Shares of specialty microcontroller chip giant Microchip Technology (MCHP +12.17%) rallied 12.2% on Wednesday as of 3:46 p.m. EDT.

Microchip has been a relative laggard in the semiconductor space this year, as its specialty chips used across a wide variety of industrial applications haven't been as in-demand as leading-edge chips centered on the AI revolution.

However, in conjunction with its presentation at an industry conference today, Microchip formally raised its current quarter guidance, along with a positive outlook for a recovery in 2026.

NASDAQ: MCHP

Key Data Points

Microchip's long downcycle is ending

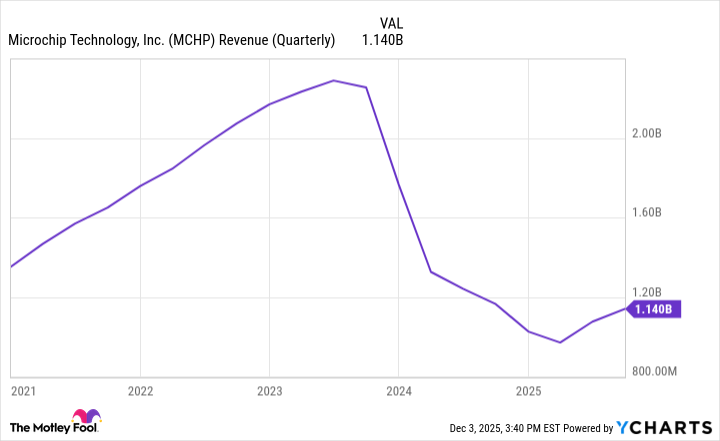

For context, Microchip experienced a significant surge in demand for its products following the pandemic, as auto, clean energy, and other industrial end markets clamored for Microchip's offerings amid a widespread shortage. But that boom later gave way to arguably the biggest cyclical bust in Microchip's history, with sales falling off a cliff beginning in late 2023:

MCHP Revenue (Quarterly) data by YCharts

The downturn has been longer and deeper than even Microchip's experienced executives imagined. Yet today's news offered encouragement that the long hangover may be coming to an end.

In conjunction with the company's presentation at the UBS Global Technology and AI conference, Microchip issued a press release regarding its results for the current December quarter.

Management now expects revenue to come in near the high end of prior guidance, with sequential growth of approximately 1% and year-over-year growth of around 12%. Prior guidance indicated that sales would fall quarter-over-quarter, due to normal seasonality. Adjusted (non-GAAP) earnings are now expected to come in at $0.40, relative to the prior guidance of $0.34 to $0.40.

CEO Steve Sanghi added:

With two months of the quarter behind us, our business is performing better than we expected at the time of our November 6, 2025 earnings conference call. Our bookings activity has remained strong through November with backlog filling in better than expected in the current quarter and growing nicely into the March 2026 quarter.

Image source: Getty Images.

Microchip may be in for a catch-up trade

After today's jump, Microchip is now up over 11% on the year, but the stock is still 37% below all-time highs from a couple of years ago. Meanwhile, there is a wide range of analyst estimates for earnings next year, with fiscal 2027 EPS estimates ranging from $1.62 to $3.87.

If Microchip comes in toward the higher end of those estimates, the stock appears quite cheap. Therefore, today was a very encouraging indicator that the company's more bullish analysts may be more accurate in their assessment of this high-yielding chip stock.