IonQ (IONQ 0.28%) is perhaps the most popular pure-play quantum computing stock on the market. It has already had some success in acquiring clients, and its technologies have been used in multiple government research labs, making it an easy stock to back in the quantum computing trend.

However, the stock has already had quite a bit of success, and many investors might be wondering if this stock still has the ability to produce a millionaire from a single investment. Is that the case for IonQ? Or is the road too steep?

Image source: Getty Images.

IonQ's approach to quantum computing may separate it from the field

IonQ uses trapped-ion technology to power its quantum computing aspirations. This is different from most companies that use superconducting computing, which requires cooling a particle to near absolute zero. Trapped-ion computing can be done at room temperature, and it also has another inherent benefit: accuracy.

The primary reason quantum computing isn't being deployed at a mass scale yet is that it isn't accurate enough. Once quantum computing reaches a level where accuracy is acceptable for general-purpose computing, that's when we'll see widespread quantum computing adoption begin. Most companies point to 2030 as the year when that will occur.

IonQ is the world's current leader in quantum computing accuracy, and it holds a decent lead due to the inherently accurate nature of the trapped-ion approach. Recently, IonQ announced that it has achieved 99.99% two-qubit gate fidelity, which measures the accuracy of a quantum calculation after going through two operations.

NYSE: IONQ

Key Data Points

This is a big deal, as IonQ believes it has now reached the accuracy level required to have a commercially viable quantum computer. Now it will need to turn to scaling this technique up while also improving accuracy when it can. However, one outstanding problem for IonQ is its speed.

There's no free lunch in quantum computing; otherwise, every company would be taking the same approach. The trapped-ion technology that IonQ uses is slower than the processing speeds as the superconducting variety, which could make it a less-popular choice in the end if the superconducting companies can develop a large-scale quantum computer that has similar accuracy levels to IonQ's computer.

Time will tell if IonQ's technology allows it to stand out from its peers, but I think it has at least a fighting chance.

But will that be enough to make you a millionaire?

IonQ can be a successful investment even if it can't provide 100 times returns

If you invest $900,000 in IonQ stock, you'll likely be a millionaire based on the daily swings of the stock price. However, that's not what investors are looking for. Indeed, they want to become a millionaire by investing a much smaller sum of money. For this exercise, I'll set the base investment as $10,000, which would require 100 times returns to turn $10,000 into $1 million.

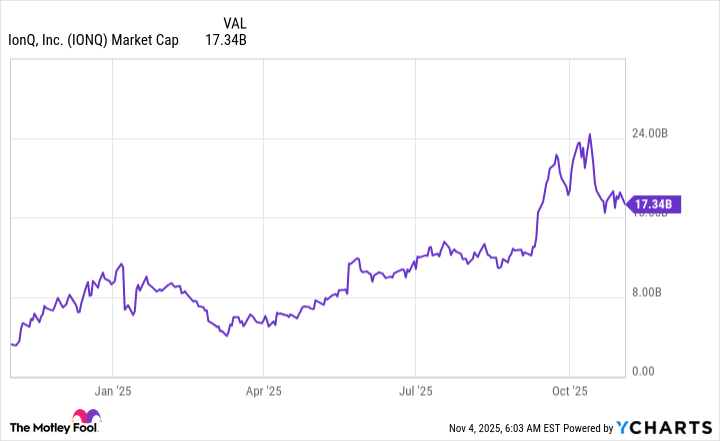

With IonQ's $17 billion market cap, that would transform IonQ into a $1.7 trillion business.

IONQ Market Cap data by YCharts

That's a massive company, and it would likely be larger than where IonQ projects the addressable market for its products could be. IonQ projects that the total addressable market for quantum computing products could reach $87 billion by 2035. That's not an annual value; that's a cumulative market projection. So, even if 20% of quantum computing sales occur in 2035 and IonQ can capture every one of them, that would give IonQ an annual revenue of $17.4 billion.

If it can convert 30% of that into profits and trade at a 40 times earnings multiple, that would price the stock at $209 billion. That would yield an excellent return, but it isn't enough for IonQ to make you a millionaire.

There's a lot of risk in IonQ's stock, as it may not be the quantum winner in the end. Still, if it is the overall winner in the space, it would provide investors monstrous returns. But you have to be OK with the volatility that comes with it and the potential for the stock to go to $0 if the technology doesn't pan out.