DigitalOcean (DOCN 1.33%) may be leagues behind the likes of Amazon, Microsoft, and Google in the cloud computing market, but there is no doubt that it is playing a critical role in this space. Not everyone may have the budget to use the cloud computing services offered by the hyperscalers mentioned here. This is where DigitalOcean steps in. The company provides an on-demand cloud infrastructure platform and software tools that are used by start-ups, developers, and small and medium-sized businesses.

Customers can rent hardware from DigitalOcean according to their needs for running workloads in the cloud without the need to invest in expensive equipment and incur other overheads. Meanwhile, its software-as-a-service (SaaS) solutions enable customers to build, customize, and deploy applications. Importantly, DigitalOcean customers can scale up or reduce their usage based on their requirements.

Not surprisingly, the smaller companies that DigitalOcean caters to are now spending more on its cloud computing platform, driven mainly by the growing adoption of artificial intelligence (AI). Let's see why DigitalOcean could become a key enabler of companies looking to jump onto the AI bandwagon.

Image source: Getty Images.

DigitalOcean's pricing explains why it is attracting AI companies at an impressive pace

DigitalOcean classifies its customers into four categories -- learners, builders, scalers, and scalers+.

Learners are those customers who spend less than $50 on DigitalOcean's platform in a month and have been using its services for over three months. The monthly revenue of builders ranges from $50 to $500. Scalers spend more than $500 and up to $8,333 in a month, while scalers+ are larger customers that spend more than that.

The important point worth noting is that a large chunk of DigitalOcean's customer base is in the first two categories. The company had more than 450,000 learners at the end of 2024, while the number of builders stood at over 147,000. The reason why there are so many learners and builders on DigitalOcean's platform is because of its predictable and transparent pricing, simplicity, and a better price-to-performance ratio compared to the large cloud service providers.

All this puts DigitalOcean in an ideal position to fuel the next decade of AI start-ups. The company is already getting a significant boost from the adoption of its cloud services by AI native customers. That's not surprising, as DigitalOcean offers a full-stack AI platform that includes powerful hardware from the likes of Nvidia, along with fully managed services offered by the company that customers can use to integrate generative AI tools into their business.

DigitalOcean customers can use its platform to build AI agents, access popular large language models (LLMs), and create and customize their own models, among other things. Management says that these services are in hot demand. DigitalOcean's revenue from AI native customers doubled on a year-over-year basis in the third quarter of 2025.

In fact, DigitalOcean's AI-driven revenue has doubled for five straight quarters. What's more, the company points out that the demand for its AI inference solutions continues to increase, which is why it is ordering more graphics processing units (GPUs) to shore up its capacity. As a result, it won't be surprising to see DigitalOcean attracting more AI customers in the future, and that should allow it to further accelerate its growth.

NYSE: DOCN

Key Data Points

The company's growth rate has picked up

DigitalOcean released its third-quarter results on Nov. 5. Its revenue increased by 16% from the year-ago period to $230 million, an improvement of 4 percentage points over the growth it clocked in the same period last year. Even better, the company has raised its full-year guidance and is expecting revenue to grow by 18% to 20% in 2026. It was earlier hoping to achieve 18%-20% growth in 2027.

The company's improving growth profile is a result of higher spending on its platform. Customers with more than $100,000 in annual recurring revenue (ARR) jumped by 41% in the previous quarter. Meanwhile, those with more than $1 million in ARR shot up by a remarkable 72%. DigitalOcean can continue to win more business from its existing customers -- apart from attracting new ones -- as the global AI market is expected to clock an annual growth rate of almost 31% over the next decade.

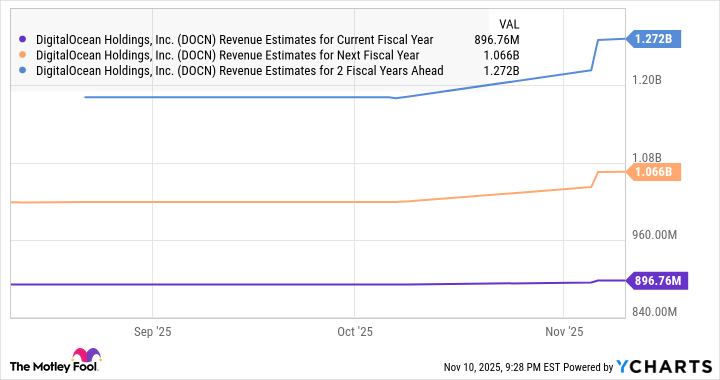

As such, it is easy to see why analysts have raised their growth expectations for DigitalOcean.

Data by YCharts.

Finally, this cloud stock trades at a very attractive 4.6 times sales as of this writing. That's a discount to the U.S. technology sector's average price-to-sales ratio of 9.2. The market could put a higher valuation on DigitalOcean owing to its accelerating growth, and that could translate into solid gains on the stock market.

So, investors looking to buy an AI stock that could fuel the adoption of this technology for the next decade should take a closer look at DigitalOcean, as it seems capable of growing at a stronger pace in the long run.