Arguably, no two retailers are a bigger part of Americans' everyday lives than Walmart (WMT +1.29%) and Target (TGT 0.76%). They are the only two national brick-and-mortar multi-category retailers, meaning they're everywhere and they sell everything.

While they compete closely with Costco Wholesale and Amazon, Costco is a membership-based, buy-in-bulk retailer, a much different type of business, and Amazon operates almost entirely online.

In terms of scale, Walmart is far larger than Target, as it has many more stores in the U.S., a thriving international business, and Sam's Club, a direct competitor to Costco. Walmart is also the world's biggest retailer by revenue.

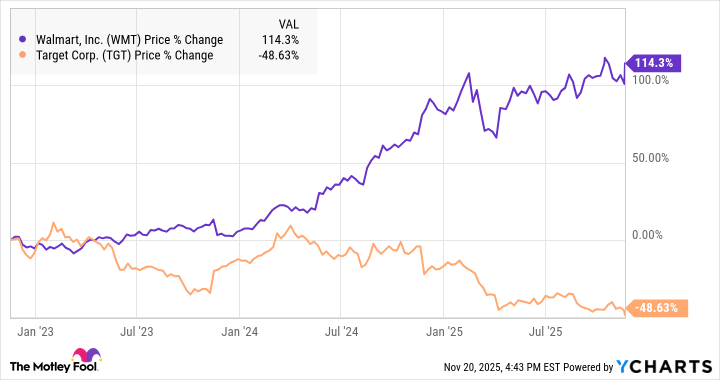

While Walmart is much bigger than Target, Target has outperformed Walmart at times, including during the pandemic. Since then, this retail battle royal has been no contest. As the chart below shows, Walmart has dominated Target over the past three years, as the two have been virtually mirror images of each other.

While Walmart's stock has more than doubled during that time, Target stock has been nearly cut in half. The growing gulf between the two retail titans continued to grow wider in the latest quarter. Let's review the headline numbers before discussing why Walmart is leaving Target in the dust.

Image source: Walmart.

A tale of two retailers

Walmart continued to deliver solid growth in its latest earnings report with overall revenue growth up 5.8% to $179.5 billion, ahead of the consensus at $175.2 billion. U.S. comparable sales were up 4.5%. Adjusted operating income rose 8%, showing its margins are expanding, and it raised its guidance for the year. The stock finished up 6.5% on Thursday even as the broad market tumbled on AI bubble fears.

At Target, on the other hand, comparable sales were down 2.7%, resembling its results earlier this year, driving overall revenue down 1.5% to $25.3 billion, which matched estimates. Its operating margin fell from 4.6% to 3.8% due to deleveraging from lower comparable sales and increased markdowns. It also cut its adjusted EPS from $7-$9 to $7-$8.

Can Target turn it around?

Almost everything that could go wrong for Target in the last three years has, it seems. Like other retailers that boomed during the pandemic, Target seemed to suffer from a hangover as those tailwinds faded.

Since then, it's struggled with theft, reporting hundreds of millions of dollars in losses from "shrink," and a backlash over its reversal on its DEI policies. The latter may be reflective of a broader identity crisis at the company and seemed to alienate both left and right-leaning companies.

Target's biggest challenge may be that demand for discretionary goods has been weak since inflation soared in 2022. Target and Walmart both noted an affordability crisis in their latest earnings calls with analysts. Though Target sells groceries, it is much more dependent on discretionary goods, and its reliance on the discretionary category seems to have become its biggest disadvantage in recent years when it's compared to Walmart.

There's not much Target can do to change that. Overhauling its stores to become full-service groceries would require massive capital expenditures. Selling groceries has proved advantageous to Walmart because it's easier to pass along price increases for essentials than for discretionary products, and its reputation for low prices has also given it an edge.

There's evidence that Walmart has gained market share from chains like Dollar General, showing it's effectively punching down, while also appearing to grab market share from Target.

NASDAQ: WMT

Key Data Points

What's behind Walmart's success

Walmart, on the other hand, has executed effectively over the last decade, building up its e-commerce business by opening up grocery pickup stations, adjusting its international portfolio, improving its inventory management and reducing out-of-stocks, building up its digital advertising business, and avoiding the culture war pitfalls that have shaken Target and other brands.

After earlier ignoring the threat from Amazon, Walmart has leaned into its strengths in areas like grocery, its locations -- which put it within 10 miles of most Americans -- and its reputation for low prices to fix its vulnerabilities, and those moves have paid off for the stock, as comparable sales are steadily climbing, operating margin is expanding, and the stock has soared over the last few years.

What it means for investors

If there's a silver lining for Target, it's that the stock is now much cheaper, though that disparity is warranted. Target now trades at a price-to-earnings ratio of 10.4, while Walmart is valued at 40.4 times earnings.

In order for this pattern to change, however, Target is going to need help in the form of improving demand for discretionary goods, as that has been the biggest weak spot for the company. Given the poor labor market, stubborn inflation, and an evolving "affordability crisis," that weakness seems likely to get worse before it gets better.