Enbridge (ENB +0.75%) is one of the largest energy infrastructure companies in North America. It transports about 30% of the crude oil produced on the continent, ships almost 20% of the natural gas consumed in the U.S., and operates North America's largest gas utility franchise. Additionally, it's an early leader in investing in renewable energy.

However, there are a few crucial factors investors need to know about the energy stock before buying shares.

Image source: Getty Images.

It's a Canadian company

While Enbridge is a leading infrastructure investor in the U.S., it's a Canadian company. Its corporate headquarters is in Calgary, Alberta. As a result, the company reports its financial results in Canadian dollars.

This has a couple of noteworthy impacts on U.S. investors. A big one is the effect this has on its dividend payments. Enbridge pays dividends in Canadian dollars, subjecting investors to foreign exchange fluctuations. The company currently pays a quarterly dividend of 0.9425 Canadian dollars per share (CA$3.77 annualized). At the current exchange rate, that's $0.67 per share ($2.57 annually). This payment will fluctuate based on the exchange rate.

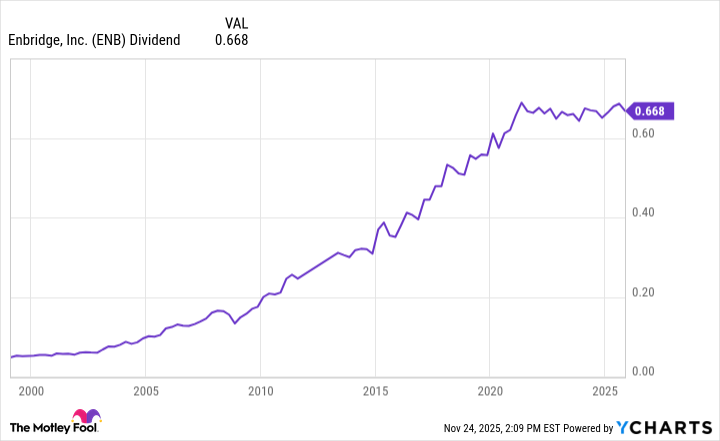

For example, while Enbridge has increased its dividend (in Canadian dollars) for 30 straight years, its payment in U.S. dollars has had a bit more variability over the years:

ENB Dividend data by YCharts

Another way being a Canadian company impacts Enbridge is dividend taxes. Shareholders who aren't Canadian residents will be subject to Canadian withholding tax, which is 15% for U.S. residents. However, that only applies to shares held in a regular brokerage account (shares held in an IRA are tax-exempt). Further, you can claim a credit for any tax paid when you file your annual tax return.

Enbridge has one of the lowest-risk business models in the energy sector

While Enbridge operates in the volatile energy sector, it has one of the industry's lowest-risk business models. About 98% of the company's cash flows come from assets secured by cost-of-service agreements or long-term, fixed-rate contracts. As a result, Enbridge produces very predictable results. The company's results are so predictable that it has achieved its annual financial guidance for 19 years in a row.

NYSE: ENB

Key Data Points

The company has enhanced the stability of its cash flows over the years by diversifying its business and replacing assets with commodity price exposure with those that produce steadier cash flows. For example, last year Enbridge closed the acquisition of three very stable U.S. gas utility assets. The deal meaningfully diversified its business mix. Its earnings from stable gas distribution assets rose from 12% of its total to 22%, while its earnings from liquids pipelines fell from 57% of the total to 50%. The company helped fund the deal by selling its interest in Aux Sable, which operates NGL extraction and fractionation facilities with commodity price exposure

A low-risk Canadian income stock

Enbridge is a leading energy infrastructure company headquartered in Canada. That has some foreign exchange and tax implications for U.S. investors. However, Enbridge has one of the lowest-risk business models in the energy sector, which supports its high-yield dividend (5.7% current yield).