One of the largest electric vertical takeoff and landing (eVTOL) companies by market capitalization is Archer Aviation (ACHR 1.36%). Valued at $5.5 billion, Archer Aviation is on the front lines of developing this potentially disruptive aviation technology, bringing vertical air travel to the masses within the decade. That is, of course, if it can get its vehicles approved commercially.

Even though its stock has soared in the last year, Archer Aviation's Midnight aircraft is still not approved for flying in the United States. Now, it is raising funds through a share offering that has brought selling pressure on its stock price, which is has quickly fallen 39% from recent highs.

At a price below $9, should investors buy the dip on this pullback in Archer Aviation stock? Or is this disruptor to be left for dead?

NYSE: ACHR

Key Data Points

Airport acquisition and testing developments

Earlier in November, Archer Aviation reported earnings for the third quarter of 2025. In conjunction with the report, the company announced the $171 million acquisition of the small Hawthorne Airport in the Los Angeles area. This is a strategic purchase to give Archer Aviation a presence in Los Angeles, which is one of its first planned hubs for electric air travel.

The company's business model will rely on building an air taxi point-to-point network in cities, connecting travelers to places such as airports and sports stadiums. Its Midnight aircraft can lift four passengers and a pilot vertically across cities, making travel quicker by skipping the traffic below. If successfully implemented, an air taxi network could be a game changer for urban air travel and the millions upon millions of hours stuck in traffic every year.

Building the air taxi network is only one part of the equation. The second is getting the actual aircraft approved by the Federal Aviation Administration (FAA). In the fourth and final phase of FAA certification, the Midnight aircraft recently flew a test flight of 55 miles at 10,000 feet of elevation, which is a huge step in proving the reliability of the aircraft. These vehicles definitely work, but will come with extremely high safety standards due to the fact they will be flying over dense urban areas.

Image source: Archer Aviation.

Raising money and share dilution

Archer Aviation is making progress with its Midnight aircraft, and if all goes according to plan it should get its network up and running in Los Angeles within the next few years. It also has international deals for aircraft operations and planned orders in the United Arab Emirates, Japan, and South Korea that can drive sales growth once certifications are finished.

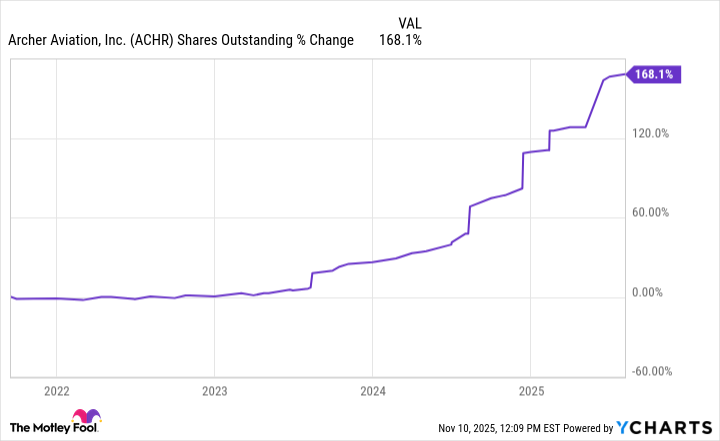

To do so will require a lot of upfront capital spending. Over the last 12 months, Archer Aviation has burned around $448 million in free cash flow, which is why the company just announced a new capital raise of $650 million by selling 81.25 million shares at a price of $8. This is 12.5% of the current shares outstanding of 645 million and will be highly dilutive to existing shareholders. However, it is necessary for the company to obtain financing for its growth plans. Total shares outstanding are up 168% since going public, and that is before including this upcoming offering.

ACHR Shares Outstanding data by YCharts

Should you buy Archer Aviation stock?

If the electric air taxi network can be built, Archer Aviation may have a solid business on its hands with minimal competition within the urban areas it serves. A competitor is not going to pop up overnight, making these type of aviation businesses legal monopolies in some cases.

However, Archer Aviation is far from making this dream a reality. It has spent hundreds of millions of dollars on development but is still pre-revenue and years away from any operational scale. The airport acquisition is expensive, indicating that upfront spending on the taxi network will be lofty. Further shareholder dilution will likely be coming in order to finance all this upfront spending.

Shareholder dilution will raise the market cap of Archer Aviation without a rising share price, which will present a headwind to investors buying today. Even the institutional investors are buying below the current price of $8.38, indicating that Archer Aviation stock is overvalued when you consider all the risks facing the business.

Add it all together, and Archer Aviation is not a buy even though the price has dipped below $9 again.