Investors are naturally drawn to the idea of buying an asset for a low price and selling it for a profit. While this is a pretty basic idea to understand, the perception of a low valuation can be distorted.

In other words, determining a company's value purely through the lens of its stock price can be misleading. This same concept applies to investing in cryptocurrency.

In recent years, one popular cryptocurrency that has amassed immense intrigue is Shiba Inu (SHIB 1.94%). While the token currently trades for just fractions of a penny, some investors are hoping to make multibagger returns if Shiba Inu can one day reach or eclipse the psychological threshold of $1.

Let's analyze what it would take for Shiba Inu to reach such price levels and determine whether or not the cryptocurrency deserves a spot in your portfolio today.

What is Shiba Inu?

Investing in cryptocurrency can be a lucrative way to build wealth. But in a similar vein to stocks, investors need to be wise about which cryptocurrencies they choose to buy.

While crypto adoption is still in its early phases, opportunities such as Bitcoin and Ethereum could be considered the closest comparable to a blue chip stock.

By contrast, Shiba Inu is considered a meme coin. Unlike Bitcoin, Ethereum, or even XRP, Shiba Inu's price is determined more through investor sentiment than actual product updates or user adoption.

Taking this one step further, Shiba Inu -- like many of its altcoin peers -- tends to exhibit pronounced levels of volatility as its prices ebb and flow based on narratives typically drummed up on social media.

Image source: Getty Images.

How does Shiba Inu coin work?

Beyond its meme coin origins, Shiba Inu's developer base has been hard at work introducing some new features.

One of its more notable updates is the creation of ShibaSwap, a decentralized exchange (DEX). ShibaSwap allows users to send tokens and earn rewards (staking) within Shiba Inu's native ecosystem, as opposed to using an outside network.

In addition, Shiba Inu also offers its own infrastructure through Shibarium. In essence, users can process payments, purchase non-fungible tokens (NFTs), or engage with other decentralized applications (dApps) more cheaply and efficiently than relying on Ethereum's blockchain.

Can Shiba Inu reach $1?

Just like any other type of asset, the law of supply and demand dictates the price direction of cryptocurrency.

On the supply side, Shiba Inu began with 1 quadrillion tokens in circulation. With such an intensely high number of tokens outstanding, Shiba Inu's price naturally hovers below a penny.

What is unique about Shiba Inu is that whenever a token is purchased, it is burned -- or removed from circulation and sent to an inactive wallet. Today, there are an estimated 589 trillion Shiba Inu tokens in the supply base.

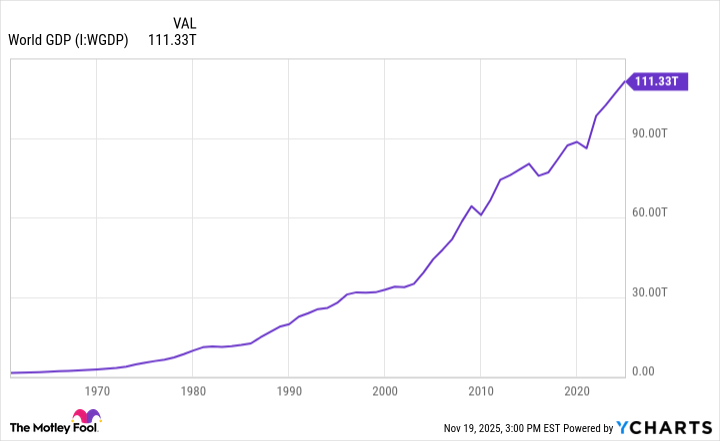

This means that if Shiba Inu were to be worth $1 today, the market value of the entire cryptocurrency would be $589 trillion. To put this figure into perspective, the value of gross domestic product (GDP) for the entire world is about $111 trillion.

Though Shiba Inu might look cheap due to its perceptually low price, the market cap of the cryptocurrency is roughly $5 billion. That is a meaningful sum for a crypto project with limited utility and a niche user base of retail investors.

In order for Shiba Inu to reach a price of $1, prolonged and sustained coordinated buy-in from institutional money managers and large banks would have to occur. In other words, demand would need to rise by unprecedented levels. This is highly unlikely, verging on impossible.

Against this backdrop, I would not invest in Shiba Inu based on the idea that it could one day be worth $1 -- turning a modest investment into potential millions of dollars. This is wishful thinking -- the kind that will get you caught holding the bag in a dangerous value trap.

At the end of the day, I do not see much reason to own Shiba Inu. While its movements may be entertaining to follow, it is speculative at best and is not worth meaningful capital allocation in a portfolio seeking to build durable, compounding wealth.