Ever since the U.S. Supreme Court granted states permission to decide whether to legalize sports betting, the industry has been booming. As of this writing, 38 states and Washington, D.C., have legalized sports betting in some form.

Within the newly legalized industry, an influx of investors has been looking at sports betting stocks to capitalize on the rapid growth. Penn Entertainment (PENN 4.09%) has been around for a while, operating physical casinos and now venturing into the mobile world. However, if you're looking for a better sports betting stock option, look no further than DraftKings (DKNG 1.13%).

Image source: Getty Images.

A tale of two different directions

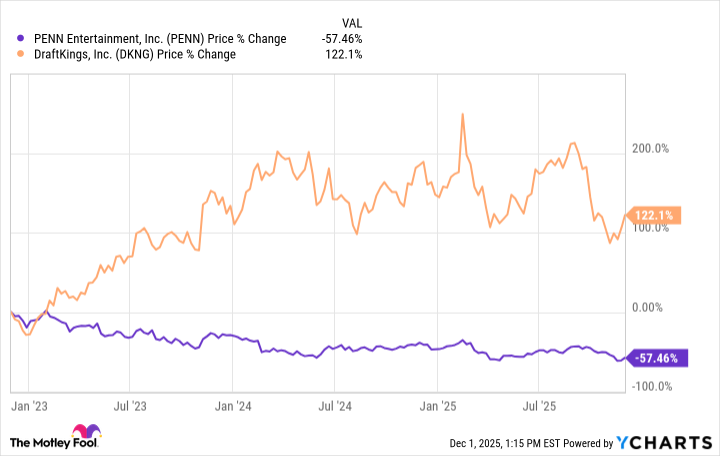

Penn Entertainment and DraftKings' stocks have been moving in opposite directions over the past three years. In that time, Penn Entertainment's stock is down around 57%, while DraftKings' stock is up around 122%. Admittedly, both have had a tough first 11 months in 2025, down 24% and 8%, respectively, but the future looks much brighter for DraftKings because of the position its business is in.

While Penn Entertainment has struggled to gain digital market share, DraftKings has its hand in sports betting, daily fantasy sports, iGaming, and lottery. This diversified ecosystem works in DraftKings' favor for sports betting because it gives the company multiple ways to acquire and retain customers without relying on a single channel.

DraftKings' ecosystem and cross-selling opportunities are largely why it has been able to scale so efficiently and operate a virtual duopoly with Flutter Entertainment's FanDuel.

The new wave of sports betting

There's no denying the world is going mobile, and sports betting is another industry where this is showing up. Physical casinos surely have their purpose, but the convenience of mobile sports betting has introduced millions more to the industry. And it's an area where DraftKings thrives.

NASDAQ: DKNG

Key Data Points

DraftKings runs an asset-light business that runs almost exclusively on its software and is much easier to scale. Doing so allowed DraftKings to avoid much of the debt that physical casinos rely on and to be much closer to consistent profitability than it may have initially imagined.

In 2022, DraftKings reported an adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) loss of more than $700 million. This year, it expects its adjusted EBITDA to come in between $450 million and $550 million. That's an impressive $1.15 billion to $1.25 billion turnaround in only three years.

DraftKings will inevitably experience some bumps along the way (as with any growth stock), but its strides should leave investors with confidence in its long-term trajectory.