Target (TGT +2.56%) just released its third-quarter 2025 earnings report, and it did little to inspire confidence in the company. Net sales and profits have continued their declines, even as Walmart and Costco continue to report steady sales growth.

Moreover, it had recently alienated customers over its political stances, and the decision to replace longtime CEO Brian Cornell and promote current COO Michael Fiddelke to the CEO position was not well received by investors.

However, the current state of Target arguably makes the retail stock an increasingly compelling contrarian buy. Amid its troubles, it might be time for investors to start adding shares. Here are three reasons why.

Image source: Target.

1. Market positioning

Admittedly, touting its market position may seem nonsensical when sales are declining. Its reputation as an "upscale discounter" may fail to resonate with investors when its customer base has become increasingly budget-conscious. Also, a decision to take a political stance and later reverse it had the effect of alienating both right-leaning and left-leaning customers.

Nonetheless, Target remains strongly positioned across America's retail landscape to reach customers. It operates nearly 2,000 stores in all 50 states, meaning that at least one Target store is within 10 miles of more than 75% of the U.S. population.

With its extensive product selection, it can offer customers a wide variety of goods. Of its competitors, only Walmart can match that kind of scale. Still, Walmart tends to target a more price-sensitive customer base, a significant contrast from the Target shopper, who tends to earn higher incomes and seeks more upscale items at affordable prices. Hence, Target can still differentiate itself in the retail landscape.

2. Target's dividend

Moreover, thanks to the decline in the stock price, income investors have a unique opportunity in Target stock.

NYSE: TGT

Key Data Points

Target offers shareholders an annual payout of $4.48 per share, and with the lower stock price, that amounts to a dividend yield of 5.4%. Considering that the S&P 500 pays an average dividend yield of about 1.2%, that's an extremely generous payout.

Plus, the dividend is on track to keep moving higher. Target has raised its dividend for 54 consecutive years, making it a Dividend King. Abandoning such streaks often leads to years of struggle for a stock, making it unlikely that Target will stop the annual payout hikes unless it's necessary.

Fortunately, its dividend has remained stable, even amid the declining sales. Over the trailing 12 months, Target still managed to generate almost $3.4 billion in free cash flow. Since the dividend cost Target less than $2.1 billion over the same time, the company can probably sustain its payout and continue to hike the dividend annually.

3. Valuation

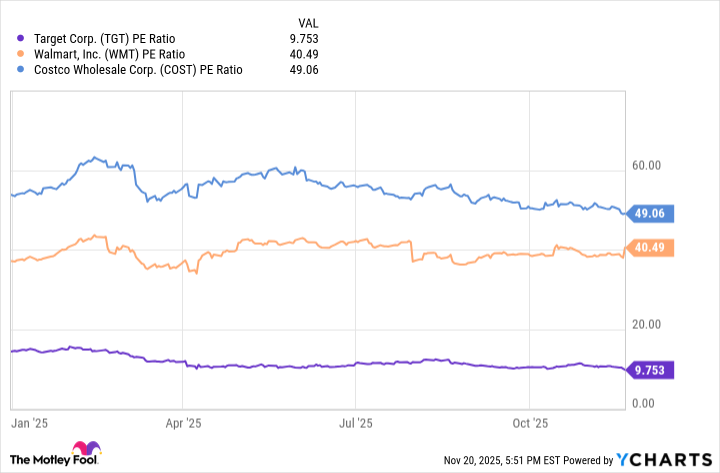

In addition to paying a high dividend, Target stock has become cheap by just about any measure. Currently, it trades at a P/E ratio around 10, well below that of Walmart or Costco.

TGT PE Ratio data by YCharts

Target stock is cheap for a reason. Its $74 billion in net sales for the first nine months of fiscal 2025 (ended Nov. 1) dropped 5% compared to the same period in fiscal 2024. Also, the net earnings of just under $2.7 billion fell 11% from year-ago levels.

Still, the P/E ratio indicates the market may have gone too far in punishing Target for such results. That point alone could limit its downside and lead to a considerable resurgence in the stock should its results improve.

Buying Target stock

Given the current state of Target stock, it's looking increasingly like an excellent contrarian play.

Indeed, the continued sales declines have understandably frustrated investors, and that disappointment has brought steady declines in Target stock.

Nonetheless, Target's extensive footprint and continued popularity among some shoppers could help stabilize its sales levels and perhaps help it return to growth.

The company also offers a generous dividend yield, and the Dividend King status all but compels Target to keep hiking that payout for as long as possible. When investors also consider its extremely low valuation, they have a strong incentive to collect huge dividends and wait for a recovery in Target stock.