Citigroup (C +3.82%) is a household name in the banking sector, though its business spans well beyond the local corner bank. The 2.3% dividend yield isn't huge on an absolute basis, but it is roughly in line with the yield of the average large bank and nearly twice the 1.2% or so yield you would collect from the S&P 500 index.

There's a good reason why dividend investors might be interested in this financial industry giant. However, don't hit the buy button before reading this, as there's one notable issue with Citigroup's stock today.

A much-improved business

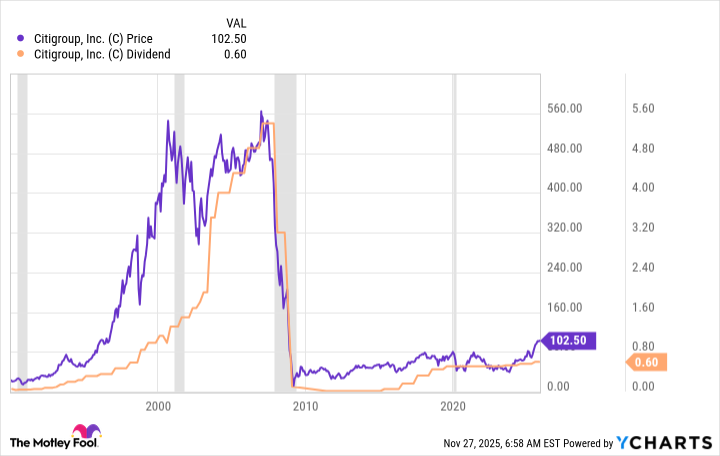

You can't discuss Citigroup without taking a trip all the way back to the Great Recession, which occurred between 2007 and 2009. It was a particularly challenging time for the finance sector, which was deeply affected by the housing crisis. Citigroup did not avoid the hit; it ultimately received a government bailout and was forced to cut its dividend.

Data by YCharts.

Recessions are generally difficult for banks, but the Great Recession was a true turning point. Citigroup's share price and dividend remain far below their pre-Great Recession peaks, even after close to 20 years have passed. However, its business is drastically different, with management now taking a far more conservative approach than it did leading up to the housing crisis.

Citigroup's recent financial performance has actually been quite good. For example, in the third quarter of 2025, revenue jumped 9% year over year. Earnings of $1.86 per share were up materially from the $1.51 earned in the same period of 2024. And if you exclude one-time items related to an asset divestiture, that $1.86 per share jumps to $2.24, making the year-over-year comparison even more favorable. Return on average tangible common equity increased a full percentage point year over year.

All in, Citigroup is a bank that is probably worth considering, despite its very troubling history. Ultimately, it is a very different business today. But is it actually worth buying?

Image source: Getty Images.

A very good run for Citigroup's stock

Investors have not missed the change that has taken place at Citigroup, nor has Wall Street ignored the strong performance so far in 2025. The stock price is up more than 45% over the past 12 months. That compares to a roughly 13% rise in the S&P 500 index. Clearly, investors have priced in the good news. However, what's even more telling here is that the average large U.S. bank is down nearly 5%. Valuation is an issue that you have to consider quite carefully.

While Citigroup's dividend yield is roughly average, more traditional valuation metrics are less favorable. The stock's price-to-sales, price-to-earnings, and price-to-book value ratios are all notably above their five-year averages. Investors have clearly rewarded the stock for the success the business has achieved.

NYSE: C

Key Data Points

To be fair, the average P/B ratio for large banks is around 1.2x, making Citigroup's roughly 1x look relatively cheap. However, the roughly comparable dividend yield means that Citigroup doesn't really stand out even for dividend lovers. The good news is likely fully priced in, or at least very close to it.

Probably better to keep Citigroup on the watch list

Citigroup stock is trading just a hair's breadth away from its 52-week high of just over $103 per share. After such a quick price advance that appears to have closed the valuation gap with peers, investors should probably tread with caution. Given the strong business performance of late, it wouldn't take much for Wall Street to turn negative again now that the shares look fully priced. Even good results may not be enough after the great stock run from which the shares have benefited.