When I think of Archer Aviation (ACHR 7.34%), I keep coming back to a mental picture. It's 2030, and there's a line of people at a vertiport. And everyone's looking up as an electric vertical takeoff and landing (eVTOL) craft glides in quietly, with the next four passengers getting ready to board it.

Of course, that future is still hypothetical. Shares of Archer currently trade around $7 to $8, and the company still hasn't docked a single dollar of revenue.

NYSE: ACHR

Key Data Points

At the same time, Archer has backing from big names in manufacturing, like United Airlines and Stellantis. And with policy tailwinds this year from the White House, its tallest hurdle right now -- obtaining FAA-type certification -- may not be as formidable as it once was.

Down about 22% on the year, is today's price an early bird special on future industrial success?

Image source: Stellantis.

A company between cash burn and disruption

The first thing to know about Archer is that it's mostly riding on speculation. Although the company delivered an aircraft to the U.S. Air Force last year and showcased one at a California air show in October, its ability to scale production and generate revenue is still hypothetical.

In order for the company to prove itself, it needs the FAA's regulatory blessing to operate commercially. On that front, there may be strong movement: A new FAA integration program, which launched in September, aims to accelerate how eVTOLs are tested and certified. Although it doesn't have the green light yet, this program could fast-track the process.

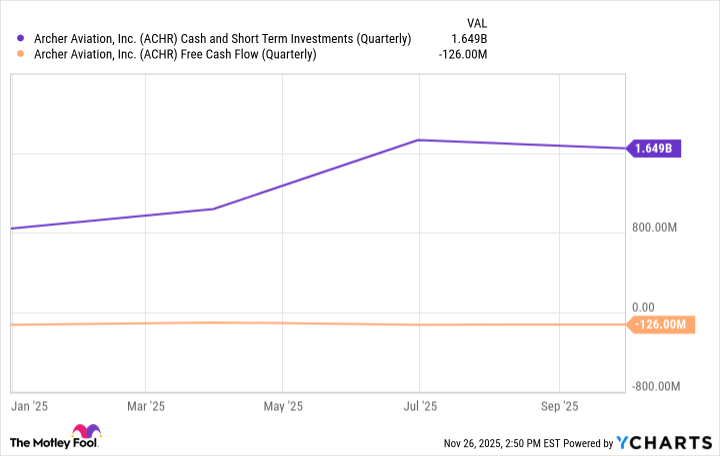

The company had about $1.6 billion in cash and short-term investments at the end of the third quarter. Its quarterly cash burn is about $125 million.

ACHR Cash and Short Term Investments (Quarterly) data by YCharts

The stock is still a speculative play on urban mobility, but the FAA's pilot program could fast-track its path to reality. For aggressive investors thinking long-term, buying Archer while it's under $15 could be a calculated bet on its future liftoff.