Buying a company with solid growth prospects and holding it for a long time is a tried and tested strategy for making money in the stock market. This philosophy allows investors to not only capitalize on disruptive and secular growth trends but also to benefit from the power of compounding, leading to market-beating returns in the long run.

Let's say that you have $1,000 in investible cash right now after paying off your bills, clearing high-interest loans, and saving an emergency fund for difficult times. It would be a good idea to put that money into shares of Advanced Micro Devices (AMD +1.72%). Let's look at the reasons why.

Image source: Getty Images.

AMD could clock terrific growth over the next five years

An investment of $1,000 made in AMD five years ago is now worth just under $3,000. AMD has the capability to repeat such a performance in the future as well, though it won't be surprising to see it delivering bigger gains thanks to a couple of solid catalysts.

NASDAQ: AMD

Key Data Points

The data center business is going to be AMD's first big growth driver for the next three years. AMD sells both data center server central processing units (CPUs) and graphics processing units (GPUs). Demand for both types of chips is set to increase nicely over the next five years, driven by huge investments in AI infrastructure.

AMD rival Nvidia is projecting an annual increase of 40% in data center capex over the next five years. By 2030, annual data center capex could range between $3 trillion and $4 trillion. AMD has started capitalizing on this opportunity after getting off to a slow start in the data center chip market.

The company reported a 22% year-over-year increase in data center revenue last quarter to $4.3 billion. The segment's solid growth was driven by an increase in sales of both server processors and the company's data center GPUs, with AMD pointing out that it witnessed market share gains in both segments.

AMD says that its Epyc server CPUs are gaining ground among hyperscalers such as Alphabet, Microsoft, Alibaba, and others. Importantly, the company now sees its customers "planning substantially larger CPU build-outs over the coming quarters to support increased demands from AI serving as a powerful new catalyst for our server business."

More importantly, AMD is gaining share in the server processor market. The company's revenue share of server CPUs increased to 41% in the second quarter, up by 7.2 percentage points from the year-ago period, according to Mercury Research. So, AMD still has room for growth in this market going forward, and the secular growth opportunity presented by AI chips should allow it to sustain healthy revenue growth in server CPUs.

On the other hand, AMD is now cutting its teeth in the data center GPU market, which has been dominated by Nvidia so far. The likes of OpenAI, Oracle, IBM, DigitalOcean, Amazon, and others are set to deploy the company's Instinct GPUs in large numbers from next year. Even the U.S. Department of Energy is building supercomputers powered by AMD's Instinct accelerators.

All this indicates that AMD's data center business is on track to grow at a robust pace over the next five years.

Meanwhile, AMD's client CPU revenue jumped 46% year over year last quarter to a record $2.8 billion. Sales of the company's Ryzen CPUs were strong across both consumer and commercial segments. The company believes that it can "continue growing our client business faster than the overall PC market based on the strength of our Ryzen portfolio."

Grand View Research expects the global personal computer (PC) market to grow at an annual rate of 8% through the end of the decade. AMD has been making big strides in this market, witnessing an increase of 20.5 percentage points in desktop revenue share in the second quarter of 2025 to 39.3%. Its revenue share of laptop CPUs increased by 3.9 points to 21.5%.

In all, the combination of market share gains and the expanding opportunities in the server and client markets is going to drive the next phase of growth for AMD. As CEO Lisa Su said on the latest earnings call:

Our data center AI, server and PC businesses are each entering periods of strong growth led by an expanding TAM, accelerating adoption of our Instinct platforms and EPYC and Ryzen CPU share gains.

Outstanding earnings growth should translate into more upside

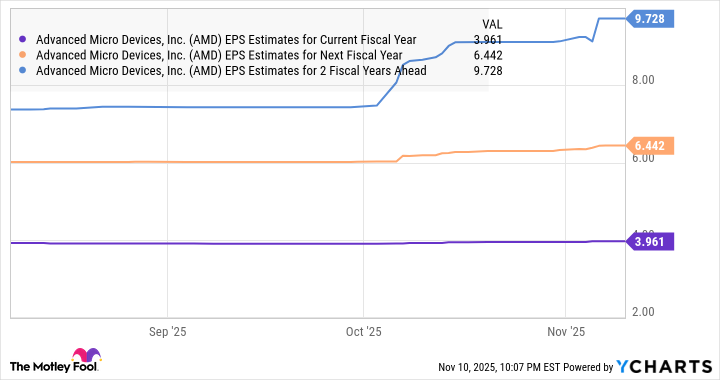

Analysts are forecasting a 19% increase in AMD's earnings this year to $3.96 per share, but the company's bottom line is expected to grow at a significantly faster pace over the next couple of years.

AMD EPS Estimates for Current Fiscal Year data by YCharts

The chart above tells us that analysts have become bullish about AMD's prospects of late, and that's not surprising considering the points discussed above. Assuming that the company's earnings grow at a much more conservative rate of 20% in 2029 and 2030, it could deliver $14.01 per share in earnings after five years.

The tech-focused Nasdaq-100 index has an average price-to-earnings ratio of 35, while AMD is trading at 28 times forward earnings. If the market decides to reward AMD with a higher multiple owing to the significant acceleration in growth and it trades at 35 times earnings after five years, its stock price could hit $490. That would be almost double AMD's current stock price.

However, this semiconductor stock could do better than that as additional catalysts such as console gaming could eventually help it achieve much stronger earnings growth. That could result in much stronger upside, which is why it would be a good idea to put $1,000 of your investible cash in AMD right now.