Exchange-traded funds (ETFs) provide investors with the opportunity to gain exposure to a basket of stocks or different financial assets. They can be purchased like stocks and are more liquid than mutual funds.

There are now thousands of ETFs all over the world, meaning there are plenty for investors to choose from, whether its growth or value stocks, small- and large-cap stocks, dividend stocks, or stocks from various geographic regions.

Here are two Vanguard ETFs to consider buying now with $1,000 and hold for the long term.

Image source: Getty Images.

Vanguard S&P 500 ETF

The Vanguard S&P 500 ETF (VOO 0.86%) is an easy way for investors to purchase the broader benchmark S&P 500 index, which contains 500 large-cap stocks in the U.S. across a variety of sectors. The goal of the market-cap weighted S&P 500 is to mirror the broader market.

As certain stocks have gotten bigger, particularly those fueled by artificial intelligence (AI) that have hit $1 trillion market caps, the index has gotten more concentrated. Here are the top 10 stocks by weighting in the Vanguard S&P 500 ETF, as of Sept. 30:

Nvidia -- 7.95%

Microsoft -- 6.73%

Apple -- 6.60%

Amazon -- 3.72%

Meta Platforms -- 2.78%

Broadcom -- 2.71%

Alphabet Class A -- 2.47%

Tesla -- 2.18%

Alphabet Class C -- 1.99%

Berkshire Hathaway Class B -- 1.61%

The top 10 stocks in the S&P 500 made up close to 39% of the total index at the end of the third quarter. This is certainly concerning because if they struggle or the AI trade struggles, the market may experience a significant correction. So concerned investors can practice dollar-cost averaging to help smooth out their cost basis over time.

NYSEMKT: VOO

Key Data Points

Furthermore, I wouldn't recommend putting your entire portfolio into the S&P 500 right now. But I still think investors should have at least some exposure to the broader market forever. History shows that between 1964 and 2024, the S&P 500 generated a total return of 39,054% and a compound annual gain of 10.4%.

I suspect the AI trade will create volatility and lead to pullbacks in the broader market, but I don't think AI is going away or is just a fad. It's also possible that over time, investors rotate more into other stocks in the S&P 500. If you hold the index for a long time, the data shows that your investment should perform well.

Vanguard High Dividend Yield ETF

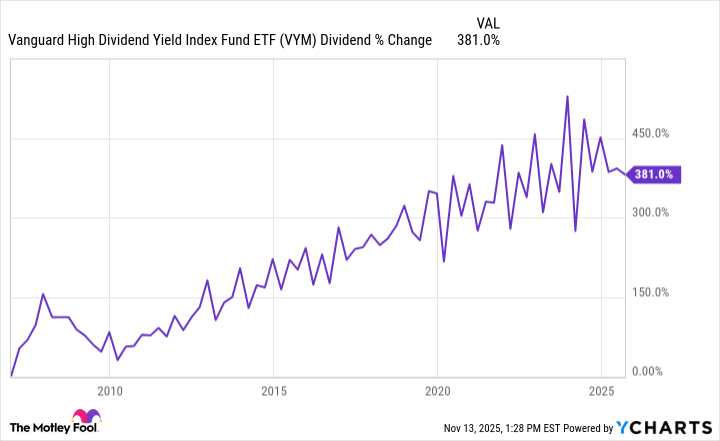

The Vanguard High Dividend Yield ETF (VYM +0.60%) seeks to follow the performance of the FTSE High Dividend Yield index, which tracks companies that it considers (of course) to have high dividend yields. It has a trailing-12-month dividend yield of nearly 2.50% and has paid and grown its payout since the mid- to late-2000s.

VYM Dividend data by YCharts.

The words "high dividend" in the ETF's title can be misleading in some ways because investors have been warned to be wary of dividends that look too good to be true. But the Vanguard High Dividend Yield ETF is full of high-quality companies that have been paying dividends for decades. Here are the five largest sectors in the fund:

Financials -- 21.6%

Technology -- 13%

Industrials -- 13%

Healthcare -- 12.4%

Consumer Discretionary -- 10.1%

Within the ETF's top 10 holdings are three companies -- Walmart, AbbVie, and Proctor & Gamble -- that are Dividend Kings, meaning they have paid and raised their dividends annually for at least 50 consecutive years. Proctor & Gamble's record is 69 years; AbbVie's is 53 years, and Walmart's is 52. Companies with this kind of track record are going to do everything in their power to avoid a dividend cut because the payout has become a core part of their investment thesis.

Ultimately, I think it's a good idea to buy some stocks and ETFs for pure appreciation, while owning others for income. This adds diversification into an investment strategy, and purchasing ETFs only increases this diversification.