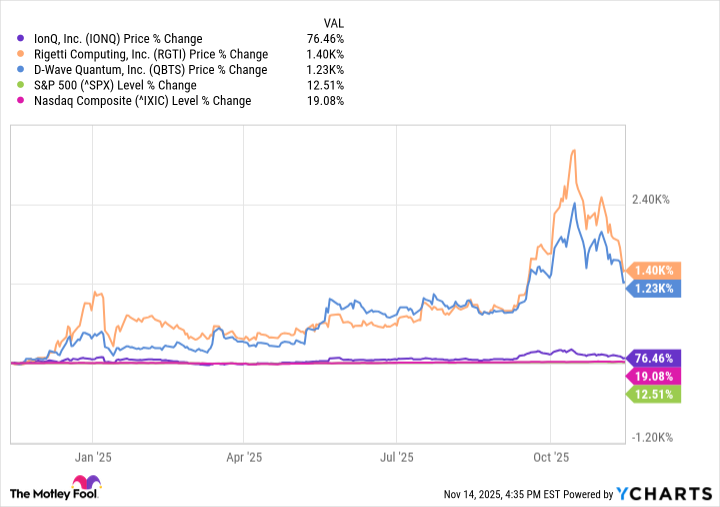

When it comes to investing in quantum computing stocks, a few news names generally rise to the top right away. These usual suspects include IonQ, Rigetti Computing, and D-Wave Quantum -- each of which has handily outpaced the returns seen in the S&P 500 and Nasdaq Composite over the last year.

While these quantum pure plays have become some of the hottest stocks fueling the artificial intelligence (AI) revolution, the reality is that these companies largely remain in exploratory phases -- spending billions in research and development (R&D) in hopes of achieving a commercial breakthrough.

Below, I'll reveal my top four quantum computing stocks to buy right now. The best part? You can invest in all of them for a relatively modest $1,000.

Image source: Nvidia.

1. Nvidia: Combining hardware and software expertise

Nvidia's (NVDA +1.14%) core sources of growth stem from its graphics processing units (GPUs) and accompanying data center services. However, as big tech pushes the frontiers of quantum AI, Nvidia is no stranger to launching innovative products.

NASDAQ: NVDA

Key Data Points

First, the company is parlaying its existing software architecture -- called CUDA -- into hybrid computing environments across classical and quantum systems.

One of the pain points of quantum computing systems is that their foundation -- built on qubits -- is quite fragile. Nvidia's NVQLink platform provides a high-bandwidth interconnect capable of supporting complex workloads bridging quantum processing units (QPUs) and classical computing architectures.

Nvidia's existing inroads across hardware and software has already given the company a competitive advantage over rivals. Now, as Nvidia moves toward new markets and product launches focused on quantum computing, the company appears well-positioned to remain a full-spectrum category leader in the AI landscape.

2. Alphabet: The vertically integrated ecosystem

When you think about Alphabet (GOOGL +0.69%) (GOOG +0.48%), odds are you immediately associate the internet giant with Google and YouTube. While search remains Alphabet's most important cash cow, the company has built a number of other businesses that are still in their growth arc. Moreover, many of these are central to Alphabet's long-term AI ambitions.

NASDAQ: GOOGL

Key Data Points

For instance, Alphabet's cloud infrastructure division -- called Google Cloud Platform (GCP) -- has won over the likes of OpenAI and Meta Platforms as high-profile customers this year. While GCP remains in a distant third place in terms of market share relative to Microsoft Azure and Amazon (AMZN 1.87%) Web Services (AWS), it's also a more nascent business -- making its current trajectory and enterprise customer adoption particularly impressive.

Another layer to GCP that makes Alphabet's cloud business interesting is the company's custom chip designs -- called tensor processing units (TPUs). Building hardware for custom AI workloads allows Alphabet to enter the budding semiconductor market and compete with the likes of Nvidia and Advanced Micro Devices.

Alphabet has the luxury of exploring new technologies and testing products through its research lab, DeepMind. The company's Willow processor has outperformed the world's fastest and most powerful supercomputers across a number of simulations.

Alphabet has quietly built a vertically integrated business model whereby its products and services become stitched together through a broader, self-reinforcing fabric.

Although Willow's achievements to date have not yet translated into large-scale revenue generation, quantum computing has not yet been completely adopted at the enterprise level. Nevertheless, Alphabet's progress in developing quantum computing systems is encouraging and represents another pillar supporting the company's broader AI foundation.

Image source: Getty Images.

3. Amazon: The everything store really has it all

Amazon is most known for its e-commerce marketplace. Similar to Alphabet, Amazon has its tentacles in many other end markets -- spanning streaming, entertainment, logistics, grocery delivery, robotics, advertising, and subscription services.

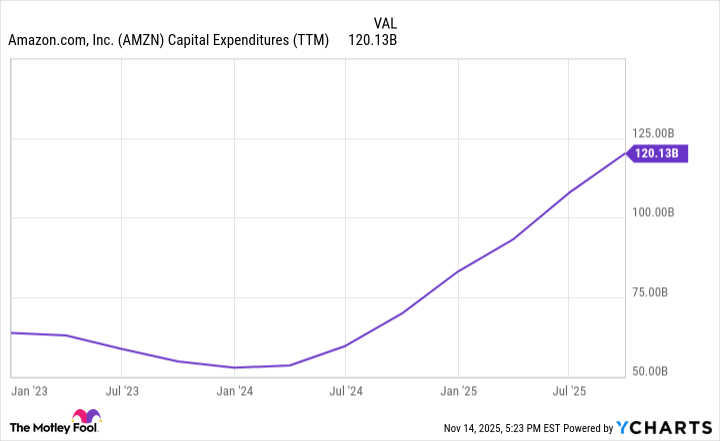

For now, Amazon's most direct pursuit of the $15.7 trillion AI opportunity revolves around infrastructure. The company is pouring billions into capital expenditures (capex) to construct data centers. Meanwhile, AWS is striking multi-billion dollar deals to rent access to GPUs while also designing its own suite of custom chips -- dubbed Trainium and Inferentia.

AMZN Capital Expenditures (TTM) data by YCharts

Within its custom hardware portfolio, Amazon has quietly built its own quantum processor, called Ocelot.

In a similar fashion to Alphabet, I think Amazon's diversified ecosystem has a unique ability to be further strengthened through AI-driven integration.

Given AWS currently holds the top spot in terms of cloud computing market share, I see the introduction of Ocelot -- alongside existing custom chips -- as a savvy product development decision. Amazon's various chip architectures could lead to lucrative cross-selling and further customer stickiness as AI workloads scale and grow more complex across the AWS network.

4. IBM: Don't call it a comeback

While International Business Machines (IBM 1.73%) hasn't exactly been associated with the idea of innovation for some time, such narratives are swiftly changing. Investors may not realize it, but IBM was investing heavily in quantum computing long before the AI revolution kicked off three years ago.

NYSE: IBM

Key Data Points

Earlier this year, IBM joined forces with AMD to commercialize its quantum-centric supercomputing chips. While AMD and IBM have certainly benefited from AI tailwinds, this deal is noteworthy because both companies have still lagged their respective competition in terms of consistent growth.

By joining forces, IBM has an opportunity to be a first mover in commercial adoption of quantum computing hardware. In turn, the company could essentially reinvent itself in the AI infrastructure era -- making it a stealthy growth opportunity beyond the typical names within big tech.