Lyft (LYFT 1.11%) is a ride-sharing platform that competes with Uber. Anyone can choose to join the platform as a driver using their own vehicle. As people need rides, they log in to the Lyft app and arrange to be picked up.

Lyft had its initial public offering (IPO) in 2019, allowing investors to purchase shares -- ownership stakes -- in the company. But for those who want to own a small stake in this company, there are some important things to understand first.

Image source: Getty Images.

The big risk

Innovation can disrupt existing business models. Consider Uber and Lyft. These two companies disrupted the traditional taxi model. When it comes to supply and demand, virtually all demand has shifted to these digital platforms, allowing these companies to capture the upside.

Investors fear that a new innovation will disrupt Lyft's business model. That innovation is autonomous vehicles. As Tesla and others push ahead with driverless technology, it seems inevitable that human drivers will be eliminated from the equation.

NASDAQ: LYFT

Key Data Points

If driverless cars take over, it's possible that riders could still hail these vehicles from Lyft's platform. Lyft is also building a business to maintain autonomous vehicle fleets. But investors need to take time to assess whether this is a material risk to Lyft's business model over the long term -- and many believe it is.

If the risk is real, then it may be best to avoid Lyft stock altogether. After all, it's often a bad idea to invest in a dying way of doing things.

The upside

Lyft's business could still have a vibrant future -- for what it's worth, this is my view. If I'm right, there are some positive aspects of this business that could make Lyft stock a good buy today.

Consider that Lyft has generated more than $1 billion in free cash flow over the last 12 months. That's good for a free-cash-flow margin of 16%. The margin is already quite strong, and it's still improving, which is a good sign for investors.

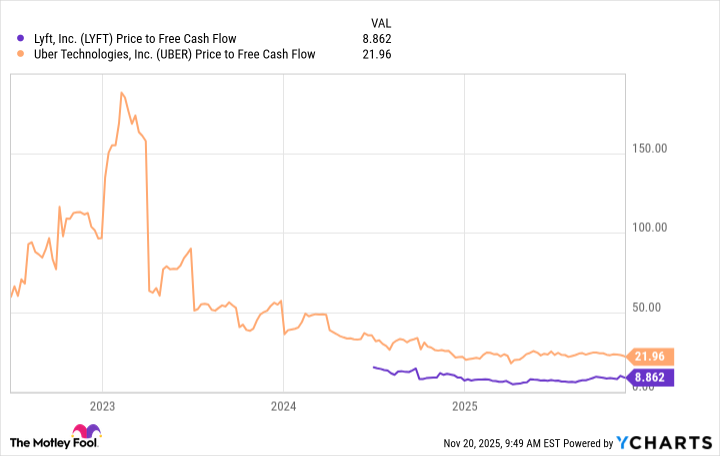

Based on the stock's valuation, investors appear to be indifferent to Lyft's profitability. As of this writing, Lyft stock trades at less than 9 times its free cash flow. For perspective, Uber stock is trading at one of its cheapest valuations ever, and its valuation is still more than twice as expensive as Lyft's.

LYFT Price to Free Cash Flow data by YCharts

I believe Lyft stock can be a strong performer for one of two reasons. First, investors could come to appreciate the profits and increase its valuation. The stock could double and still not seem overvalued. Second, Lyft's valuation could stay the same, meaning its stock gains would be the same as its gains in profitability. For what it's worth, Lyft's free cash flow jumped 60% year over year in the most recent quarter.

I find it unlikely that Lyft would get cheaper, considering it's so cheap already.

Lyft wouldn't be worthy of an investment today if it didn't have a future. But I believe it does. Key metrics such as riders, rides, and bookings all broke records in the most recent quarter, suggesting that this is a business with a strong customer base that can keep carrying it higher.