So far, 2025 has been good for stocks, with the S&P 500 index up by a solid 16% year to date. While this is far from a life-changing return, some individual stocks have well outperformed that average. Many of those companies are participating in burgeoning new industries like generative artificial intelligence (AI) and quantum computing, where hype and investor optimism may have gotten ahead of the fundamentals.

Let's explore why shareholders of Palantir Technologies (PLTR 1.71%) and Quantum Computing Inc. (QUBT 1.35%) may want to consider taking some profits off the table.

Image source: Getty Images.

1. Palantir Technologies

With shares up by 153% year to date, Palantir has been a slam-dunk investment for its long-term shareholders. And on the surface, it's easy to see why. The data analytics company is a natural beneficiary of the growing popularity of large language models (LLMs), which it is using to better serve its enterprise and government clients. And its political connections and long track record give it a deep economic moat in the challenging world of defense and law enforcement contracting. That said, a good company isn't always a good investment.

NASDAQ: PLTR

Key Data Points

This year's rally has lifted Palantir to a market cap of $461 billion. To put that number into perspective, it is larger than any public company in Europe or Japan, and makes it the 19th largest company in the U.S.

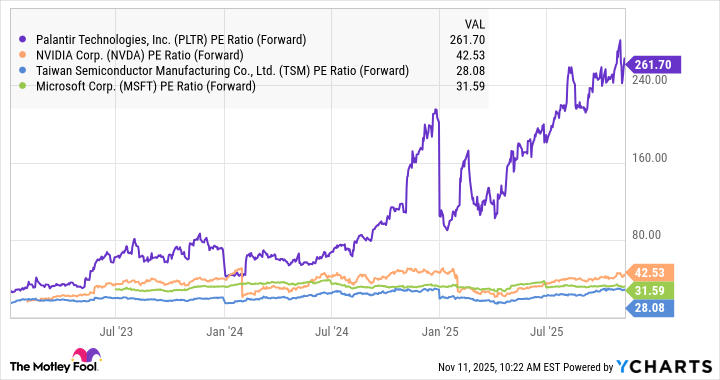

Yet Palantir isn't dramatically more profitable than other companies; it simply has a higher valuation -- which is the multiple each share is worth relative to fundamental metrics like revenue and earnings. Trading at a lofty forward price-to-earnings (P/E) multiple of 262, Palantir makes even other high-flying AI-related stocks like Nvidia, Taiwan Semiconductor Manufacturing, and Microsoft look downright cheap.

PLTR PE Ratio (Forward) data by YCharts.

If there is any silver lining to the situation, it's that Palantir is growing relatively fast, with third-quarter revenues jumping by 63% year over year to $1.2 billion. But over time, even strong results may not impress the market when such high expectations are already priced into Palantir's stock.

2. Quantum Computing Inc.

Since early October, Quantum Computing Inc. (also known as QCi) has been on a sharp downslope that erased all of its considerable 2025 gains and left it down by about 40% year to date. Yet its shares are still quite expensive, up by more than 600% over the last 12 months. As its name suggests, the company is an early mover in the market for quantum computing hardware -- an industry where share prices are currently based on hype and optimism rather than revenues or profits.

NASDAQ: QUBT

Key Data Points

According to analysts at McKinsey & Company, it might take until 2040 before any company is able to offer a commercially viable quantum computer that can operate at scale. And while industry leader Alphabet has asserted that it can bring quantum computing products to market within five years, it could take years longer for this to become the basis for a sustainable business, even once the underlying technology works reliably enough.

Generative AI should serve as a cautionary tale here. Industry leader OpenAI is believed to have lost an eye-watering $12 billion in just the third quarter, despite offering a technically viable service. Investors shouldn't expect quantum computing to quickly achieve commercial viability either, even assuming it can iron out the immense technical challenges ahead of it.

With profitability years or even decades away, investors should look at QCi's current financial results and ask themselves how much punishment they are willing to take. In the second quarter, its revenue dropped 66% to $61,000 -- which is minuscule for a company valued at $2.5 billion. Meanwhile, losses almost doubled to $10.2 million. Investors who buy QCi shares now also face the prospect of immense equity dilution, as the company will likely keep making use of secondary stock sales to raise capital to fund its cash-burning operations.

Consider selling, but be careful

Palantir and Quantum Computing Inc. look to be at risk of substantial downside, so investors who own either stock should consider taking profits off the table. That said, investors who don't own shares should be careful about opening short positions. As a great economist once warned, the stock market can stay irrational for longer than you can stay solvent. And both of these stocks are incredibly susceptible to positive hype and press, which could cause shares to spike sharply, despite the companies' relatively weak fundamentals.