My investment approach is fairly simple. I prefer to examine companies with strong dividend histories and historically high dividend yields. I will buy if my evaluation of the underlying business is positive.

In 2024 and 2025, I have been buying one of the largest consumer staples companies in the world. Here's why it would be the stock I would buy if I could only own one stock.

Diversification matters to me

The stock I've chosen to buy is PepsiCo (PEP +0.64%), and to illustrate why, I'll compare and contrast it with its beverage competitor, Coca-Cola (KO 0.53%). The key here is that Coca-Cola is actually a fairly attractive stock today, but not as attractive, in my opinion, as PepsiCo.

Image source: Getty Images.

One of my key stock screens is dividend history. A long string of annual dividend increases is something that only a well-run business can support. Both Coca-Cola and PepsiCo are Dividend Kings. Achieving that status requires at least five decades worth of annual dividend increases. That's not something that happens by accident, and it shows that both of these consumer staples companies are well run.

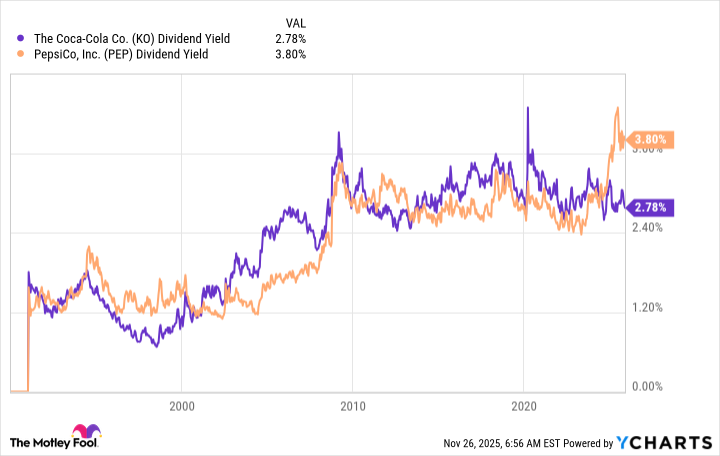

The next piece of my simple approach is to focus on companies with historically high dividend yields, which I use as a rough gauge of valuation. Dividends tend to be more stable over time than earnings, and stocks often trade within a consistent yield range.

Currently, Coca-Cola's yield is 2.8%, which is attractive relative to the market but does not stand out for the company, historically speaking. PepsiCo's nearly 3.9% yield is near its highest levels ever.

KO Dividend Yield data by YCharts.

From a top-level view, PepsiCo grabs my attention more than Coca-Cola. But I don't just start buying at this point. I confirm the attractive valuation hinted at by the dividend yield using more traditional valuation tools.

My preference is the price-to-sales ratio (P/S), but I also consider price-to-earnings (P/E) and price-to-book-value (P/B). The comparison with Coca-Cola remains relevant, as the soda giant's P/S, P/E, and P/B ratios are all roughly in line with their five-year averages. PepsiCo's P/S and P/B ratios are below their five-year averages, while the P/E is above.

On balance, Coca-Cola appears reasonably priced, while PepsiCo looks relatively cheap. I have a value bent, so I'm drawn to companies like PepsiCo. A more conservative dividend investor could easily argue in favor of Coca-Cola.

NASDAQ: PEP

Key Data Points

What about the business?

While I've moved beyond Coca-Cola at this point in my stock search, I'm going to keep it in the mix to help explain why I think PepsiCo is a better choice. For starters, both companies hold highly attractive industry positions in the consumer staples sector. They each possess strong capabilities in product development, distribution, and marketing. And they are both large enough to act as industry consolidators, acquiring brands to round out their portfolios and keep pace with consumer trends.

What really separates them is that Coca-Cola is a one-trick pony since it is entirely focused on beverages. To be fair, the trick this pony does is very good, given that it is the world's most important nonalcoholic beverage company. But I'm a fan of diversification, and PepsiCo operates in beverages, salty snacks, and packaged foods. It has more levers to pull to support long-term growth, and if one segment is struggling, there are two others to keep the business chugging along.

When I add it all up, PepsiCo appears to be a great business that has fallen on hard times. I believe that history has shown that the company will navigate this difficult period and regain its footing eventually. It could be a few years before it looks like a winner again, but the historically high yield is paying me well to wait.

NYSE: KO

Key Data Points

Everything is relative on Wall Street

There is no perfect investment. Every stock comes with trade-offs, which is why it is essential to compare investments to one another, a tactic often employed by Benjamin Graham, one of the most famous investors to ever work on Wall Street. In fact, some of the things I do as an investor are directly taken from Graham's playbook.

Using his tools and others I've picked up along the way, I think PepsiCo is a great investment opportunity right now. I'm glad I don't have to buy just one stock, but I would be very happy with PepsiCo if I were limited to a one-stock portfolio.