With just a few weeks left in the year, now's a great time to review your savings, put idle money to work for you, and set yourself up for financial success in 2026 and beyond. Dividend investing is a solid strategy to build wealth.

By buying stocks that pay a regular dividend, you can earn a steady passive income and grow your capital by reinvesting those dividends. Better still, when dividend-paying companies regularly raise their dividends, those payouts compound over time and can often turn your stocks into multibaggers.

Here are four such magnificent multibagger-potential dividend stocks you could double up on right now.

Image source: Getty Images.

This stock should give you a dividend raise every year through at least 2030

Chevron (CVX +0.63%) held its Investor Day on Nov. 12 and it outlined its five-year growth plan through 2030. The oil giant is offering everything a dividend investor would want to see in a stock they own.

Chevron's top priority is to consistently grow its dividend. But it also aims to maintain a strong balance sheet and reinvest capital efficiently into its business. That's important because a dividend may not be safe if the company is highly leveraged, borrows money to pay a dividend, or prioritizes dividend over growth solely to attract income investors.

NYSE: CVX

Key Data Points

Chevron is an established dividend growth stock, having increased its dividend for the 38th straight year in early 2025. Here are Chevron's goals through 2030:

- Increase oil production by a compound annual growth rate (CAGR) of 2% to 3%.

- Grow adjusted earnings per share and free cash flow (FCF) by a CAGR of more than 10% at a nominal Brent crude oil price of $70 per barrel.

- Sustain dividends even if oil prices fall below $50 per barrel.

- Increase dividends regularly and repurchase shares worth up to $20 billion every year.

Having also recently acquired Hess in a megadeal valued at $53 billion, Chevron expects its capital expenditures to decrease significantly going forward, which should further free up cash for distribution among shareholders. That could mean even bigger dividends for investors who buy the oil stock now, making this 4.5%-yielding stock an incredible dividend stock to double up on right now.

This company's big plans should fetch you big dividends

If you love dividends but don't own Brookfield Asset Management (BAM 0.09%) stock, now's the perfect time to scoop up some shares.

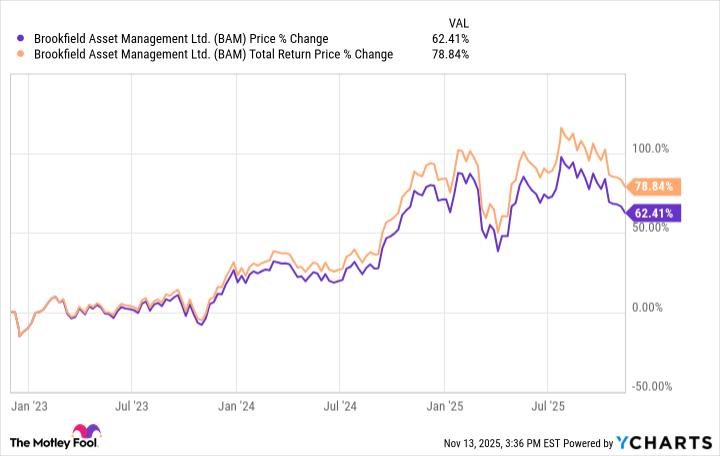

If you'd invested $10,000 in Brookfield Asset Management in December 2022, when the company was formed after a spinoff from Brookfield Corporation, and reinvested its dividends all along, your investment would be worth $18,000 now.

I expect even bigger shareholder returns from Brookfield Asset Management stock going forward, given the company's ambitious growth goals. Before I tell you what they are, it's essential to know how the company funds its dividends.

Brookfield Asset Management is a massive company, with more than $1 trillion in assets under management (AUM) across over 50 countries in five key verticals: infrastructure, renewable energy, real estate, private equity, and credit. Here's the most important bit: More than 50% of its AUM is fee-based capital, generating recurring fees and supporting dividends.

With megatrends such as digitalization (including artificial intelligence (AI) data centers) and decarbonization gaining momentum, Brookfield Asset Management expects to double its business in five years and grow its distributable earnings (the earnings it pays out in dividends) by a CAGR of nearly 18% through 2030. That almost assures a dividend raise every year for investors who buy the stock today.

