With a market cap of $22 billion, Dogecoin (DOGE 0.15%) is currently the ninth-largest cryptocurrency in the world -- putting it ahead of recognizable names such as Cardano, Stellar, Litecoin, and Avalanche.

While Dogecoin may be one of the most prominent tokens in the crypto realm, some investors may not fully understand what it's used for.

Let's break down the ins and outs of Dogecoin and determine if now is a good time to invest in the popular cryptocurrency.

CRYPTO: DOGE

Key Data Points

What is Dogecoin?

Dogecoin was introduced in 2013 by software engineers Billy Markus and Jackson Palmer. Originally, Dogecoin was launched as a satirical altcoin in the midst of early crypto adoption.

Similar to many other cryptocurrencies, people can use Dogecoin to send peer-to-peer payments and is accepted in some retail settings.

While Dogecoin's early days were rooted in mockery of the rise of digital assets, the cryptocurrency's developer base deserves some credit for introducing real-world utility into its ecosystem.

Image source: Getty Images.

What makes Dogecoin's price move?

Whether it's a stock, a bond, or an alternative investment like gold, real estate, or artwork, underlying prices are determined through the law of supply and demand.

Despite its utility, Dogecoin's application in the real world remains quite muted compared to more mainstream cryptocurrencies.

For this reason, when macro uncertainty becomes more pronounced or the Federal Reserve reduces interest rates -- thereby freeing up capital -- more widely adopted cryptocurrencies such as Bitcoin or XRP may witness heightened buying activity. These same demand mechanics are not always seen in Dogecoin given its limited traction at the enterprise level.

On the other side of the equation is Dogecoin's supply base, which is unlimited. The annual inflation rate drops very slowly, as 5 billion new coins are added each year. Against this backdrop, it's monumentally difficult for Dogecoin to actually sustain price appreciation.

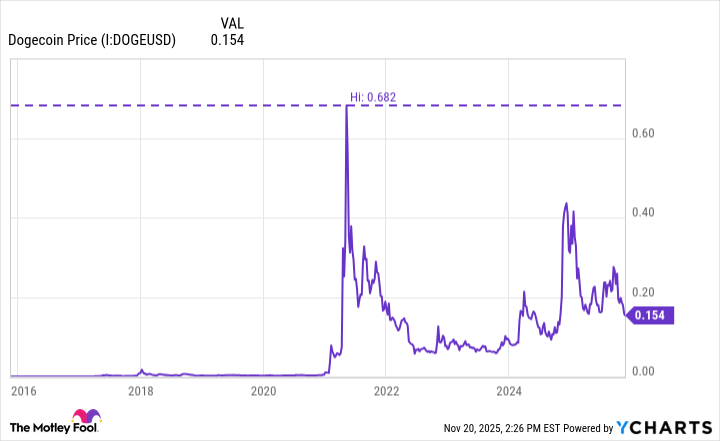

Dogecoin Price data by YCharts

The chart above illustrates the price fluctuations of Dogecoin over the past 10 years. To call Dogecoin volatile would be an understatement.

In reality, Dogecoin's price moves less on macro indicators and more on investor sentiment. As a meme coin, Dogecoin primarily experiences sharp ebbs and flows based on viral narratives that come to light on social media or online chat forums.

In other words, there isn't really a fundamental rhyme or reason why Dogecoin rises and falls. Rather, its movements are incredibly unpredictable and largely fueled by a combination of hype and hope among retail investors.

Is Dogecoin a good cryptocurrency to invest in?

Investing in cryptocurrency should still be considered a speculative exercise. While Bitcoin, Ethereum, XRP and some others have achieved a degree of institutional adoption, these cryptocurrencies remain both volatile and unpredictable relative to a blue chip stock.

When it comes to Dogecoin, there is a dual risk of niche demand and the underlying structural supply issues -- ultimately creating limited upside in the long run. The easy profits in Dogecoin have already been made, and investors who got in early were lucky in their timing.

Ultimately, Dogecoin provides little tangible value for investors seeking to compound their wealth. At best, it's a tradable asset that entertains less responsible investors. Unless you are a day trader looking to capitalize on extreme price swings, Dogecoin is best left avoided.

By contrast, if you are an investor with a long-term time horizon seeking to build durable wealth, it's not a bad idea to have some exposure to the broader cryptocurrency opportunity in your portfolio.

However, it's how these positions are constructed that matters most. Most investors are better off gaining exposure to the cryptocurrency realm through more insulated channels such as spot Bitcoin exchange-traded funds (ETFs) or cryptocurrency stocks like Coinbase Global or Robinhood Markets.

These opportunities provide diverse allocation to the crypto market and do not require the administrative setup of digital wallets or using brokerages outside of your traditional custodian platform.

Given the analysis above, I do not see Dogecoin as a good opportunity for investors interested in cryptocurrency.