The stock market is having a pretty good year, with the S&P 500 (^GSPC +1.04%) index climbing 13% and the technology-heavy Nasdaq-100 returning almost 17%. Investors with a lot of exposure to high-growth themes like artificial intelligence (AI) might be doing even better, because shares of leading chipmaker Nvidia (NVDA 0.28%) have soared by 31%.

However, one very boring commodity with no revenue or earnings is obliterating the stock market in 2025. Gold has returned an eye-popping 56% so far, which is 7 times better than its average annual gain of 8% over the last 30 years. A combination of economic uncertainty, soaring government spending, and a rising national debt is fueling the rally.

Those issues aren't going away anytime soon, so buying some gold might be a good idea. It has never been easier thanks to the availability of exchange-traded funds (ETFs) like the SPDR Gold Trust (GLD 0.38%), which eliminate the inconvenience of owning physical metal. Read on.

Image source: Getty Images.

Why is everyone so hot on gold this year?

Gold has been considered a store of value for thousands of years, primarily because of its scarcity. According to the World Gold Council, just 216,000 tons have been pulled out of the ground throughout history, compared to around 1.7 million tons of silver and billions of tons of coal.

In fact, many countries used to peg the value of their domestic currencies to the shiny yellow metal, including the U.S., which was on the gold standard until 1971. This structure meant a country needed to have physical gold to back up its currency reserves, so it couldn't just print money out of thin air. Unfortunately, since abandoning the gold standard, countries like the U.S. have significantly grown their money supply.

The U.S. dollar has lost almost 90% of its purchasing power since 1971, and the national debt recently hit a record $38 trillion. The government ran a budget deficit of $1.8 trillion in fiscal 2025 alone (ended Sept. 30), so it's spending far more than it's taking in. Investors fear the government will have to debase the U.S. dollar even further by significantly increasing the money supply to bring the fiscal situation under control, which will contribute to inflation.

Therefore, investors are parking their cash in hard assets, which will inevitably increase in value as paper currency continues to lose its buying power. Gold has been one of the best hedges against the perils of fiat currency throughout history. It might not produce any revenue or earnings, but it also doesn't pose any of the risks investors might encounter in stocks or real estate. It's a very simple, vanilla asset.

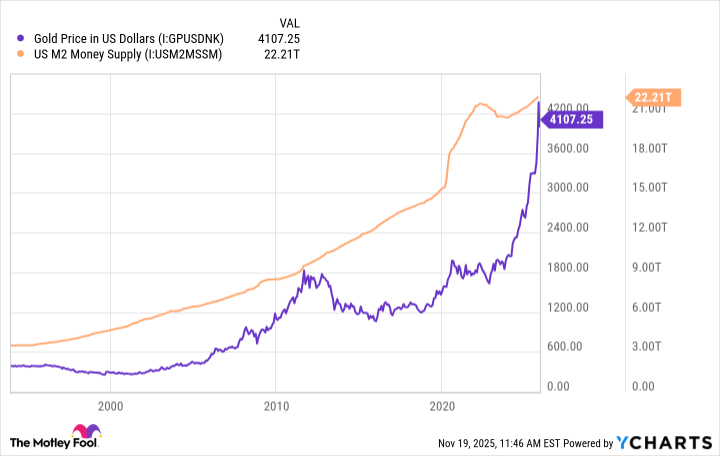

As displayed in the chart below, the price of an ounce of gold in U.S. dollar terms typically tracks the money supply, so it should continue to be the ideal hedge against reckless government spending and any subsequent inflation.

Gold Price in US Dollars data by YCharts.

The SPDR Gold Shares ETF makes gold ownership easy

Owning physical gold is the surest way to capture the commodity's increasing value, but it isn't always practical. The metal has to be stored securely with insurance, which adds costs, and it can be difficult to sell in a hurry, especially in large quantities. Buying the SPDR Gold Trust can solve those problems because it requires no physical storage and can be sold instantly with the click of a button.

NYSEMKT: GLD

Key Data Points

However, those benefits aren't free. The ETF has an expense ratio of 0.4%, which is the proportion of the fund deducted each year to cover management costs, so an investment of $100,000 will incur an annual fee of around $400. Over the long term, this will probably still work out cheaper than paying storage and insurance costs.

But there is another drawback. The SPDR ETF is fully backed by physical gold reserves, so it owns enough metal to cover the fund's $136 billion in assets under management, but investors aren't entitled to any of it. They will still profit from gold's upside, so this won't be an issue unless there is an apocalyptic event that prevents them from accessing their financial assets, in which case, nothing would beat owning physical gold.

With all that said, buying the SPDR Gold Trust is the simplest way for most investors to profit from gold's upside, but they should buy it only as part of a diversified portfolio of other assets. As I mentioned earlier, the shiny metal's incredible 56% return this year certainly isn't typical. Rather, it has averaged an annual gain of closer to 8% over the last three decades.