This highly bankable dividend stock yields a massive 6.9%

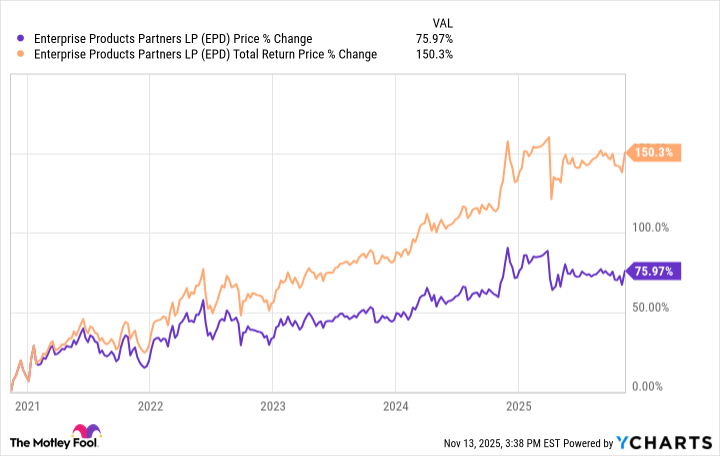

Enterprise Products Partners (EPD +0.16%) stock offers a monster 6.9% yield. That yield is also safe, as the pipeline giant backs dividend raises with steady cash-flow growth. To put some numbers to that, Enterprise Products has increased its dividend (or distribution, as master limited partnerships call it) every year for the past 27 consecutive years, and this has made a significant difference to the stock's returns over the years.

Its distributable cash flows have grown consistently over the years, covering its dividend payout by 1.5 times or more every year since 2018. As one of the largest midstream energy companies in the U.S., Enterprise Products earns fees and generates cash flows under long-term contracts, 90% of which also have escalation clauses that limit the impact of inflation on the company's earnings.

Enterprise Products has nearly $5 billion of major capital projects currently under construction, with all of them expected to be in service by the end of 2026. As these projects come online, they should start contributing to the company's cash flows. At the same time, Enterprise Products' capital expenditures are expected to decrease from 2026 onward as these projects come online. That should leave the company with a substantial amount of cash in hand to distribute to shareholders in the form of annual dividend increases, and that alone makes this high-yield stock a solid buy now.

A phenomenal no-brainer dividend stock to buy

Although I love all the dividend stocks discussed in this article, the one I'll you about next is probably the most boring business ever, but also one of the most phenomenal stocks that have gone unnoticed.

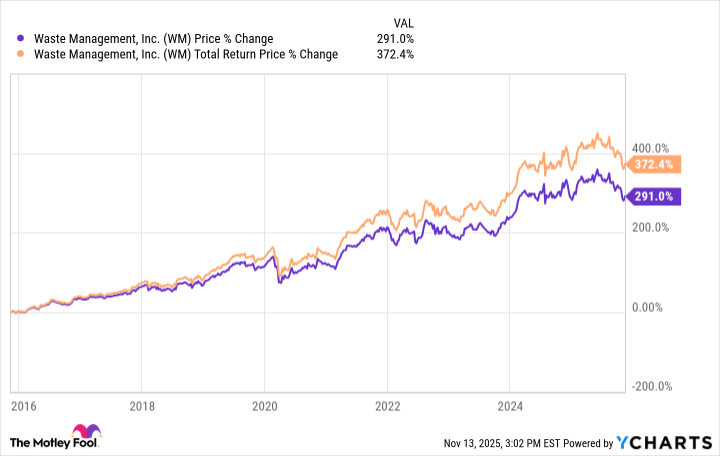

Waste Management (WM +0.54%) has raised its dividend for 22 straight years. Over the past decade, its dividend has grown at an 8% CAGR. That dividend growth has contributed significantly to the stock's total returns -- in just 10 years, your investment in Waste Management stock would have increased by fivefold.

Waste Management provides critical services of managing waste and is the largest player in the industry. It's a recession-resilient business, generating stable revenue and cash flows that can support steady dividend growth. With an extensive landfill network, Waste Management is also the largest recycler in the U.S.

Waste Management has just announced financial goals through 2027. It expects to grow revenue at a rate of around 9% CAGR, with the majority of growth coming from its healthcare solutions -- a business formed as a result of Waste Management's recent acquisition of medical waste management giant Stericycle. Moreover, the company expects to generate nearly $10 billion in FCF between 2025 and 2027, which should support annual dividend raises.

Given its solid track record and high visibility into the future, Waste Management is a fantastic dividend stock to buy now, despite its modest 1.6% yield. Compounding dividends often more than make up for small yields in the long run.