The energy sector supplies the juice that makes the economy run. From transportation to data centers to whatever device you're reading this on, energy is an input for everything.

That sector is going to grow substantially over the next decade. Analysts at Deloitte, for example, project that U.S. peak electricity demand will grow by about 26% by 2035, which would strain the grid's current capacity. Moreover, power demand could grow even faster, especially if the data center buildout accelerates more quickly than expected.

With those compelling long-term tailwinds in mind, here are five no-brainer energy stocks that could be worth a $1,000 investment today.

Image source: Getty Images.

1. Oklo

Oklo (OKLO +14.05%) is the poster child for the idea that nuclear energy will power data centers.

The company is designing a small modular reactor that can be built right next to the data centers and industrial sites it is intended to power, providing a dedicated electricity source.

NYSE: OKLO

Key Data Points

The company is aiming to deploy its first Aurora powerhouse microreactor around 2027, and has advanced its licensing efforts with the Nuclear Regulatory Commission in 2025.

Oklo was recently selected for the Department of Energy's Reactor Pilot Program, which aims to demonstrate at least three test reactors before July 4, 2026. It has also partnered with several data center operators, including Equinix and Vertiv.

For this pre-revenue company valued at roughly $14 billion, though, everything will depend on getting regulatory approval for its reactor designs. As such, investors should expect share price volatility in the short term as the company continues to work toward commercialization.

2. Nano Nuclear Energy

Like Oklo, Nano Nuclear Energy (NNE +8.53%) is developing small modular reactors. However, its reactors are still in earlier design stages, so their commercialization is likely further out on the horizon.

NASDAQ: NNE

Key Data Points

In a nutshell, Nano is developing portable and stationary microreactors. Its portable reactor (named "Zeus") is designed to fit in a standard shipping container. This, in theory, could let its customers move a self-contained nuclear power source to wherever it's needed.

Nano also wants to manufacture its own nuclear fuel, as well as transport it. That would make it a nuclear company with a rare degree of vertical integration.

If the company can get its concepts through the regulatory process, its reactors could provide power to remote sites such as military zones and research centers. However, for now, this company has no revenue and no operating reactors, so, as with Oklo, expect a bumpy road for the stock.

3. Constellation

Constellation (CEG +3.10%) runs the largest U.S. nuclear reactor fleet and is already cashing in on a tighter power market.

In the third quarter, its adjusted earnings climbed to $3.04 per share, up from $2.74 a year ago. Nuclear output rose year over year, with the company leaning into power contracts in regions like the mid-Atlantic that are loaded with data centers.

NASDAQ: CEG

Key Data Points

Constellation shares are up 60% year to date and trade at a trailing price-to-earnings ratio of just over 40. That's quite a premium for an energy company. Still, for investors who want exposure to an energy company with real earnings today, Constellation is the blue chip option.

4. Centrus Energy

Centrus Energy (LEU +6.07%) is a nuclear company that sits "upstream" of the rest of the sector.

It's one of the few U.S. companies that not only enriches uranium but has a license to produce high-assay low-enriched uranium (HALEU), the fuel that many advanced nuclear reactor designs need.

NYSEMKT: LEU

Key Data Points

In 2023, Centrus became the first company in the U.S. to produce HALEU under a Department of Energy contract. Since then, it has continued to deliver HALEU to the Department of Energy from its Ohio facility.

That early-mover status is crucial. If Oklo and other advanced nuclear reactor developers get commercial licenses, they'll need this specialized fuel to power their reactors.

On the flip side, if these same companies slip or if the timelines for the deployment of their designs get pushed out, Centrus' HALEU production could end up underutilized.

5. Bloom Energy

Bloom Energy (BE +13.99%) is a Silicon Valley-based company that makes solid oxide fuel cells (called "energy servers") for on-site power generation. Simply put, its fuel cells convert natural gas, biogas, or hydrogen into electricity through a complex electrochemical process -- without combustion.

NYSE: BE

Key Data Points

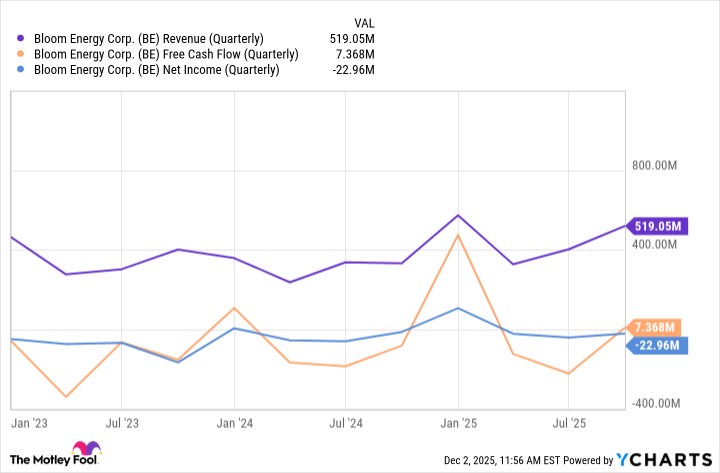

In the third quarter, Bloom booked $519 million in revenue, an increase of about 57% year over year. That marked its fourth straight quarter of record revenue. It also reported an operating profit of about $7.8 million.

BE Revenue (Quarterly) data by YCharts.

These five energy stocks will fit best in the portfolios of people pursuing a high-growth strategy. That means high potential rewards, but also high risk. More conservative investors might find an energy-focused exchange-traded fund is a better fit for them.