It would be a massive understatement to say that artificial intelligence (AI) has consumed a large part of the business and investing world over the past couple of years. It's essentially inescapable at this point. And recently, the parts of AI that have gotten the most attention are generative AI tools like ChatGPT and Alphabet's Gemini, planned data center buildouts, and the race for designing the most advanced AI chips.

However, one part of the AI ecosystem that has seemingly slid under the radar is AI's role in the cybersecurity industry. As AI expands into more businesses, cybersecurity is becoming increasingly important. Yet it's not receiving the mainstream love that the headlines above do.

Image source: CrowdStrike.

The true cost of slacking on cybersecurity

Cybersecurity has gone from a "it's nice to have" expense for businesses to one of the more mandatory costs businesses must account for. It's essentially like business insurance: paying an upfront fee to avoid the financial and reputational costs if something goes wrong.

According to an International Business Machines Cost of a Data Breach Report, the average cost of a data breach globally in 2025 was $4.4 million. Maybe the biggest takeaway from IBM's report is that 97% of organizations "reported an AI-related security incident and lacked proper AI access controls."

In simpler terms, this means many companies are deploying AI tools faster than their cybersecurity tools can keep pace. And organizations that did use AI extensively for cybersecurity saved $1.9 million compared to those that didn't.

In the vast majority of cases, the upfront subscription costs don't remotely compare to the headache that can be avoided by having the proper cybersecurity in place to catch these threats before anything meaningful happens.

CrowdStrike is beating threats at their own game

One of the best AI stocks operating in the cybersecurity industry is undoubtedly CrowdStrike (CRWD 9.27%). It's been operating since 2011 and was arguably the first AI-native cybersecurity company. When it comes to that lane, it's not new to it -- it's true to it.

As one of the first AI-native cybersecurity companies, CrowdStrike has a major advantage over other cybersecurity companies: data. It has been collecting relevant data for quite some time, allowing it to train its AI solutions much more effectively than a company that may have just started in the past few years.

NASDAQ: CRWD

Key Data Points

That's part of the reason CrowdStrike consistently ranks among the top cybersecurity companies. When research firm Gartner graded companies on their endpoint effectiveness (the ability to protect devices connecting to a network, such as computers, phones, tablets, etc.), CrowdStrike placed highest for its ability to execute.

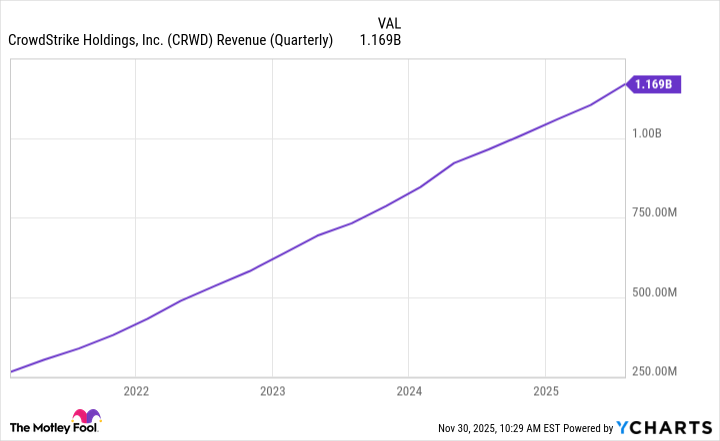

Being a cybersecurity go-to has worked wonders for CrowdStrike's financials as it attracts many high-dollar companies. Its revenue is up over 340% in the past five years, and its subscription revenue has cracked the billion-dollar mark, coming in at over $1.1 billion in its fiscal second quarter.

CRWD Revenue (Quarterly) data by YCharts

CrowdStrike is a company long-term investors can embrace

The trend of AI-related cybersecurity attacks may not get much attention, but it's a problem CrowdStrike is uniquely positioned to address. And with that comes a good chance for investors to embrace a company that is showing all the signs of a company that's here for the long haul.

Like any growth stock -- especially ones dealing with AI -- CrowdStrike's stock will inevitably have its ups and downs (we've seen numerous 20%-plus drops in short periods), but it has shown resilience and rewarded its investors who've stuck around for the ride.

Trading at 26.7 times its projected sales for the next 12 months, CrowdStrike's stock isn't cheap. However, paying a premium price for a premium company is expected. For investors who can stomach the inevitable volatility, it's a stock I would consider slowly but surely adding a stake in.