Nvidia (NVDA +2.06%) has been one of the best stocks to own since the AI revolution kicked off in 2023. However, there are questions about its dominance heading into 2026. There is rising competition from AMD, but a relatively unheralded competitor could be challenging Nvidia.

Who is this competitor that is making headlines in recent weeks? It's not Alphabet and its high-powered Tensor chips; it's Broadcom (AVGO +0.90%).

Image source: Getty Images.

Alphabet and Broadcom are set to benefit from a new sales stream

Nvidia makes graphics processing units (GPUs), which are well-suited for any task that requires accelerated computing. These devices were the top picks for many companies looking to train artificial intelligence workloads, but they are incredibly expensive. While AMD has offered a cheaper alternative, their supporting hardware and software are not the same as Nvidia's. However, there's another option many companies are turning to.

Broadcom's custom AI accelerators are a different style of computing unit than the GPU. Instead of being suited to run a wide variety of workloads, these custom AI accelerator chips are tailored to run a specific style of workload. This can increase performance and drive down cost, at the price of flexibility.

As we move toward an inference-heavy computing power deployment, the workloads are fairly known, so it doesn't require as many Nvidia GPUs to train the AI model. In their place, companies can deploy custom AI chips from Broadcom.

NASDAQ: AVGO

Key Data Points

Broadcom and Alphabet collaborated to design the promising tensor processing units (TPUs). Alphabet has been using these for a long time for internal use. These days, external clients can even rent access to them via its cloud computing platform, Google Cloud.

However, that access may be changing. Reportedly, Alphabet is in talks with Meta Platforms to sell billions of dollars worth of TPUs to them. While this will benefit Alphabet, it also boosts Broadcom. It gets a cut of every TPU Alphabet purchase (or sale) because it is a codesigner of the chip.

It's unknown if this deal will go through or how much Meta will buy, but if it does come to fruition, don't be surprised if deals like this start to get announced more frequently. This could also drive other AI hyperscalers to work directly with Broadcom to spec in their custom AI chip, which will further boost its sales.

The downside risk of Broadcom's AI business is almost nothing, and it has a ton of upside ahead. This makes the stock a potential massive winner in 2026, and investors should consider adding it to their portfolio. However, there are a few caution signals with the stock.

Market excitement has caused Broadcom's stock to rise

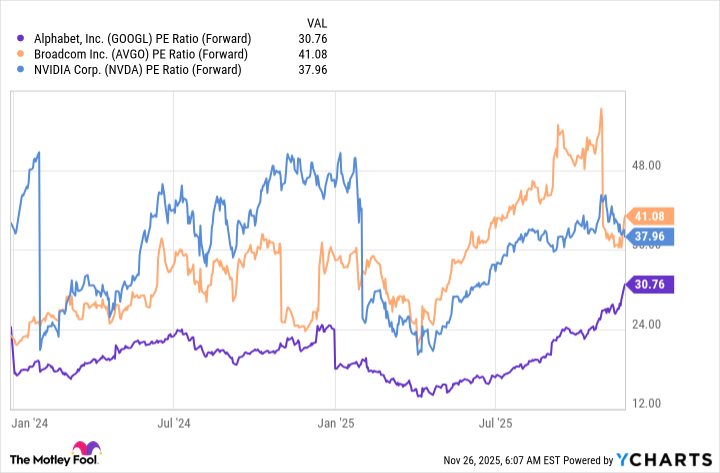

Although Wall Street analysts have recently reworked Broadcom's forward earnings projections, it's still an expensive stock when compared to Nvidia or Alphabet.

GOOGL PE Ratio (Forward) data by YCharts

Furthermore, Broadcom isn't solely an AI business. In Q3 FY 2025 (ending Aug. 3), only $5.2 billion of its $15.9 billion total came from AI-related revenue streams. This division is projected to rapidly grow, with management expecting $6.2 billion in revenue in Q4.

However, Broadcom isn't as much of a pure play as some believe it is, and weakness from its core business could overshadow its AI aspirations until the AI segment is large enough to become the majority of Broadcom's business.

Still, I think Broadcom will have an excellent 2026 as more clients adopt a custom AI chip rather than a general-purpose one. This does not mean the end for Nvidia -- just Nvidia's level of dominance. I think both Nvidia and Broadcom are still great investments to make, but if the AI computing market keeps trending in this direction, I think Broadcom could end up being the next Nvidia.