With less than two months left in the year, now is a perfect time for investors to update their watchlists with top stocks and exchange-traded funds (ETFs) to buy in 2026.

Investment management firm, Vanguard, offers over 50 equity ETFs. These ETFs feature low fees and are simple yet effective ways to get exposure to the broader market, classes of stocks (such as growth or value), stock market sectors, and quantitative strategies.

Here's are two Vanguard ETFs worth buying now, as well as one investors may want to pass on.

Image source: Getty Images.

Two sides of the S&P 500

The Vanguard S&P 500 ETF (VOO 0.51%) is the largest S&P 500 ETF by net assets. It's a good, catch-all way to invest in the market. But some investors may prefer to drill down further into a portfolio of stocks based on their preferences.

If the Vanguard S&P 500 ETF were a coin, the Vanguard Growth ETF (VUG 1.28%) would be heads, and the Vanguard Value ETF (VTV +0.56%) would be tails. These funds are massive, featuring a combined $550 billion in net assets.

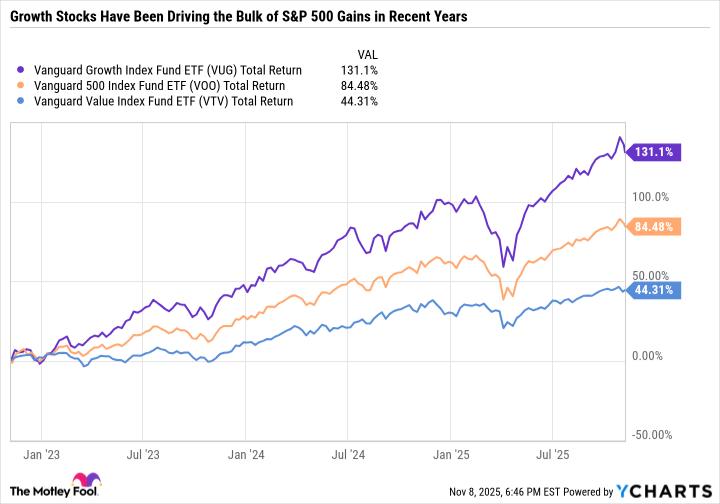

In recent years, megacap tech-focused growth stocks have been leading the market to new heights. So it comes as no surprise that the Growth ETF has outperformed the S&P 500, which has outperformed the Value ETF.

VUG Total Return Level data by YCharts.

I think both funds are great buys for 2026 but for different reasons.

Vanguard Growth ETF

The Vanguard Growth ETF is an excellent way to gain exposure to market-leading growth stocks. Buying stocks at all-time highs is never easy, especially if you feel like you've missed out on epic gains. ETFs can make that buying decision easier by spreading the investment across multiple companies. ETFs can also be easier to hold during market sell-offs or even corrections because an investor doesn't have to question a specific company's investment thesis.

The Growth ETF is an especially good buy for investors looking to load up on the "Ten Titans," as 60% of the ETF is invested in these 10 leading growth stocks: Nvidia, Microsoft, Apple, Alphabet, Amazon, Broadcom, Meta Platforms, Tesla, Oracle, and Netflix.

NYSEMKT: VUG

Key Data Points

Vanguard Value ETF

Investors seeking industry-leading companies at reasonable valuations may want to take a closer look at the Value ETF for 2026 and beyond. The fund sports a price-to-earnings (P/E) ratio of just 20.5 and a dividend yield of 2.1%, which is less expensive than the Vanguard S&P 500 ETF's 28.4 P/E. The S&P 500 also has a lower dividend yield of just 1.2%. Meanwhile, the Vanguard Growth ETF has a 39 P/E and mere 0.4% yield.

A big reason for the Value ETF's low valuation is that it includes only one Ten Titan -- Oracle -- with a 1% weighting. By comparison, the S&P 500 has 40% of its holdings invested in the Ten Titans. The Value ETF's top holdings include JPMorgan Chase, Berkshire Hathaway, ExxonMobil, Walmart, and Johnson & Johnson.

The holdings in the ETF may lack the glitz and glam of high-octane growth stocks, but they tend to produce steady earnings. And many holdings in the Value ETF pay growing dividends, which is ideally suited for investors looking to build a portfolio around passive income.

In sum, the Growth ETF and Value ETF are both better buys than the Vanguard S&P 500 ETF because they can more precisely address a portfolio's needs by aligning investment objectives and risk tolerance. Both ETFs sport 0.04% expense ratios compared to 0.03% for the Vanguard S&P 500 ETF. That's just a ten-cent difference for every $1,000 invested.

An ETF for traders, not investors

The Vanguard U.S. Momentum Factor ETF (VFMO 2.94%) embodies trading rather than long-term investing.

The fund uses a rules-based quantitative model to invest in small-cap, mid-cap, and large-cap stocks that have been running up. Top holdings include stocks like Palantir Technologies and AppLovin. However, to the fund's credit, no position makes up more than 1.2% of the ETF. So although the ETF chases hot stocks, it does so while maintaining a lot of diversification.

Due to its quantitative model, the fund has an extremely high turnover rate -- 76.9% as of Nov. 30, 2024. For comparison, the Vanguard Value ETF has a turnover rate of just 8.8%, and the Growth ETF's turnover rate is 11%.

A high turnover rate means that a fund is actively trading, whereas a low rate resembles a buy-and-hold strategy. So unlike the Value and Growth ETFs, where an investor builds a portfolio around top holdings unlikely to change, the Momentum ETF bets on investor enthusiasm and euphoria.

Over the last five years, the Vanguard S&P 500 ETF has outperformed the Momentum ETF with a 108.2% total return compared to 99.5%. So, it's not like all that trading is paying off.

In today's relatively expensive market, it's especially important for investors to focus on fundamentals and long-term investing rather than get caught up in the noise that comes with momentum-based products.