Large organizations often use several different cloud platforms (like Amazon Web Services and Alphabet's Google Cloud) to run their day-to-day operations. This creates fragmented data sets, meaning valuable information is stored in different places, which makes it difficult to analyze.

Snowflake (SNOW 2.10%) created the Data Cloud, which sits on top of other cloud platforms so businesses can bring all of their data together in one place. This is especially important when developing artificial intelligence (AI) models, because they need real-time access to all a company's data to produce the best results.

Snowflake stock is comfortably outperforming the broader market in 2025 with a gain of 48%, thanks to the company's strong operating results throughout the year. It's scheduled to release its latest quarterly report on Dec. 3, which could be a catalyst for further gains for investors.

Is the stock a buy ahead of time?

Image source: Getty Images.

Snowflake is well-positioned for the AI boom

Snowflake launched a platform called Cortex AI in 2023, which is like a hub where businesses can access all the tools and services they need to develop AI software. It includes a series of information-gathering features like Document AI, which can extract data from unstructured sources like invoices or contracts, and Cortex Agents, which can be trained to analyze business material to find patterns and opportunities.

Cortex AI also offers access to ready-made large language models (LLMs) from top developers like OpenAI and Anthropic. Businesses can plug their internal data into these models to fast-track the development of AI software applications.

Cortex has become central to the AI strategy of many large organizations. Global asset manager BlackRock, for instance, uses the platform to aggregate every piece of information it has on each of its clients, including from previous correspondence. Cortex then produces immediate insights to help the company provide the highest level of customer service.

Snowflake had 12,062 customers at the end of its fiscal 2026 second quarter (ended July 31), and 6,100 of them were using at least one of its AI products every week. That more than doubled from 2,500 customers in the year-ago quarter.

NYSE: SNOW

Key Data Points

Strong revenue growth, but steep losses

Snowflake generated $1.09 billion in product revenue during the second quarter, which was a 32% increase from the year-ago period. That growth rate marked a welcome acceleration from 26% in the prior quarter three months earlier, after several quarters of slowing growth.

But according to management's guidance, Snowflake's revenue likely came in at around $1.13 billion in the third quarter (which ended on Oct. 31), representing a year-over-year increase of 26%. In other words, the company's renewed momentum might have been short-lived.

Snowflake's bigger challenge is at the bottom line, because it's spending heavily to acquire more customers and build new products -- and that is driving steep losses. The company's operating expenses jumped 19% to $1.1 billion during the second quarter, led by a 25% increase in marketing spending, which resulted in a net loss of $297.9 million on a generally accepted accounting principles (GAAP) basis. Through the first six months of fiscal 2026, the company lost a whopping $728 million.

The picture looks a lot better on an adjusted (non-GAAP) basis, which excludes one-off and noncash expenses like stock-based compensation. By that measure, Snowflake actually generated a profit of $128.9 million during the second quarter, which was more than double its year-ago result. However, this isn't considered true profitability in the eyes of most Wall Street analysts because of all the exclusions.

Should you buy Snowflake stock before Dec. 3?

Snowflake's solid financial results in fiscal 2026 so far -- particularly in the second quarter -- have fueled the 48% rally in its stock this year. However, I'm not convinced further upside is on the horizon in the short term, even if the company delivers a better set of third-quarter results than expected on Dec. 3.

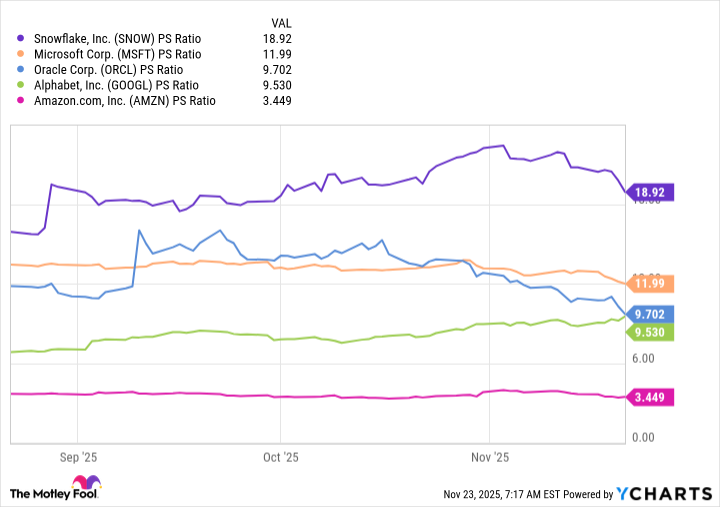

Simply put, Snowflake stock is very expensive right now. It's trading at a price-to-sales (P/S) ratio of 18.9, and although there aren't many comparables to this specialist company in the public markets, it's significantly more expensive than each of the major cloud providers:

SNOW PS Ratio data by YCharts

In the most recent quarter, the cloud divisions in each of those companies delivered faster revenue growth than Snowflake, except for Amazon Web Services; Google Cloud grew by 33%, Microsoft Azure grew by 40%, and Oracle Cloud Infrastructure grew by 55%.

Each of those four companies operate several other businesses beyond the cloud, so they aren't the perfect comparisons to Snowflake. However, I don't think Snowflake's valuation deserves such a steep premium, considering its revenue growth is expected to resume slowing, and given the scale of the company's GAAP losses.

As a result, I think further upside in Snowflake stock could be limited in the near term, so the risk-reward equation doesn't make a lot of sense heading into the Dec. 3 report.