By and large, GoPro's (GPRO +0.78%) action cameras get positive reviews. However, we can't say the same about the company's stock.

As an investment, broadly speaking, GoPro has been a laggard and a declining asset over time. Here's a look at how the company has performed across three different timeframes.

No go

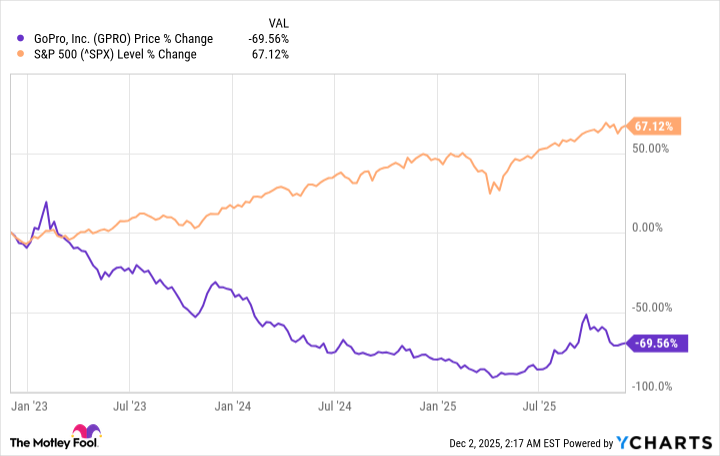

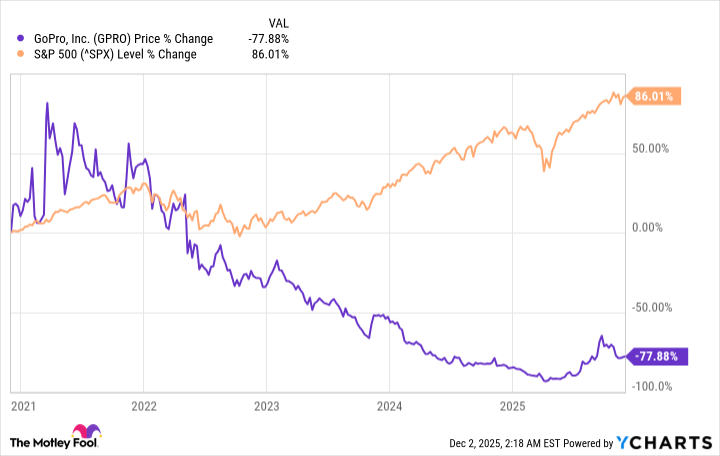

I'll analyze three different periods -- the past one, three, and five years -- comparing GoPro's stock performance with that of the benchmark S&P 500 index. The numbers don't lie, as they say, and neither do the graphs.

The further we look back, the worse we see that GoPro stock performed. That five-year graph is particularly revealing, with a night-and-day difference between the stock's nearly 78% decline and the index's 86% rise.

The outlier among the three is the one-year graph, and much of GoPro's outperformance in the latter months can be chalked up to its attaining meme stock status that summer. Since then, it's frequently been the subject of much online speculation. This has caused the shares to fluctuate suddenly at times, with little or no warning.

Falling like a bungee jump

A high volume of online chatter can also distract from a company's fundamental performance. Before it was anointed as a meme stock, GoPro more or less traded in line with its results.

Image source: Getty Images.

Alas, these haven't been outstanding. In 2021, the company managed to increase its revenue by a beefy 30%, thanks in no small part to a shift into direct-to-consumer (DTC) sales. That was the high-water mark, though, as in each of the following years, the top line eroded.

There's no indication that GoPro will go in the direction of sustained growth. In its third quarter of 2025, revenue plummeted by 37% (to under $163 million). Worse, net loss not according to generally accepted accounting principles (GAAP) deepened considerably, to nearly $14 million from the year-ago quarter's $463,000.

Worse still, the company badly missed the consensus analyst estimates on both the top and bottom lines.

NASDAQ: GPRO

Key Data Points

A good try, but...

While GoPro management has effectively created other revenue streams -- like subscription and services, which together increased from $82 million in full-year 2022 to $107 million two years later -- it's still, at heart, a manufacturer of niche cameras.

Those cameras are ideal for the action footage enthusiasts among us, and they made a significant impression when they were first introduced to the market. For most people, however, the decent cameras now packed into their smartphones are sufficient to handle most, if not all, photo/video opportunities.

In short, GoPro hasn't sufficiently evolved its business or its products to become a compelling gadget maker. Generally speaking, it hasn't been a good stock for investors over time, either.