When it comes to ride-sharing platform Lyft (LYFT 1.71%), the company name and the ticker symbol are exactly the same. But even though it's easy to remember this ticker symbol, buying it hasn't necessarily been a good idea.

Lyft went public in early 2019 at $72 per share. Now, over six years later, the stock has lost 73% of its value. In short, it hasn't done well. Anyone who invested $1,000 in Lyft stock at the beginning has seen the value drop to just $272.

Image source: Getty Images.

Over the long term, factors such as revenue growth, profitability, and valuation can all affect stock performance. Lyft hasn't really struggled with the first factor -- it's grown revenue considerably. After a brief setback in 2021, the company has consistently grown the top line at a double-digit rate, including 11% year-over-year growth in the third quarter of 2025.

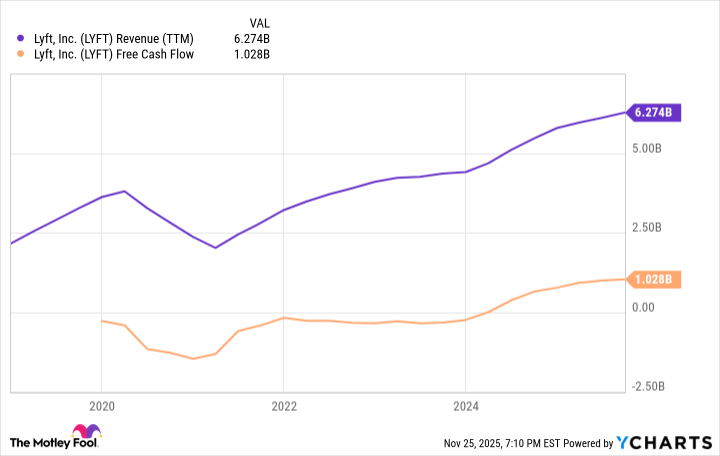

Lyft took longer to gain traction in terms of profitability. One measure of profitability is free cash flow. The company didn't turn the corner on a trailing 12-month basis until 2024, as the chart below shows.

LYFT Revenue (TTM) data by YCharts.

Lyft has grown its revenue well enough, and the company's profitability is now on track thanks to operational changes made in recent years. The final piece of the puzzle for the stock performance is its valuation. As of this writing, the stock trades at an inexpensive valuation of just 8 times its free cash flow.

With the stock's valuation this cheap, investors clearly doubt Lyft's long-term prospects. What does that mean for investors now?

Will Lyft stock do better?

Lyft will certainly face competitive pressures in the coming years. On the one hand, larger platforms such as Uber could make it difficult to grow. On the other hand, advances in autonomous vehicles could unleash fleets of driverless taxis, upending the business models for both Lyft and Uber.

NASDAQ: LYFT

Key Data Points

It's possible that investors will continue to doubt Lyft stock because of its potential threats, keeping it in bargain territory. If that happens, the company could still deliver for investors by growing profits and returning them to shareholders.

To be sure, Lyft is already returning profits to shareholders by repurchasing shares -- it's repurchased $400 million in shares in the first three quarters of 2025 alone. This is clearly a priority for the company, which can boost the stock price.

However, the more important factor for Lyft stock from here will be whether it can overcome competitive pressures and continue to grow profitably. Given the ongoing adoption trends for the platform, I believe this is a likely outcome. But investors will want to understand industry trends before making predictions about the future of the ride-sharing space.