Let's talk about a stock that's been kicked around lately. The Trade Desk (TTD 2.03%) is down 66% in 2025, as of Nov. 12. That's like watching a seasoned professor flunk a pop quiz in their own field of expertise. But here's the thing: Sometimes the best opportunities come wrapped in ugly paper.

What makes The Trade Desk special?

Remember the old adage about "buy low, sell high"? Well, TTD is serving up a masterclass in what "low" looks like for a quality growth stock. Trading at 50 times earnings today, it's still not a traditional value stock, but for a company revolutionizing digital advertising, it's practically in Wall Street's bargain bin.

So what does The Trade Desk actually do? Think of it as the Switzerland of digital advertising -- completely neutral, helping advertisers place their ads across the entire internet without playing favorites.

NASDAQ: TTD

Key Data Points

Tech giants Alphabet (GOOG 0.80%) (GOOGL 0.83%), Meta Platforms (META 0.09%), and Amazon (AMZN +0.49%) also offer online advertising services, but they also provide the content that makes people look at the ad spot. They want to keep readers and video viewers nestled in their walled gardens. By contrast, TTD says, "Hey, let's find the absolute best spot for your ad dollar, wherever that might be." It's like having a real estate agent who actually works for you, not the seller.

The secret sauce? Something called UID2 -- and no, that's not a chemical symbol for an obscure protein. It's TTD's privacy-friendly way of tracking users without being creepy about it. Many ad services used to rely on third-party cookies to collect user data, around which ad-placement decisions could be made. TTD figured out how to help advertisers find their audience while keeping everyone's personal info under wraps, using anonymized user IDs.

Strong revenue through tough times

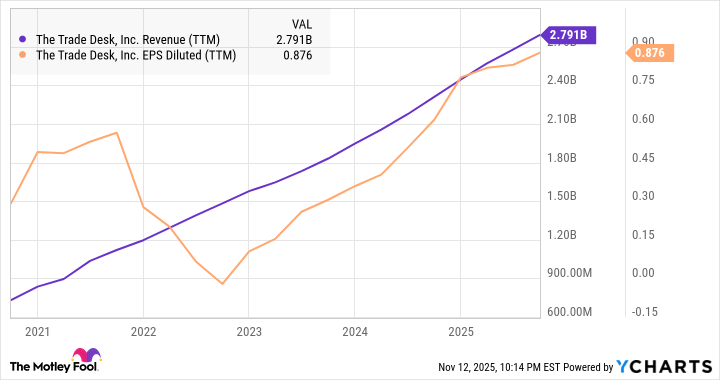

Here's what really gets my attention: Even during 2022's inflation crisis, when most digital ad companies were crying into their quarterly reports, TTD just kept chugging along. Bottom-line profits took a swan dive that year but the revenue chart barely hiccupped:

TTD Revenue (TTM) data by YCharts

Why? Because when budgets get tight, advertisers need every dollar to work harder -- and that's exactly what TTD delivers.

Now, I won't sugarcoat it -- there are risks. Ad spending can dry up faster than a summertime puddle in Miami when the economy sneezes. Browser-building giants Google and Apple (AAPL 0.93%) keep changing their privacy rules back and forth, sometimes to stay ahead of the competition and other times to comply with legal rulings. It isn't easy to run a targeted ad business in this ever-changing environment.

Why TTD's future looks bright

But TTD isn't just surviving; the company is skating right where the puck is heading (to borrow from Wayne Gretzky's famous success story). Ad dollars are flooding from traditional TV to streaming and digital. Retailers want better ad tech. Everyone needs help navigating the post-cookie world. And TTD sits at the intersection of all these trends like a traffic cop at rush hour.

The stock's beaten down because they missed revenue expectations in February's Q4 report. The market threw a tantrum, and that's how the story goes. But TTD is still growing revenue 15%-25% annually with expanding profit margins over the past three years. Share prices are way down but for all the wrong reasons. That's not a broken business -- it's a growth story on fire sale.

Image source: Getty Images.

Why now is the right time to push the "buy" button

At these levels, you're getting a market leader with a unique position of innovative leadership, solid business growth, and actual profits (remember those?) at a price that finally makes sense for many investors. Sure, it could go lower -- anything can in this economy. But if you're looking for a low-priced growth stock that could reward patient investors when the ad market rebounds, TTD deserves your consideration in November.