While mergers and acquisitions (M&A) aren't a new concept by any means, the underlying rationale behind each deal is unique. Sometimes, a business will decide that acquiring a competitor is a more efficient use of capital as opposed to increasing sales activity in order to expand market share.

Alternatively, businesses will acquire platforms that offer tangential services in an effort to bolster its product roadmap. This strategy is currently employed by quantum computing pure play IonQ (IONQ +2.88%).

While the sharp appreciation in IonQ stock could suggest that the market likes the company's M&A strategy, I think most investors are overlooking a massive opportunity cost as it relates to these transactions.

Let's explore IonQ's M&A history and break down why these deals may not be as lucrative as investors think.

NYSE: IONQ

Key Data Points

IonQ spent $2.5 billion on acquisitions

So far this year, IonQ has acquired the following companies: Oxford Ionics, Capella Space, id Quantique, Lightsynq, and an undisclosed marketing intelligence platform. IonQ also acquired a company called Qubitekk in December 2024.

In aggregate, IonQ has spent $2.5 billion across its acquisitions over the last year.

Image source: Getty Images.

Have IonQ's acquisitions paid off?

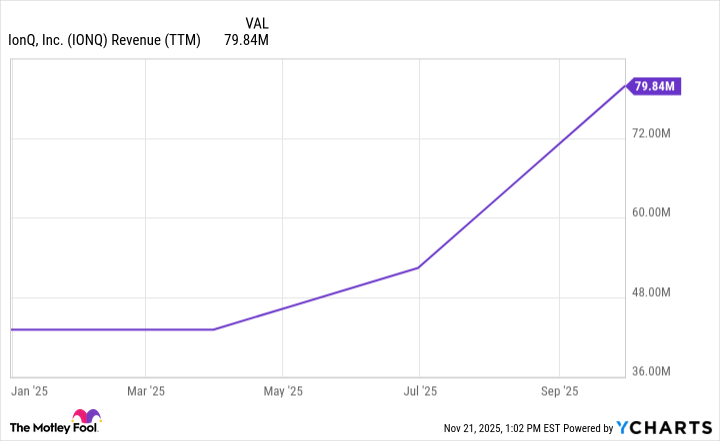

Over the last 12 months, IonQ has generated $80 million in revenue. As the slope of the sales line pictured below illustrates, IonQ's growth has accelerated significantly -- thanks in part to the company's acquisition strategy.

IONQ Revenue (TTM) data by YCharts

In the table below, I've summarized the time frame of each acquisition and its respective revenue contribution between closing and the period ended Sept. 30.

| Company Name | Date Acquired | Revenue Contribution Since Acquisition |

|---|---|---|

| Oxford Ionics | Sept. 16, 2025 | Not reported |

| Capella Space | July 11, 2025 | $9.6 million |

| id Quantique | April 30, 2025 | $9.0 million |

| Lightsynq | May 30, 2025 | Not reported |

| Qubitekk | Dec. 27, 2024 | Not reported |

Data source: IonQ 10Q Filing.

Given the Oxford Ionics deal essentially closed concurrently with the end of the third quarter, investors shouldn't expect much of a contribution to IonQ's pro forma financials.

IonQ notes in its 10Q that stand-alone figures are not broken out for Qubitekk "due to the immateriality of this acquisition relative to the Company's condensed consolidated financial position." Don't be alarmed by this comment.

Qubitekk is IonQ's smallest acquisition over the last year. Moreover, sometimes a company will buy another business purely for its customer base, technology expertise, or intellectual property (IP). In the M&A world, these types of deals are referred to as an acquihire -- transactions in which the buyer wants fast and direct access to a potentially groundbreaking platform rather than its underlying business. This is likely the case between IonQ and Qubitekk.

Lastly, IonQ's decision to keep Lightsynq's revenue undisclosed probably means the contribution was nominal -- if anything.

To summarize, it would appear that IonQ has spent far more on its acquisitions than they are currently contributing in terms of new revenue. But to be fair, most of these deals are recent.

Furthermore, it takes quite a bit of time -- months or even years -- before an acquisition is fully integrated into the overall operation and becomes accretive.

Image source: Getty Images.

How did IonQ fund its acquisitions?

I will give IonQ the benefit of the doubt here and buy into the idea that its acquisitions all play a role in the company's broader product roadmap. To me, the more glaring issue is how IonQ funded these deals.

| Company Name | Cash | Fair value of common stock issued and Equity Awards | Total Purchase Price |

|---|---|---|---|

| Oxford Ionics | $10 million | $1.6 billion | $1.6 billion |

| Capella Space | $48.3 million | $376.5 million | $424.8 million |

| id Quantique | No cash | $116.2 | $116.2 million |

| Lightsynq | $100,000 | $306.7 million | $306.8 million |

| Qubitekk | $22.1 million | No stock | $22.1 million |

| Total | $80.4 million | $2.4 billion | $2.5 billion |

Data Source: IonQ 10Q Filing.

As the table above illustrates, IonQ has parted ways with very little cash to buy its competition. The reason? Because the company is unprofitable and doesn't generate cash organically. As a result, IonQ has taken advantage of its soaring valuation -- issuing stock at a premium price point to raise sufficient capital and spearhead its acquisition strategy.

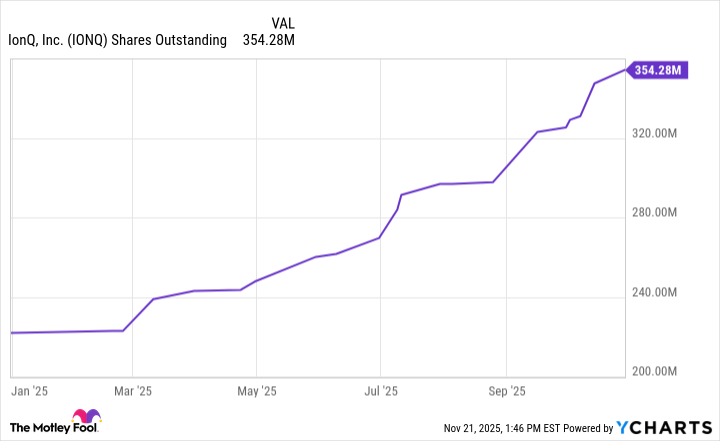

On the surface, this might not seem like a big deal. Companies issue stock all of the time. But take a look at how IonQ's outstanding share count has changed over the last year.

IONQ Shares Outstanding data by YCharts

Another way of looking at these dynamics is that the cost of these transactions is increasingly becoming shareholder dilution. Given the company's aggressive appetite for deal flow, I am suspicious that further dilution could be on the way.

While IonQ may have a detailed and ambitious product roadmap, I think the company's capital allocation strategy needs improvement. For these reasons, I would stay clear of IonQ stock until the company proves that all of these acquisitions are bearing fruit. Investors buying the stock at its current levels risk further dilution and becoming bag holders.