Walmart (WMT +3.04%) CEO Doug McMillon, who just announced his retirement, doesn't get as much credit as tech titans like Jeff Bezos and Elon Musk do, but he's been one of the best CEOs of the 21st century.

McMillon took over the retail giant in 2014 at a time when it was flailing as Amazon was ascendant. Walmart stock had essentially gone nowhere for over a decade, and the company failed to adequately update its business model for the e-commerce era, essentially ignoring the threat from Amazon.

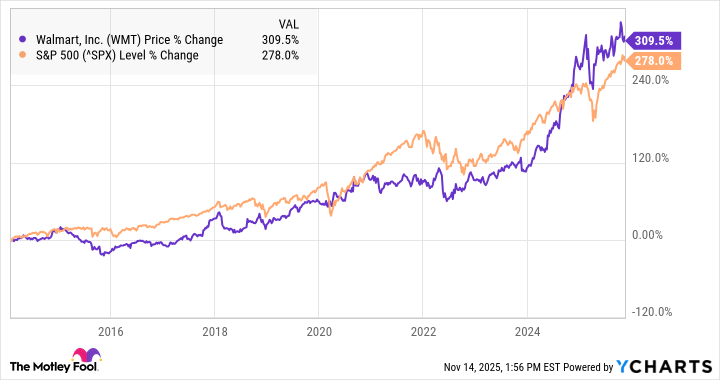

As you can see from the chart below, despite a weak start under McMillon as he made needed changes, Walmart has beaten the S&P 500 during his tenure, something many of its brick-and-mortar retail peers have not done.

Over the last five years, Walmart has even outperformed Amazon by a wide margin.

How McMillon revamped Walmart

Among McMillon's first steps was ramping up capital expenditures (capex) and shifting Walmart's focus to the omnichannel and e-commerce rather than building new stores. He wisely recognized that Walmart had saturated the country with stores and could leverage them in the online channel through grocery pick-up stations. That was a key investment strategy under his watch, as the company added kiosks to its stores so customers could order groceries online and seamlessly pick them up. The strategy resonated with customers, got them accustomed to ordering on Walmart.com, and notably offered something Amazon couldn't provide.

McMillon made e-commerce his north star. The company acquired Jet.com and folded it into Walmart, putting e-commerce wiz Marc Lore in charge of its online operations, and borrowed ideas from Amazon where it made sense. That included launching a Prime-like membership program, Walmart+, expanding its e-commerce marketplace, and launching a media network to monetize its website app through advertising.

Under his watch, Walmart also rearranged its international portfolio, pulling out of markets where it struggled, like Brazil, and investing in growth opportunities.

Image source: Walmart.

What's next for Walmart

John Furner, the current Walmart U.S. CEO, will take over for McMillon in February. Walmart stock pulled back modestly on the announcement, but the transition should be smooth. Furner has been in that position for six years, and Walmart seems to be well positioned for growth, having overcome the earlier challenge it faced in e-commerce.

McMillon will also remain on the board of directors for an additional year after his retirement to help with the transition.

Walmart stock isn't cheap at this point, trading at a price-to-earnings ratio of 39, but that's a reflection of the premium that McMillon has helped it earn. While the company has built a formidable e-commerce operation, it also retains strengths in economies of scale and low prices. That's been an advantage in an inflationary environment, and it should continue to be one going forward.

Even as McMillon will be missed, the future looks bright for Walmart.