Drone maker AeroVironment (AVAV +5.63%) was one of the first movers in the autonomous aerial vehicle space, and it's still one of the most prominent drone companies around.

However, a lot other tech and defense companies are investing heavily in autonomous vehicles, putting AeroVironment's supremacy at risk and sending its share price down 32% from its all-time high. How well has AeroVironment actually performed for investors?

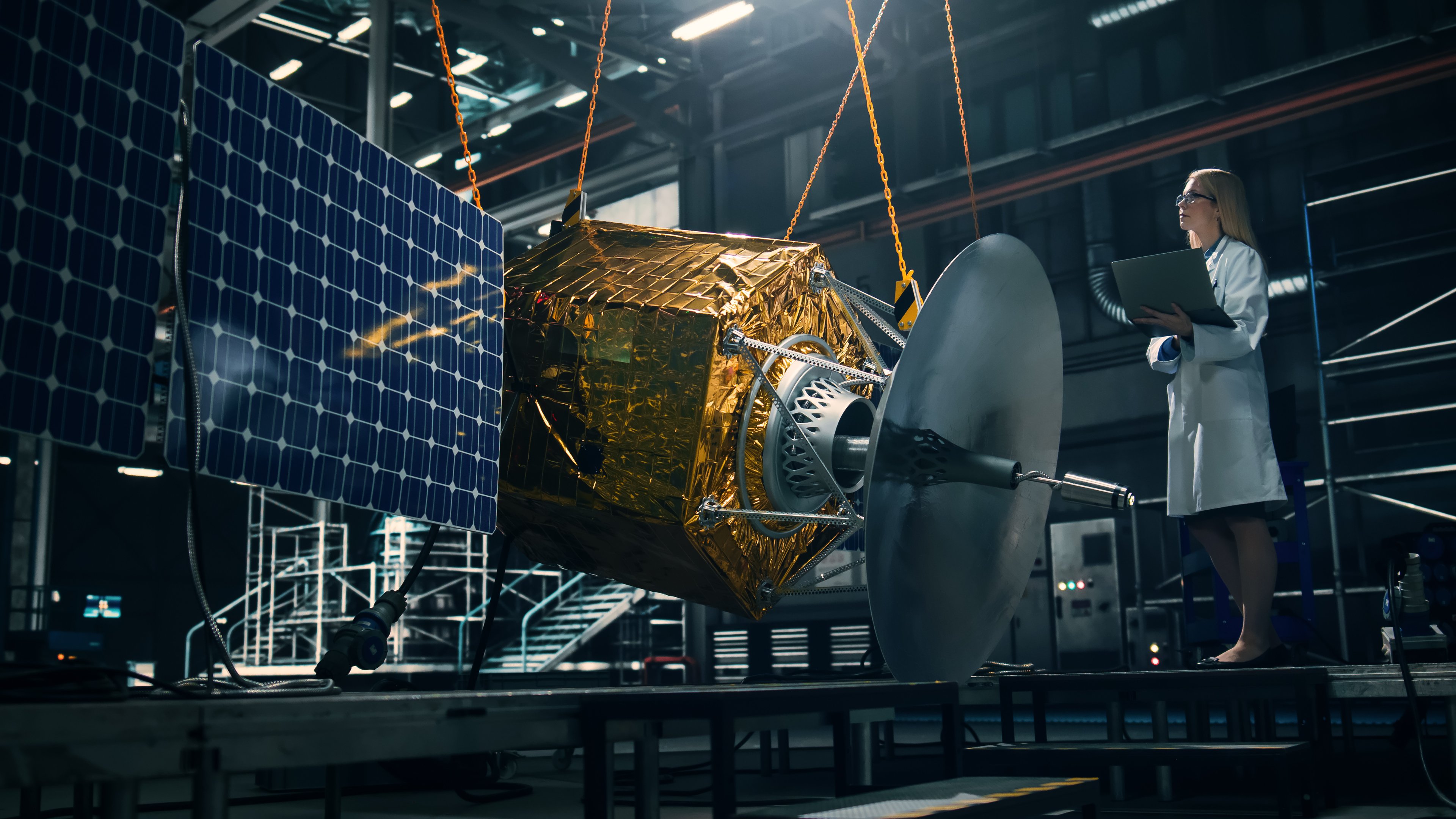

Image source: Getty Images.

One year: Flying high

Despite AeroVironment's recent stock price slump, which seems to have been triggered in part by partial sell-offs from one of Cathie Wood's Ark Invest ETFs, investors who bought shares of AeroVironment a year ago should be feeling good about their investments.

While the broader stock market, as measured by the S&P 500, has risen 14.2% over the past year, AeroVironment's shares are up 46.6%. That said, it's been a bumpy ride. In April, the stock's shares were down 45% before going airborne again. In October, they briefly topped $400 a share, up 112%, before settling to today's share price of $279.46.

But what about investors who bought in earlier? How have they fared?

Three years: Soaring higher

AeroVironment's three-year performance is even better. Investors who bought shares in November 2022 have seen their investments rise 203.8% over just three years, handily beating the S&P 500's 70% return. Even if you look at the S&P 500's performance on a total return basis -- which factors in reinvestment of dividends -- it's up only 76.8%, giving AeroVironment's shares an easy win despite the lack of a dividend.

Does this pattern hold? Are the five-year returns exponentially better?

Five years: Cruising altitude?

Surprisingly, AeroVironment's five-year returns aren't much better than its three-year returns. The stock is up 222.8% over the last five years, just 19 percentage points more than its three-year gain. That's because AeroVironment hit a rough patch in 2021, and unlike much of the rest of the market, its stock went down throughout that year.

Meanwhile, the S&P 500 was soaring in 2021, so its current five-year gain of 88.3% -- or 101.6% on a total return basis -- is noticeably better than its current three-year gain:

NASDAQ: AVAV

Key Data Points

AeroVironment's previously sagging shares really took off after the Russian invasion of Ukraine in February 2022. Drones became so important to the battlefield strategy of both sides that their revolutionary potential became clear, which led to the company getting more interest from investors. It's a good example of how holding shares of a quality business at the right time can lead to massive market-beating returns, and long-term holding makes being there at the right time far more likely.