio, which measures how much investors pay for every dollar of revenue generated over the trailing 12 months.

Data by YCharts.

The chart shows that while IonQ's P/S multiple has dropped from its peak, it's still higher than throughout most of the past year, indicating shares are expensive. For comparison, competitor IBM has a P/S ratio of four.

At this point, IonQ's shares are pricey, its financial position is far from ideal, and while it's gaining momentum on technology adoption, quantum computers still have a ways to go before they are ready for broad commercial adoption.

Consequently, the prudent approach is to wait for IonQ stock to drop before deciding to purchase shares. Even then, only investors with a high risk tolerance should consider a buy.